OPEN-SOURCE SCRIPT

ATR Stop-Loss with Fibonacci Take-Profit [jpkxyz]

ATR Stop-Loss with Fibonacci Take-Profit Indicator

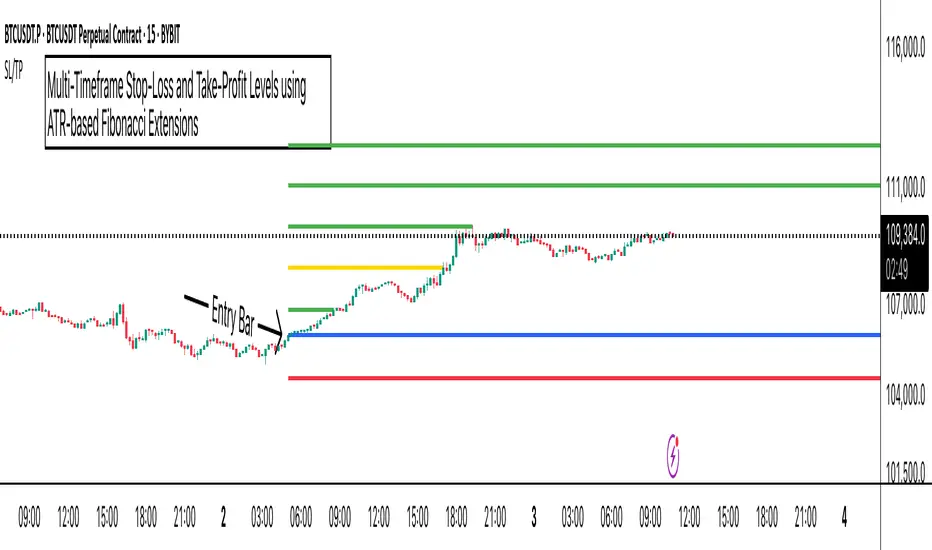

This comprehensive indicator combines Average True Range (ATR) volatility analysis with Fibonacci extensions to create dynamic stop-loss and take-profit levels. It's designed to help traders set precise risk management levels and profit targets based on market volatility and mathematical ratios.

Two Operating Modes

Default Mode (Rolling Levels)

In default mode, the indicator continuously plots evolving stop-loss and take-profit levels based on real-time price action. These levels update dynamically as new bars form, creating rolling horizontal lines across the chart. I use this mode primarily to plot the rolling ATR-Level which I use to trail my Stop-Loss into profit.

Characteristics:

Custom Anchor Mode (Fixed Levels)

This is the primary mode for precision trading. You select a specific timestamp (typically your entry bar), and the indicator locks all calculations to that exact moment, creating fixed horizontal lines that represent your actual trade levels.

Characteristics:

Core Calculation Logic

ATR Stop-Loss Calculation:

Pine Script®

Fibonacci Take-Profit Projection:

The distance from entry to stop-loss becomes the base unit (1.0) for Fibonacci extensions:

Pine Script®

Available Fibonacci Levels:

Multi-Timeframe Functionality

One of the indicator's most powerful features is timeframe flexibility. You can analyze on one timeframe while using stop-loss and take-profit calculations from another.

Best Practices:

Example Scenario:

Visual Intelligence System

Line Behaviour in Custom Anchor Mode:

Customisation Options:

This comprehensive indicator combines Average True Range (ATR) volatility analysis with Fibonacci extensions to create dynamic stop-loss and take-profit levels. It's designed to help traders set precise risk management levels and profit targets based on market volatility and mathematical ratios.

Two Operating Modes

Default Mode (Rolling Levels)

In default mode, the indicator continuously plots evolving stop-loss and take-profit levels based on real-time price action. These levels update dynamically as new bars form, creating rolling horizontal lines across the chart. I use this mode primarily to plot the rolling ATR-Level which I use to trail my Stop-Loss into profit.

Characteristics:

- Levels recalculate with each new bar

- All selected Fibonacci levels display simultaneously

- Uses plot() functions with trackprice=true for price tracking

Custom Anchor Mode (Fixed Levels)

This is the primary mode for precision trading. You select a specific timestamp (typically your entry bar), and the indicator locks all calculations to that exact moment, creating fixed horizontal lines that represent your actual trade levels.

Characteristics:

- Entry line (blue) marks your anchor point

- Stop-loss calculated using ATR from the anchor bar

- Fibonacci levels projected from entry-to-stop distance

- Lines terminate when price breaks through them

- Includes comprehensive alert system

Core Calculation Logic

ATR Stop-Loss Calculation:

Stop Loss = Entry Price ± (ATR × Multiplier)

- Long positions: SL = Entry - (ATR × Multiplier)

- Short positions: SL = Entry + (ATR × Multiplier)

- ATR uses your chosen smoothing method (RMA, SMA, EMA, or WMA)

- Default multiplier is 1.5, adjustable to your risk tolerance

Fibonacci Take-Profit Projection:

The distance from entry to stop-loss becomes the base unit (1.0) for Fibonacci extensions:

TP Level = Entry + (Entry-to-SL Distance × Fibonacci Ratio)

Available Fibonacci Levels:

- Conservative: 0.618, 1.0, 1.618

- Extended: 2.618, 3.618, 4.618

- Complete range: 0.0 to 4.764 (23 levels total)

Multi-Timeframe Functionality

One of the indicator's most powerful features is timeframe flexibility. You can analyze on one timeframe while using stop-loss and take-profit calculations from another.

Best Practices:

- Identify your entry point on execution timeframe

- Enable "Custom Anchor" mode

- Set anchor timestamp to your entry bar

- Select appropriate analysis timeframe

- Choose relevant Fibonacci levels

- Enable alerts for automated notifications

Example Scenario:

- Analyse trend on 4-hour chart

- Execute entry on 5-minute chart for precision

- Set custom anchor to your 5-minute entry bar

- Configure timeframe setting to "4h" for swing-level targets

- Select appropriate Fibonacci Extension levels

- Result: Precise entry with larger timeframe risk management

Visual Intelligence System

Line Behaviour in Custom Anchor Mode:

- Active levels: Lines extend to the right edge

- Hit levels: Lines terminate at the breaking bar

- Entry line: Always visible in blue

- Stop-loss: Red line, terminates when hit

- Take-profits: Green lines (1.618 level in gold for emphasis)

Customisation Options:

- Line width (1-4 pixels)

- Show/hide individual Fibonacci levels

- ATR length and smoothing method

- ATR multiplier for stop-loss distance

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.