OPEN-SOURCE SCRIPT

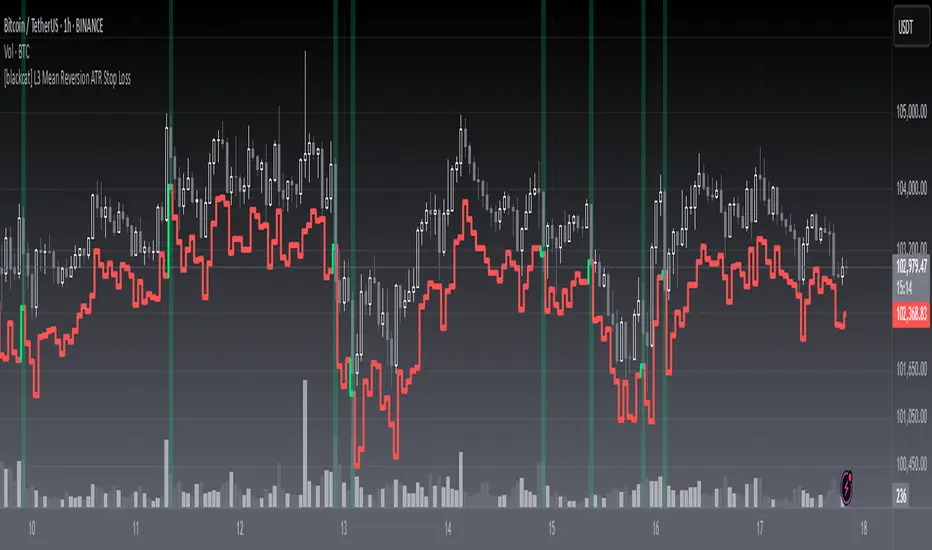

[blackcat] L3 Mean Reversion ATR Stop Loss

OVERVIEW

The [blackcat] L3 Mean Reversion ATR Stop Loss indicator is meticulously crafted to empower traders by offering statistically-driven stop-loss levels that adapt seamlessly to evolving market dynamics. By harmoniously blending mean reversion concepts with Advanced True Range (ATR) metrics, it delivers a robust framework for managing risks more effectively. 🌐 The primary objective is to furnish traders with intelligent exit points grounded in both short-term volatility assessments and long-term trend evaluations.

Key highlights encompass:

• Dynamic calculation of Z-scores to evaluate deviations from established means

• Adaptive stop-loss pricing leveraging real-time ATR measurements

• Clear visual cues enabling swift decision-making processes

TECHNICAL ANALYSIS COMPONENTS

📉 Z-SCORE CALCULATION

Measures how many standard deviations an asset's current price lies away from its average

Facilitates identification of extreme conditions indicative of impending reversals

Utilizes simple moving averages and standard deviation computations

📊 STANDARD DEVIATION MEASUREMENT

Quantifies dispersion of closing prices around the mean

Provides insights into underlying price distribution characteristics

Crucial for assessing potential volatility levels accurately

🕵️♂️ ADAPTIVE STOP-LOSS DETECTION

Employs ATR as a proxy for prevailing market volatility

Modulates stop-loss placements dynamically responding to shifting trends

Ensures consistent adherence to predetermined risk management protocols

INDICATOR FUNCTIONALITY

🔢 Core Algorithms

Integrate Smooth Moving Averages (SMAs) alongside standardized deviation formulas

Generate precise Z-scores reflecting true price deviations

Leverage ATR-derived multipliers for fine-grained stop-loss adjustments

🖱️ User Interface Elements

Interactive plots displaying real-time stop-loss markers

Context-sensitive color coding enhancing readability

Background shading indicating proximity to stop-level activations

STRATEGY IMPLEMENTATION

✅ Entry Conditions

Confirm bullish/bearish setups validated through multiple confirmatory signals

Ensure alignment between Z-score readings and broader trend directions

Validate entry decisions considering concurrent market sentiment factors

🚫 Exit Mechanisms

Trigger exits upon hitting predefined ATR-based stop-loss thresholds

Monitor continuous breaches signifying potential trend reversals

Execute partial/total closes contingent upon cumulative loss limits

PARAMETER CONFIGURATIONS

🎯 Optimization Guidelines

Period Length: Governs responsiveness versus smoothing trade-offs

ATR Length: Dictates the temporal scope for volatility analysis

Stop Loss ATR Multiplier: Tunes sensitivity towards stop-trigger activations

💬 Customization Recommendations

Commence with baseline defaults; iteratively refine parameters

Evaluate impacts independently prior to combined adjustments

Prioritize minimizing erroneous trigger occurrences first

Sustain balanced risk-reward profiles irrespective of chosen settings

ADVANCED RISK MANAGEMENT

🛡️ Proactive Risk Mitigation Techniques

Enforce strict compliance with pre-defined maximum leverage constraints

Mandatorily apply trailing stop-loss orders conforming to script outputs

Allocate positions proportionately relative to available capital reserves

Conduct periodic reviews gauging strategy effectiveness rigorously

⚠️ Potential Pitfalls & Solutions

Address frequent violations arising during heightened volatility phases

Manage false alerts warranting manual interventions judiciously

Prepare contingency plans mitigating margin call possibilities

Continuously assess automated system reliability amidst fluctuating conditions

PERFORMANCE AUDITS & REFINEMENTS

🔍 Critical Evaluation Metrics

Assess win percentages consistently across diverse trading instruments

Calculate average profit ratios per successful execution

Measure peak drawdown durations alongside associated magnitudes

Analyze signal generation frequencies revealing hidden patterns

📈 Historical Data Analysis Tools

Maintain comprehensive records capturing every triggered event

Compare realized profits/losses against backtested simulations

Identify recurrent systematic errors demanding corrective actions

Implement iterative refinements bolstering overall efficacy steadily

PROBLEM SOLVING ADVICE

🔧 Frequent Encountered Challenges

Unpredictable behaviors emerging within thinly traded markets

Latency issues manifesting during abrupt price fluctuations

Overfitted models yielding suboptimal results post-extensive tuning

Inaccuracies stemming from incomplete or delayed data inputs

💡 Effective Resolution Pathways

Exclude low-liquidity assets prone to erratic movements

Introduce buffer intervals safeguarding major news/event impacts

Limit ongoing optimization attempts preventing model degradation

Verify seamless connectivity ensuring uninterrupted data flows

USER ENGAGEMENT SEGMENT

🤝 Community Contributions Welcome

Highly encourage active participation sharing experiences & recommendations!

THANKS

A heartfelt acknowledgment extends to all developers contributing invaluable insights about adaptive stop-loss strategies using statistical measures! ✨

The [blackcat] L3 Mean Reversion ATR Stop Loss indicator is meticulously crafted to empower traders by offering statistically-driven stop-loss levels that adapt seamlessly to evolving market dynamics. By harmoniously blending mean reversion concepts with Advanced True Range (ATR) metrics, it delivers a robust framework for managing risks more effectively. 🌐 The primary objective is to furnish traders with intelligent exit points grounded in both short-term volatility assessments and long-term trend evaluations.

Key highlights encompass:

• Dynamic calculation of Z-scores to evaluate deviations from established means

• Adaptive stop-loss pricing leveraging real-time ATR measurements

• Clear visual cues enabling swift decision-making processes

TECHNICAL ANALYSIS COMPONENTS

📉 Z-SCORE CALCULATION

Measures how many standard deviations an asset's current price lies away from its average

Facilitates identification of extreme conditions indicative of impending reversals

Utilizes simple moving averages and standard deviation computations

📊 STANDARD DEVIATION MEASUREMENT

Quantifies dispersion of closing prices around the mean

Provides insights into underlying price distribution characteristics

Crucial for assessing potential volatility levels accurately

🕵️♂️ ADAPTIVE STOP-LOSS DETECTION

Employs ATR as a proxy for prevailing market volatility

Modulates stop-loss placements dynamically responding to shifting trends

Ensures consistent adherence to predetermined risk management protocols

INDICATOR FUNCTIONALITY

🔢 Core Algorithms

Integrate Smooth Moving Averages (SMAs) alongside standardized deviation formulas

Generate precise Z-scores reflecting true price deviations

Leverage ATR-derived multipliers for fine-grained stop-loss adjustments

🖱️ User Interface Elements

Interactive plots displaying real-time stop-loss markers

Context-sensitive color coding enhancing readability

Background shading indicating proximity to stop-level activations

STRATEGY IMPLEMENTATION

✅ Entry Conditions

Confirm bullish/bearish setups validated through multiple confirmatory signals

Ensure alignment between Z-score readings and broader trend directions

Validate entry decisions considering concurrent market sentiment factors

🚫 Exit Mechanisms

Trigger exits upon hitting predefined ATR-based stop-loss thresholds

Monitor continuous breaches signifying potential trend reversals

Execute partial/total closes contingent upon cumulative loss limits

PARAMETER CONFIGURATIONS

🎯 Optimization Guidelines

Period Length: Governs responsiveness versus smoothing trade-offs

ATR Length: Dictates the temporal scope for volatility analysis

Stop Loss ATR Multiplier: Tunes sensitivity towards stop-trigger activations

💬 Customization Recommendations

Commence with baseline defaults; iteratively refine parameters

Evaluate impacts independently prior to combined adjustments

Prioritize minimizing erroneous trigger occurrences first

Sustain balanced risk-reward profiles irrespective of chosen settings

ADVANCED RISK MANAGEMENT

🛡️ Proactive Risk Mitigation Techniques

Enforce strict compliance with pre-defined maximum leverage constraints

Mandatorily apply trailing stop-loss orders conforming to script outputs

Allocate positions proportionately relative to available capital reserves

Conduct periodic reviews gauging strategy effectiveness rigorously

⚠️ Potential Pitfalls & Solutions

Address frequent violations arising during heightened volatility phases

Manage false alerts warranting manual interventions judiciously

Prepare contingency plans mitigating margin call possibilities

Continuously assess automated system reliability amidst fluctuating conditions

PERFORMANCE AUDITS & REFINEMENTS

🔍 Critical Evaluation Metrics

Assess win percentages consistently across diverse trading instruments

Calculate average profit ratios per successful execution

Measure peak drawdown durations alongside associated magnitudes

Analyze signal generation frequencies revealing hidden patterns

📈 Historical Data Analysis Tools

Maintain comprehensive records capturing every triggered event

Compare realized profits/losses against backtested simulations

Identify recurrent systematic errors demanding corrective actions

Implement iterative refinements bolstering overall efficacy steadily

PROBLEM SOLVING ADVICE

🔧 Frequent Encountered Challenges

Unpredictable behaviors emerging within thinly traded markets

Latency issues manifesting during abrupt price fluctuations

Overfitted models yielding suboptimal results post-extensive tuning

Inaccuracies stemming from incomplete or delayed data inputs

💡 Effective Resolution Pathways

Exclude low-liquidity assets prone to erratic movements

Introduce buffer intervals safeguarding major news/event impacts

Limit ongoing optimization attempts preventing model degradation

Verify seamless connectivity ensuring uninterrupted data flows

USER ENGAGEMENT SEGMENT

🤝 Community Contributions Welcome

Highly encourage active participation sharing experiences & recommendations!

THANKS

A heartfelt acknowledgment extends to all developers contributing invaluable insights about adaptive stop-loss strategies using statistical measures! ✨

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.