OPEN-SOURCE SCRIPT

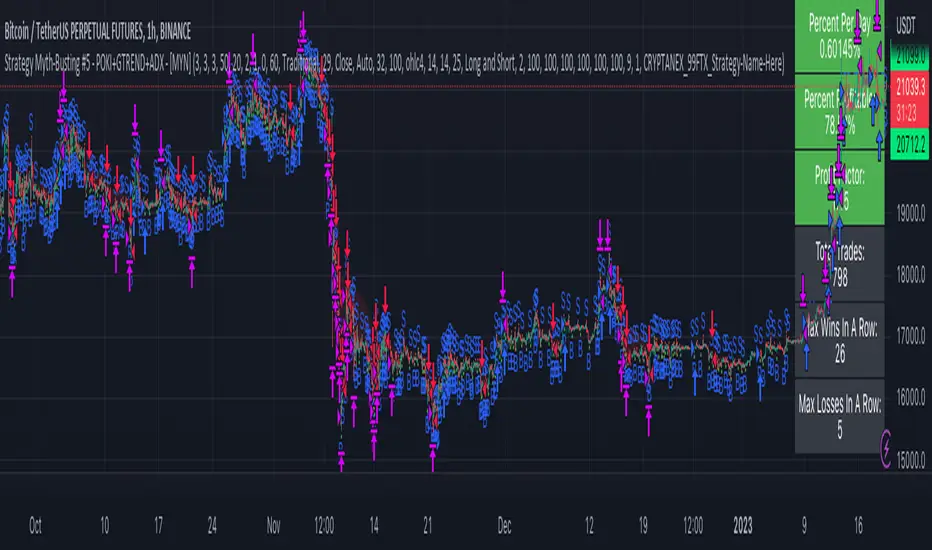

Strategy Myth-Busting #5 - POKI+GTREND+ADX - [MYN]

This is part of a new series we are calling "Strategy Myth-Busting" where we take open public manual trading strategies and automate them. The goal is to not only validate the authenticity of the claims but to provide an automated version for traders who wish to trade autonomously.

Our fifth one we are automating is one of the strategies from "The Best 3 Buy And Sell Indicators on Tradingview + Confirmation Indicators ( The Golden Ones ))" from "Online Trading Signals (Scalping Channel)". No formal backtesting was done by them and resuructo messaged me asking if we could validate their claims.

Originally, we mimic verbatim the settings Online Trading Signals was using however weren't getting promising results. So before we stopped there we thought we might want to see if this could be improved on. So we adjusted the Renko Assignment modifier from ATR to Traditional and adjusted the value to be higher from 30 to 47. We also decided to try adding another signal confirmation to eliminate some of the ranged market conditions so we choose our favorite, ADX . Also, given we are using this on a higher time-frame we adjusted the G-Channel Trend detection source from close to OHLC4 to get better average price action indication and more accurate trend direction.

This strategy uses a combination of 2 open-source public indicators:

poki buy and sell Take profit and stop loss by RafaelZioni

G-Channel Trend Detection by jaggedsoft

Trading Rules

15m - 4h timeframe. We saw best results at the recommended 1 hour timeframe.

Long Entry:

When POKI triggers a buy signal

When G-Channel Trend Detection is in an upward trend (Green)

ADX Is above 25

Short Entry:

When POKI triggers a sell signal

When G-Channel Trend Detection is in an downward trend (red)

ADX Is above 25

If you know of or have a strategy you want to see myth-busted or just have an idea for one, please feel free to message me.

Our fifth one we are automating is one of the strategies from "The Best 3 Buy And Sell Indicators on Tradingview + Confirmation Indicators ( The Golden Ones ))" from "Online Trading Signals (Scalping Channel)". No formal backtesting was done by them and resuructo messaged me asking if we could validate their claims.

Originally, we mimic verbatim the settings Online Trading Signals was using however weren't getting promising results. So before we stopped there we thought we might want to see if this could be improved on. So we adjusted the Renko Assignment modifier from ATR to Traditional and adjusted the value to be higher from 30 to 47. We also decided to try adding another signal confirmation to eliminate some of the ranged market conditions so we choose our favorite, ADX . Also, given we are using this on a higher time-frame we adjusted the G-Channel Trend detection source from close to OHLC4 to get better average price action indication and more accurate trend direction.

This strategy uses a combination of 2 open-source public indicators:

poki buy and sell Take profit and stop loss by RafaelZioni

G-Channel Trend Detection by jaggedsoft

Trading Rules

15m - 4h timeframe. We saw best results at the recommended 1 hour timeframe.

Long Entry:

When POKI triggers a buy signal

When G-Channel Trend Detection is in an upward trend (Green)

ADX Is above 25

Short Entry:

When POKI triggers a sell signal

When G-Channel Trend Detection is in an downward trend (red)

ADX Is above 25

If you know of or have a strategy you want to see myth-busted or just have an idea for one, please feel free to message me.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

If you're interested in exploring and discovering other high quality free strategies come join us in Discord: discord.gg/2wkm9QqSuY

➖➖🟦➖➖➖🟦

➖🟦🟦🟦🟦🟦🟦🟦

➖🟦🟦🟦🟦🟦🟦🟦

🟦🟦⬜️⬜️🟦⬜️⬜️🟦🟦

🟦🟦⬜️⬜️🟦⬜️⬜️🟦🟦

🟦🟦🟦🟦🟦🟦🟦🟦🟦

➖🟦🟦➖➖➖🟦🟦

➖➖🟦➖➖➖🟦

➖🟦🟦🟦🟦🟦🟦🟦

➖🟦🟦🟦🟦🟦🟦🟦

🟦🟦⬜️⬜️🟦⬜️⬜️🟦🟦

🟦🟦⬜️⬜️🟦⬜️⬜️🟦🟦

🟦🟦🟦🟦🟦🟦🟦🟦🟦

➖🟦🟦➖➖➖🟦🟦

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

If you're interested in exploring and discovering other high quality free strategies come join us in Discord: discord.gg/2wkm9QqSuY

➖➖🟦➖➖➖🟦

➖🟦🟦🟦🟦🟦🟦🟦

➖🟦🟦🟦🟦🟦🟦🟦

🟦🟦⬜️⬜️🟦⬜️⬜️🟦🟦

🟦🟦⬜️⬜️🟦⬜️⬜️🟦🟦

🟦🟦🟦🟦🟦🟦🟦🟦🟦

➖🟦🟦➖➖➖🟦🟦

➖➖🟦➖➖➖🟦

➖🟦🟦🟦🟦🟦🟦🟦

➖🟦🟦🟦🟦🟦🟦🟦

🟦🟦⬜️⬜️🟦⬜️⬜️🟦🟦

🟦🟦⬜️⬜️🟦⬜️⬜️🟦🟦

🟦🟦🟦🟦🟦🟦🟦🟦🟦

➖🟦🟦➖➖➖🟦🟦

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.