PROTECTED SOURCE SCRIPT

Telah dikemas kini dmn's ICT AMD-Goldbach

█ OVERVIEW

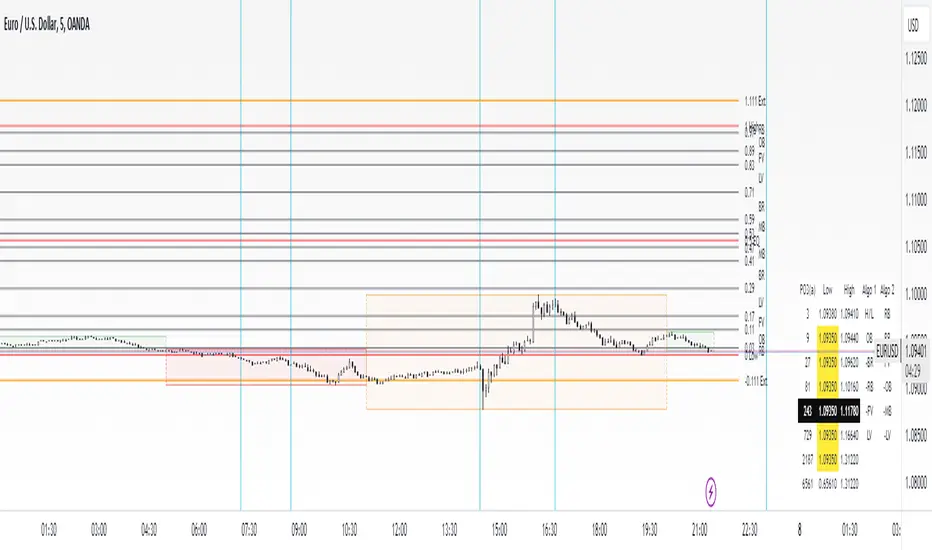

This script is built on ICT time & price theory and the theory of algorithmic market maker models, and visualizes the intraday divided using powers of three into accumulation, manipulation and distribution cycles.

It also includes an automatically calculated and plotted Goldbach level (a.k.a. IPDA level or Huddleston level) overlay, to help visualize where in the current market maker profile price is in relation to the AMD cycles, and where it might trade to.

█ CONCEPTS

Accumulation, Manipulation, Distribution Cycles

A 24 hour day, with the default set to start at 20:00 CET (the start of the Forex CLS Settlement operational timeline) is split in three parts - 9, 6 and 9 hours for the three cycles (roughly corresponding with Asia, London Open and New York + London Close sessions).

Since charts are fractals, there's also intra-cycle time fibs available in the script, to highlight the smaller fractal equivalents in each cycle.

These cycles are used to visualize the three phases (AMD) for easier identification of the current daily profile by analyzing during what cycle highs and lows of the day are made.

An example of a bullish day could be price rallying before making a low during the accumulation cycle, being manipulated higher and retracing to form an optimal trade entry during the manipulation cycle, expanding and creating the high of the day before selling off during the distribution cycle, with a potential reversal before it ends.

Goldbach levels

The Goldbach levels are based on the size of a price range (or price swing, if you will) expressed as a factor of power of three (3^n).

To decide what number to tell the script to use for the calculation, we look at what 3^n number best fits an average swing on the preferred timeframe we're trading.

For example; PO3 27 (3^3)might be fit for scalping, while PO3 243 (3^5) may correspond to the daily or weekly range, depending on the asset.

The script then calculates a range high and a range low using a power of three formula based on the current price and divides it into levels using Goldbach numbers.

At these levels one might expect to see price form various "blocks" as defined in concept by Michael J. Huddleston.

The blocks that correspond to the Goldbach levels are labeled with abbreviations as follows:

Using these levels and said blocks we identify where in the current running market maker profile price is offered, and trade the preferred timeframe in line with the AMD cycles accordingly.

█ FEATURES

█ NOTE

This script is built on ICT time & price theory and the theory of algorithmic market maker models, and visualizes the intraday divided using powers of three into accumulation, manipulation and distribution cycles.

It also includes an automatically calculated and plotted Goldbach level (a.k.a. IPDA level or Huddleston level) overlay, to help visualize where in the current market maker profile price is in relation to the AMD cycles, and where it might trade to.

█ CONCEPTS

Accumulation, Manipulation, Distribution Cycles

A 24 hour day, with the default set to start at 20:00 CET (the start of the Forex CLS Settlement operational timeline) is split in three parts - 9, 6 and 9 hours for the three cycles (roughly corresponding with Asia, London Open and New York + London Close sessions).

Since charts are fractals, there's also intra-cycle time fibs available in the script, to highlight the smaller fractal equivalents in each cycle.

These cycles are used to visualize the three phases (AMD) for easier identification of the current daily profile by analyzing during what cycle highs and lows of the day are made.

An example of a bullish day could be price rallying before making a low during the accumulation cycle, being manipulated higher and retracing to form an optimal trade entry during the manipulation cycle, expanding and creating the high of the day before selling off during the distribution cycle, with a potential reversal before it ends.

Goldbach levels

The Goldbach levels are based on the size of a price range (or price swing, if you will) expressed as a factor of power of three (3^n).

To decide what number to tell the script to use for the calculation, we look at what 3^n number best fits an average swing on the preferred timeframe we're trading.

For example; PO3 27 (3^3)might be fit for scalping, while PO3 243 (3^5) may correspond to the daily or weekly range, depending on the asset.

The script then calculates a range high and a range low using a power of three formula based on the current price and divides it into levels using Goldbach numbers.

At these levels one might expect to see price form various "blocks" as defined in concept by Michael J. Huddleston.

The blocks that correspond to the Goldbach levels are labeled with abbreviations as follows:

- Ext = External range

- Low = Range low

- High = Range high

- FVG = Fair value gap

- RB = Rejection block

- OB = Order block

- LV = Liquidity void

- BR = Breaker

- MB = Mitigation block

Using these levels and said blocks we identify where in the current running market maker profile price is offered, and trade the preferred timeframe in line with the AMD cycles accordingly.

█ FEATURES

- Custom AMD time cycles session times.

- Custom time fib for fractal cycles.

- Color and style customization.

- Show only current or also historical cycles.

- Equilibrium mode for Goldbach levels (show only high/low and midpoint)

- Autodetection of asset type, with manual override.

█ NOTE

- The default timings for the AMD cycles are set up for Forex pairs. For other asset types, such as indices, other timings are nessecary for optimal results.

- Goldbach levels requires the correct symbol type setting for the calculation to work properly. Disable the script's autodetection and enable/disable the Forex option according to the type of chart if it fails.

Nota Keluaran

- Added PO3 Stats box with all the Po3 ranges.

Nota Keluaran

- Made the Dealing Range box more fancy.

- Moved the PO3 number setting to the top of the options window, for more convenient switching between ranges.

Nota Keluaran

- Added color customization options for Goldbach levels

Nota Keluaran

- Added D1/D2 line (distribution cycle split)

Nota Keluaran

v. 1.31- Fixed Dr-calculation bug when price < 1.000

- Added optional algo flow list to the DR box.

Nota Keluaran

- Modified Goldbach level label positions to emphasize where the PD arrays reside in relation to the levels.

Nota Keluaran

- Small change to the settings.

Nota Keluaran

- Added A1/A2 line.

Nota Keluaran

- Added GB level option to not extend GB level lines to the left (only shows a small line instead).

- Modified GB label position logic.

Nota Keluaran

- Added tooltips showing price to GB level labels.

Nota Keluaran

- Modified line x-position logic. Lines will now end at a fixed number of bars to the right of the current bar, regardless of timeframe. Short lines (extend left: off) will also begin a fixed number of bars to the right.

Nota Keluaran

- Added the the Dealing Range Box option to only show either the Dealing Ranges, MMxM, or both.

Nota Keluaran

- Added options for setting individual GB line colors.

- Added options for toggling individual GB lines on/off.

Nota Keluaran

- Label bug fix.

- Added option to show only GB Levels labels or IPDA Name labels, or both.

Nota Keluaran

- Fixed a bug in the Dealing Range calculation.

- Dealing Range performance optimization.

Nota Keluaran

- Version updated to beta 1.6

- Updated script to use latest version of dmnLib

Nota Keluaran

- DR calculation performance optimizations.

Nota Keluaran

- Added highlighting of "shared" DR highs/lows to the DR table.

Nota Keluaran

Version b1.8- Added CE Levels.

Nota Keluaran

- Fixed a custom GB line color array call bug

Nota Keluaran

- Fixed autodetection not working on DXY charts.

Nota Keluaran

- Fixed CE level custom color bug.

Nota Keluaran

- Version 1.84.

- Added PO3 6561 range (useful for BTC, for example).

Nota Keluaran

- Fixed DR calculation bug when price is below 1.00

Nota Keluaran

- Bug fix: DR calculation not working properly with forex futures.

- Added: Autodetection for the major currencies forex futures (disable autodetection and keep the forex option enabled if you trade a future on which autodetection fails, and/or let me know and I'll fix it :D)

Nota Keluaran

- Version 1.87

- Fixed autodetection bug introduced in the previous version, that caused some tickers to get detected as forex futures even though they weren't (ES1! for example).

Nota Keluaran

- Version 1.89

- Complete rewrite of the po3 DR calculation. It should now work on all tickers at att price levels (hopefully)

Nota Keluaran

- Small calculation fix.

Nota Keluaran

- Removed debug info that was mistakenly left visible.

Nota Keluaran

- Added "New York" and "Stockholm" to timezone settings, for auto-timezone purposes.

Nota Keluaran

- Fixed the New York and Stockholm auto-timezones not working because of me being dumb and not naming them correctly.

Nota Keluaran

- Version 1.90

- Settings feature added: "Master switches" for boxes, GB levels, corner table and imbalances. Used for quickly toggling the modules on or off without scrolling through the settings.

- Added option: Number of days to extend GB lines to the left.

Nota Keluaran

- Version 1.91

- Added an "extend right" option to the GB levels. Used to set how many bars to the right of the current bar the GB levels should go.

Nota Keluaran

- Version 1.93

- Added non-GB levels.

Nota Keluaran

Version 1.94- Fixed non-GB repeating label bug.

Nota Keluaran

Version 1.95- Added alert conditions for price crossing GB levels.

Nota Keluaran

Version 1.96- Added linefill option to GB levels customization section of the settings (colors the area between GB levels).

Nota Keluaran

Version 1.97- Added shift DR range -1/0/+1 setting.

Nota Keluaran

Version 1.98- DR table contents now shift partitions according to the shift setting, and indicates shifted ranges with a +/-1 sign.

Nota Keluaran

Version 1.99- User request: Added po3 numbers 59049 and 177147

Nota Keluaran

Version 2.00- Made a quick fix for a dr range size issue that occured on

DXY when price dropped below 100.000.

Nota Keluaran

Version 2.01- Added missing mouseover tooltips to CE levels (on the IPDA labels)

Nota Keluaran

Version 2.02- DR shift option is no longer limited to +/-1

Nota Keluaran

#AMD-GB update version 2.03:- Discovered and squished a bug: IPDA/Level labels visibility inadvertently controlled by individual line settings, regardless of individual line toggle state

Nota Keluaran

Version 2.04a- Added +/-1 ranges visibility option.

Note: Initial multiple ranges version - functionality and features will be added in subsequent updates.

Nota Keluaran

version 2.05- Fix: Stats box (the small, horizontal/vertical one) not showing range shift amount

- New feature: Half-step dr shift increments (request by @Hopiplaka)

Nota Keluaran

Version 2.06Changes made to the main po3 calculation that should fix most, if not all broken tickers.

Nota Keluaran

Version 2.07Added: Automatic PO3 number selection using average daily/weekly range.

Nota Keluaran

Version 2.08Added labels to +/-1 ranges.

Nota Keluaran

Version 2.09• Added AxR calculation tooltip to the DR/stats boxes.

• Added auto po3 method setting - closest picks the po3 number closest to the AxR, Next picks the next po3 number above the AxR (new default method).

Nota Keluaran

Version 2.091• Fix: Auto PO3 ignoring asset type setting (autodetection/forex/not forex).

Nota Keluaran

Version 2.091Nota Keluaran

Version 2.1Added basic GB Time functionality

Nota Keluaran

Version 2.11• Added missing time zones from the settings (the weird UTC+xx:30 and xx:45 ones).

• Re-added linefills for the +/-1 ranges, which went AWOL in a previous update.

• Added a color picker for the GB time text labels

Nota Keluaran

• Renamed script slightly.Nota Keluaran

Version 2.12• Added the ability to create alerts for when GB time swings occur.

Nota Keluaran

v 2.13Added some GB time customization options.

Nota Keluaran

v 2.14Performance optimizations.

Added hold to ERD setting.

Nota Keluaran

v 2.15Fix: GB level labels getting removed when using GB time with nGB numbers.

Nota Keluaran

Re-upload of v.2.15 with typo fixed.Nota Keluaran

v2.15b• Decided to temporarily pull the "Hold to ERD" functionality from the indicator, due to it making the indicator misbehave under certain conditions (when using certain DR shifts, for example).

Always showing the correct DR is more important than Hold to ERD, so it'll be gone until I've resolved the issue. I apologize for not being able to make it work right now.

Nota Keluaran

v2.15cNo new features, only a bug fix.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya dengan percuma dan tanpa had – ketahui lebih lanjut di sini.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya dengan percuma dan tanpa had – ketahui lebih lanjut di sini.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.