OPEN-SOURCE SCRIPT

Quantum Dip Hunter | AlphaNatt

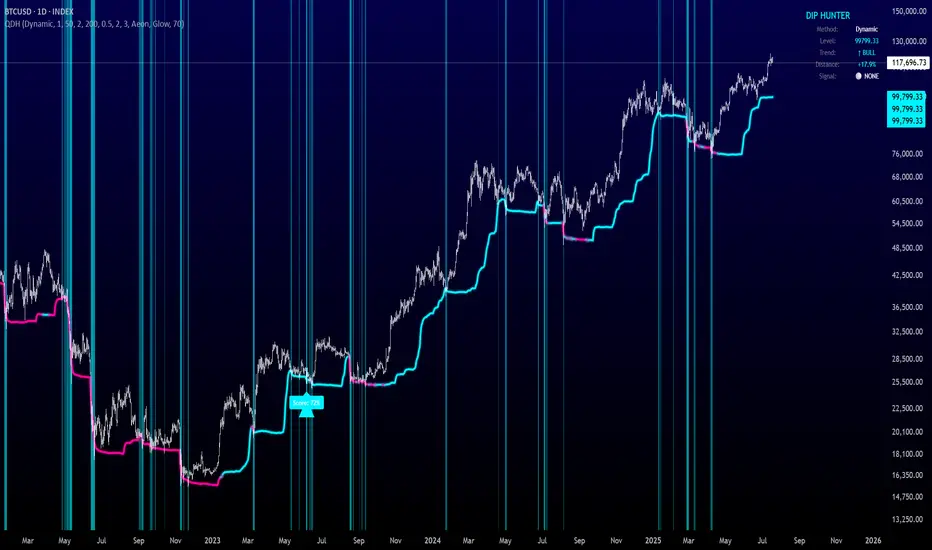

Quantum Dip Hunter | AlphaNatt

🎯 Overview

The Quantum Dip Hunter is an advanced technical indicator designed to identify high-probability buying opportunities when price temporarily dips below dynamic support levels. Unlike simple oversold indicators, this system uses a sophisticated quality scoring algorithm to filter out low-quality dips and highlight only the best entry points.

⚡ Key Features

📊 How It Works

🚀 Detection Methods Explained

Dynamic Support

Fibonacci Support

Volatility Support

Volume Profile Support

Hybrid Mode

⚙️ Key Settings

Dip Detection Engine

Quality Filters

📈 Trading Strategies

Conservative Approach

Aggressive Approach

Scalping Setup

🎨 Visual Customization

Color Themes:

Line Styles:

💡 Pro Tips

⚠️ Important Notes

📊 Statistics Panel

The live statistics panel shows:

🤝 Support

Created by AlphaNatt

For questions or suggestions, please comment below!

Happy dip hunting! 🎯

Not financial advice, always do your own research

🎯 Overview

The Quantum Dip Hunter is an advanced technical indicator designed to identify high-probability buying opportunities when price temporarily dips below dynamic support levels. Unlike simple oversold indicators, this system uses a sophisticated quality scoring algorithm to filter out low-quality dips and highlight only the best entry points.

"Buy the dip" - but only the right dips. Not all dips are created equal.

⚡ Key Features

- 5 Detection Methods: Choose from Dynamic, Fibonacci, Volatility, Volume Profile, or Hybrid modes

- Quality Scoring System: Each dip is scored from 0-100% based on multiple factors

- Smart Filtering: Only signals above your quality threshold are displayed

- Visual Effects: Glow, Pulse, and Wave animations for the support line

- Risk Management: Automatic stop-loss and take-profit calculations

- Real-time Statistics: Live dashboard showing current market conditions

📊 How It Works

- The indicator calculates a dynamic support line using your selected method

- When price dips below this line, it evaluates the dip quality

- Quality score is calculated based on: trend alignment (30%), volume (20%), RSI (20%), momentum (15%), and dip depth (15%)

- If the score exceeds your minimum threshold, a buy signal arrow appears

- Stop-loss and take-profit levels are automatically calculated and displayed

🚀 Detection Methods Explained

Dynamic Support

- Adapts to recent price action

- Best for: Trending markets

- Uses ATR-adjusted lowest points

Fibonacci Support

- Based on 61.8% and 78.6% retracement levels

- Best for: Pullbacks in strong trends

- Automatically switches between fib levels

Volatility Support

- Uses Bollinger Band methodology

- Best for: Range-bound markets

- Adapts to changing volatility

Volume Profile Support

- Finds high-volume price levels

- Best for: Identifying institutional support

- Updates dynamically as volume accumulates

Hybrid Mode

- Combines all methods for maximum accuracy

- Best for: All market conditions

- Takes the most conservative support level

⚙️ Key Settings

Dip Detection Engine

- Detection Method: Choose your preferred support calculation

- Sensitivity: Higher = more sensitive to price movements (0.5-3.0)

- Lookback Period: How far back to analyze (20-200 bars)

- Dip Depth %: Minimum dip size to consider (0.5-10%)

Quality Filters

- Trend Filter: Only buy dips in uptrends when enabled

- Minimum Dip Score: Quality threshold for signals (0-100%)

- Trend Strength: Required trend score when filter is on

📈 Trading Strategies

Conservative Approach

- Use Dynamic method with Trend Filter ON

- Set minimum score to 80%

- Risk:Reward ratio of 2:1 or higher

- Best for: Swing trading

Aggressive Approach

- Use Hybrid method with Trend Filter OFF

- Set minimum score to 60%

- Risk:Reward ratio of 1:1

- Best for: Day trading

Scalping Setup

- Use Volatility method

- Set sensitivity to 2.0+

- Focus on Target 1 only

- Best for: Quick trades

🎨 Visual Customization

Color Themes:

- Neon: Bright cyan/magenta for dark backgrounds

- Ocean: Cool blues and teals

- Solar: Warm yellows and oranges

- Matrix: Classic green terminal look

- Gradient: Smooth color transitions

Line Styles:

- Solid: Clean, simple line

- Glow: Adds depth with glow effect

- Pulse: Animated breathing effect

- Wave: Oscillating wave pattern

💡 Pro Tips

- Start with the Trend Filter ON to avoid catching falling knives

- Higher quality scores (80%+) have better win rates but fewer signals

- Use Volume Profile method near major support/resistance levels

- Combine with your favorite momentum indicator for confirmation

- The pulse animation can help draw attention to key levels

⚠️ Important Notes

- This indicator identifies potential entries, not guaranteed profits

- Always use proper risk management

- Works best on liquid instruments with good volume

- Backtest your settings before live trading

- Not financial advice - use at your own risk

📊 Statistics Panel

The live statistics panel shows:

- Current detection method

- Support level value

- Trend direction

- Distance from support

- Current signal status

🤝 Support

Created by AlphaNatt

For questions or suggestions, please comment below!

Happy dip hunting! 🎯

Not financial advice, always do your own research

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.