OPEN-SOURCE SCRIPT

Cumulative Volume Delta (CVD)

█ OVERVIEW

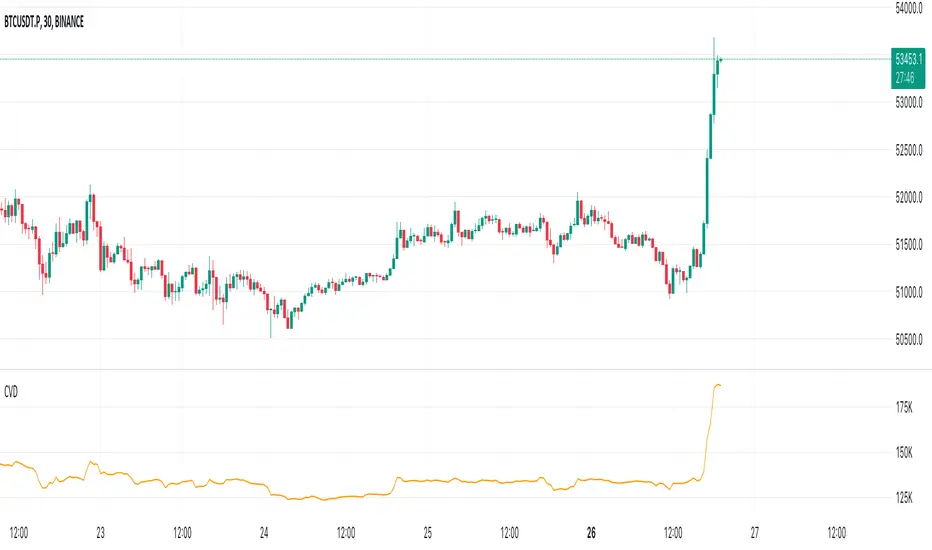

Cumulative Volume Delta (CVD) is a volume-based trading indicator that provides a visual representation of market buying and selling pressure by calculating the difference in traded volumes between the two sides. It uses intrabar information to obtain more precise volume delta information than methods using only the chart's timeframe.

Volume delta is the net difference between Buy Volume and Sell Volume. Positive volume delta indicates that buy volume is more than sell volume, and opposite. So Cumulative Volume Delta (CVD) is a running total/cumulation of volume delta values, where positive VD gets added to the sum and negative VD gets subtracted from the sum.

I found simple and fast solution how to calculate CVD, so made plain and concise code, here is CVD function :

Pine Script®

where _c, _o, _v are close, open and volume of intrabar much lower timeframe.

Indicator uses intrabar information to obtain more precise volume delta information than methods using only the chart's timeframe.

Intrabar precision calculation depends on the chart's timeframe:

CVD is good to use together with open interest, volume and price change.

For example if CVD is rising and price makes good move up in short period and volume is rising and open interest makes good move up in short period and before was flat market it is show big chance to pump.

Cumulative Volume Delta (CVD) is a volume-based trading indicator that provides a visual representation of market buying and selling pressure by calculating the difference in traded volumes between the two sides. It uses intrabar information to obtain more precise volume delta information than methods using only the chart's timeframe.

Volume delta is the net difference between Buy Volume and Sell Volume. Positive volume delta indicates that buy volume is more than sell volume, and opposite. So Cumulative Volume Delta (CVD) is a running total/cumulation of volume delta values, where positive VD gets added to the sum and negative VD gets subtracted from the sum.

I found simple and fast solution how to calculate CVD, so made plain and concise code, here is CVD function :

cvd(_c, _o, _v) =>

var tcvd = 0.0, delta = 0.0

posV = 0.0, negV = 0.0

totUV = 0.0, totDV = 0.0

switch

_c > _o => posV += _v

_c < _o => negV -= _v

_c > nz(_c[1]) => posV += _v

_c < nz(_c[1]) => negV -= _v

nz(posV[1]) > 0 => posV += _v

nz(negV[1]) < 0 => negV -= _v

totUV += posV

totDV += negV

delta := totUV + totDV

cvd = tcvd + delta

tcvd += delta

cvd

where _c, _o, _v are close, open and volume of intrabar much lower timeframe.

Indicator uses intrabar information to obtain more precise volume delta information than methods using only the chart's timeframe.

Intrabar precision calculation depends on the chart's timeframe:

CVD is good to use together with open interest, volume and price change.

For example if CVD is rising and price makes good move up in short period and volume is rising and open interest makes good move up in short period and before was flat market it is show big chance to pump.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.