PROTECTED SOURCE SCRIPT

Turtle Soup Pro (meminkrt)

Turtle Soup Pro Strategy - Explained

The Turtle Soup Pro strategy is a reversal-based trading system inspired by the original

Turtle Soup setup.

It is designed to identify potential false breakouts near significant highs or lows, using

price action and

optional volume confirmation (OBV).

Core Concept

------------

The strategy looks for fake breakouts beyond the highest or lowest price over the past

20 candles.

If price temporarily breaches this key level and then closes back within range, the

strategy treats it

as a potential trap and generates a trade signal in the opposite direction.

Long Entry Criteria

-------------------

- Price briefly drops below the lowest low of the past 20 bars.

- The candle closes back above that low (indicating a fake breakdown).

- (Optional) Volume confirmation is used through On-Balance Volume (OBV) to confirm

bullish momentum.

Short Entry Criteria

--------------------

- Price temporarily spikes above the highest high of the past 20 bars.

- The candle closes back below that high (indicating a fake breakout).

- (Optional) OBV confirmation supports bearish momentum.

Stop Loss Logic

---------------

- Instead of using the signal candle's low/high, the strategy references the previous

candle's wick.

- A stop is triggered if price moves 2% beyond the previous candle's low (for long) or

high (for short).

- This stop condition must occur within the next 5 candles after entry.

Take-Profit Conditions

----------------------

- For long trades: the strategy exits the position if price reaches the most recent pivot

high.

- For short trades: it exits once the most recent pivot low is hit.

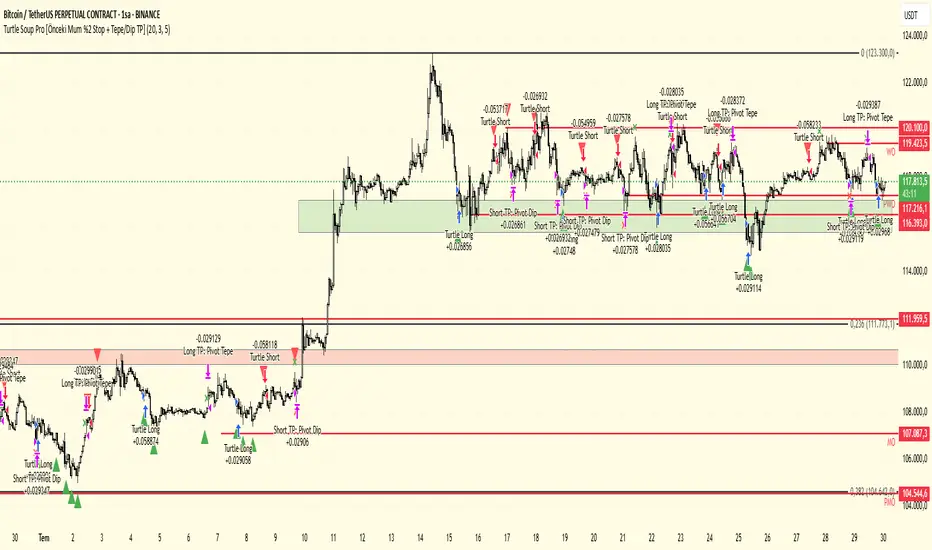

Visual Feedback

---------------

- The chart displays entry points with up/down triangles.

- Exit points (either by stop or profit target) are marked with small X symbols.

Customization

-------------

The strategy includes adjustable parameters for:

- Lookback period (default: 20 bars)

- Use of OBV confirmation

- Pivot sensitivity (number of candles used to define swing highs/lows)

- Maximum number of candles to allow for stop condition (default: 5)

This strategy is well-suited for traders looking to exploit fake-out scenarios in

range-bound or overly stretched markets,

with clear stop and profit mechanisms built around recent price structure

The Turtle Soup Pro strategy is a reversal-based trading system inspired by the original

Turtle Soup setup.

It is designed to identify potential false breakouts near significant highs or lows, using

price action and

optional volume confirmation (OBV).

Core Concept

------------

The strategy looks for fake breakouts beyond the highest or lowest price over the past

20 candles.

If price temporarily breaches this key level and then closes back within range, the

strategy treats it

as a potential trap and generates a trade signal in the opposite direction.

Long Entry Criteria

-------------------

- Price briefly drops below the lowest low of the past 20 bars.

- The candle closes back above that low (indicating a fake breakdown).

- (Optional) Volume confirmation is used through On-Balance Volume (OBV) to confirm

bullish momentum.

Short Entry Criteria

--------------------

- Price temporarily spikes above the highest high of the past 20 bars.

- The candle closes back below that high (indicating a fake breakout).

- (Optional) OBV confirmation supports bearish momentum.

Stop Loss Logic

---------------

- Instead of using the signal candle's low/high, the strategy references the previous

candle's wick.

- A stop is triggered if price moves 2% beyond the previous candle's low (for long) or

high (for short).

- This stop condition must occur within the next 5 candles after entry.

Take-Profit Conditions

----------------------

- For long trades: the strategy exits the position if price reaches the most recent pivot

high.

- For short trades: it exits once the most recent pivot low is hit.

Visual Feedback

---------------

- The chart displays entry points with up/down triangles.

- Exit points (either by stop or profit target) are marked with small X symbols.

Customization

-------------

The strategy includes adjustable parameters for:

- Lookback period (default: 20 bars)

- Use of OBV confirmation

- Pivot sensitivity (number of candles used to define swing highs/lows)

- Maximum number of candles to allow for stop condition (default: 5)

This strategy is well-suited for traders looking to exploit fake-out scenarios in

range-bound or overly stretched markets,

with clear stop and profit mechanisms built around recent price structure

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.