PROTECTED SOURCE SCRIPT

Telah dikemas kini AM Range Sniper [jmaxxx]

AM Range Sniper [jmaxxx]

Overview

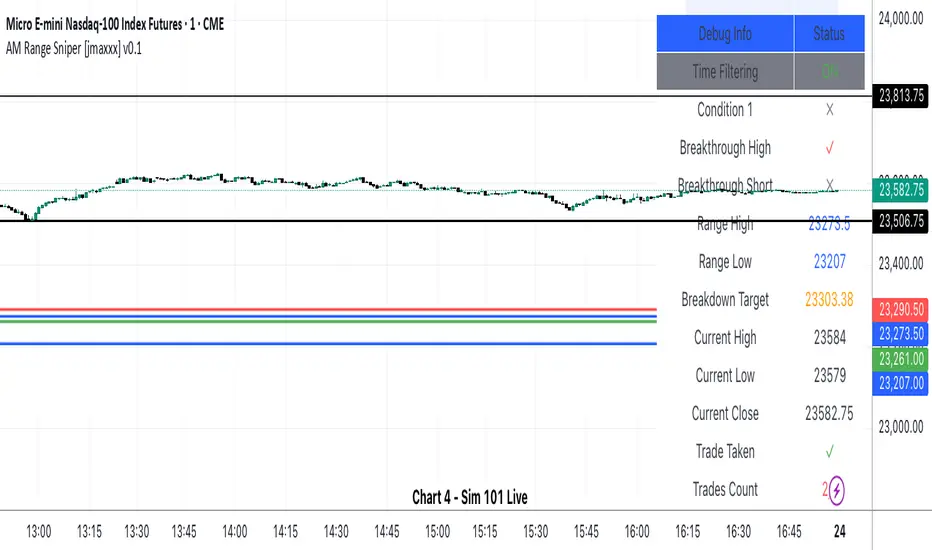

AM Range Sniper [jmaxxx] is a sophisticated morning session trading strategy designed for Micro E-mini Nasdaq-100 Index Futures (MNQ). This strategy capitalizes on the critical 8:30-9:30 AM EST range formation period, implementing precise entry and exit mechanics with advanced risk management.

Key Features

🕐 Time-Based Range Analysis

Range Definition: Automatically identifies and tracks the 8:30-9:30 AM EST range

Trading Window: Active trading from 9:30 AM to 11:00 AM EST (extended for second chance trades)

Session Management: Daily reset ensures clean state for each trading session

🎯 Multiple Entry Patterns

Breakthrough/Retest: Captures price breakthroughs above range with retest opportunities

Long/Short Opportunities: Comprehensive coverage of both directional moves

Breakdown: Identifies bearish breakdowns below range support

Break Up: Detects bullish breakups above range resistance

Range Sweeps: Monitors for range high/low sweeps with reversal entries

⚡ Advanced Risk Management

Configurable Stop Losses: Tick-based stop losses for each trade type

Take Profit Targets: Automatic target calculations based on range size

Hard Close Protection: Automatic position closure at 4 PM EST

Second Chance Feature: Optional second trade opportunity if first trade loses

🔧 Professional Features

Visual Stop Loss Lines: Real-time stop loss visualization on chart

Debug Information Panel: Comprehensive status monitoring

Alert Integration: Customizable alert messages for entries/exits

Flexible Time Settings: Adjustable for different timezones

Strategy Logic

Range Formation (8:30-9:30 AM)

The strategy monitors the first hour of trading to establish the day's range. This range serves as the foundation for all subsequent trading decisions.

Entry Conditions

Breakthrough: Price breaks above range high with retest rejection

Breakdown: Price breaks below range low with confirmed bearish momentum

Break Up: Price breaks above range high with strong bullish confirmation

Sweep Entries: Range high/low sweeps followed by reversal signals

Risk Management

Stop Loss: Configurable tick-based stops for each trade type

Take Profit: 1.5x range size targets for breakdown/breakup trades

Position Sizing: Percentage-based position sizing

Session Limits: Maximum 2 trades per session (with second chance feature)

Settings & Customization

Core Parameters

Enable/disable individual entry patterns

Configurable stop loss levels (1-500 ticks)

Second chance feature toggle

Previous day level integration

Visual Customization

Customizable stop loss colors and widths

Debug panel visibility

Range line styling

Alert Configuration

Custom entry/exit alert messages

***** Automate With *****

APEX

NinjaTrader

Crosstrade.io ( promo code JMAXXX )

Performance & Reliability

Precision Focused: Waits for high-probability setups

Risk-Aware: Comprehensive stop loss and position management

Session-Based: Clean daily resets prevent carryover issues

Professional Grade: Designed for serious traders

Ideal For

Day Traders: Morning session specialists

Futures Traders: MNQ and similar instruments

Range Traders: Traders who capitalize on range breakouts

Risk-Conscious Traders: Those who prioritize risk management

Disclaimer

This strategy is for educational and informational purposes. Past performance does not guarantee future results. Always test thoroughly on historical data and paper trading before live implementation. Risk management is crucial - never risk more than you can afford to lose.

Created by jmaxxx - Professional trading strategy developer

For questions, feedback, or customization requests, please leave a comment below.

Overview

AM Range Sniper [jmaxxx] is a sophisticated morning session trading strategy designed for Micro E-mini Nasdaq-100 Index Futures (MNQ). This strategy capitalizes on the critical 8:30-9:30 AM EST range formation period, implementing precise entry and exit mechanics with advanced risk management.

Key Features

🕐 Time-Based Range Analysis

Range Definition: Automatically identifies and tracks the 8:30-9:30 AM EST range

Trading Window: Active trading from 9:30 AM to 11:00 AM EST (extended for second chance trades)

Session Management: Daily reset ensures clean state for each trading session

🎯 Multiple Entry Patterns

Breakthrough/Retest: Captures price breakthroughs above range with retest opportunities

Long/Short Opportunities: Comprehensive coverage of both directional moves

Breakdown: Identifies bearish breakdowns below range support

Break Up: Detects bullish breakups above range resistance

Range Sweeps: Monitors for range high/low sweeps with reversal entries

⚡ Advanced Risk Management

Configurable Stop Losses: Tick-based stop losses for each trade type

Take Profit Targets: Automatic target calculations based on range size

Hard Close Protection: Automatic position closure at 4 PM EST

Second Chance Feature: Optional second trade opportunity if first trade loses

🔧 Professional Features

Visual Stop Loss Lines: Real-time stop loss visualization on chart

Debug Information Panel: Comprehensive status monitoring

Alert Integration: Customizable alert messages for entries/exits

Flexible Time Settings: Adjustable for different timezones

Strategy Logic

Range Formation (8:30-9:30 AM)

The strategy monitors the first hour of trading to establish the day's range. This range serves as the foundation for all subsequent trading decisions.

Entry Conditions

Breakthrough: Price breaks above range high with retest rejection

Breakdown: Price breaks below range low with confirmed bearish momentum

Break Up: Price breaks above range high with strong bullish confirmation

Sweep Entries: Range high/low sweeps followed by reversal signals

Risk Management

Stop Loss: Configurable tick-based stops for each trade type

Take Profit: 1.5x range size targets for breakdown/breakup trades

Position Sizing: Percentage-based position sizing

Session Limits: Maximum 2 trades per session (with second chance feature)

Settings & Customization

Core Parameters

Enable/disable individual entry patterns

Configurable stop loss levels (1-500 ticks)

Second chance feature toggle

Previous day level integration

Visual Customization

Customizable stop loss colors and widths

Debug panel visibility

Range line styling

Alert Configuration

Custom entry/exit alert messages

***** Automate With *****

APEX

NinjaTrader

Crosstrade.io ( promo code JMAXXX )

Performance & Reliability

Precision Focused: Waits for high-probability setups

Risk-Aware: Comprehensive stop loss and position management

Session-Based: Clean daily resets prevent carryover issues

Professional Grade: Designed for serious traders

Ideal For

Day Traders: Morning session specialists

Futures Traders: MNQ and similar instruments

Range Traders: Traders who capitalize on range breakouts

Risk-Conscious Traders: Those who prioritize risk management

Disclaimer

This strategy is for educational and informational purposes. Past performance does not guarantee future results. Always test thoroughly on historical data and paper trading before live implementation. Risk management is crucial - never risk more than you can afford to lose.

Created by jmaxxx - Professional trading strategy developer

For questions, feedback, or customization requests, please leave a comment below.

Nota Keluaran

🐛 Bug Fixes Addressed :1. 🚨 Critical Trade Management Bug (v0.1)

Problem: Strategy was losing track of trades when time windows changed

Symptoms: Trades taken in Early Window (9:30-10:00) were forgotten in Mid Window (10:00+)

Result: Targets never triggered, trades got "stuck"

Fix: Added strategy.position_size checks to all target logic to ensure trade management continues regardless of time window

2. 🚨 Conflicting Trade Alerts Bug (v0.1)

Problem: Strategy was sending conflicting alerts (e.g., long alert while short position was open)

Symptoms: Trade Taken: ✗ but Strategy Position Size: -5

Result: Multiple trades attempted, strategy confusion

Fix: Added global position_safety_check that blocks ALL new trades when any position is open

3. �� Noon Cutoff Bug (v0.1)

Problem: Trade management stopped at 11:00 AM due to after_range_before_noon cutoff

Symptoms: Trades taken before 11:00 AM were orphaned after 11:00 AM

Result: No take profit/stop loss management after noon

Fix: Removed noon cutoff, allowing trade management to continue all day

4. 🚨 Position Synchronization Bug (v0.1)

Problem: Strategy and broker positions getting out of sync

Symptoms: Strategy thinks no position, broker has open position

Result: Orphaned trades, no management

Fix: Added Enhanced Position Monitoring with automatic sync detection and fixing

5. 🚨 Time Window Logic Bug (v0.1)

Problem: Time-based filtering was incorrectly calculating windows

Symptoms: Mid Window (10:00-11:00): ✗ when current time was 10:33

Result: Trade types incorrectly disabled, strategy confusion

Fix: Corrected time window calculations and added debug info

🔧 What Each Fix Accomplished🔧

v0.1 Enhanced Position Validation:

✅ Prevents orphaned trades

✅ Auto-fixes sync issues

✅ Maintains trade state across time windows

✅ Blocks conflicting trade attempts

✅ Ensures targets and stop losses work properly

...I'll continue live testing and will update if I encounter any edge cases or need additional refinements for optimal performance.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.