PROTECTED SOURCE SCRIPT

Superdupermegadeduper signals by BrenFX

🚀 Superdupermegadeduper Signals by BrenFX

Overview

The Superdupermegadeduper Signals indicator is a comprehensive trading system that combines multiple advanced technical analysis concepts to identify high-probability trading opportunities. This indicator integrates supply/demand zone analysis, dynamic trendline detection, and multi-confirmation signal generation to provide traders with precise entry, stop-loss, and take-profit levels.

🎯 Key Features

Supply & Demand Zone Detection

Intelligent Zone Identification: Automatically detects high-probability supply and demand zones based on price action and touch frequency

Customizable Zone Strength: Set minimum touches required for zone validation (2-10 touches)

Visual Zone Display: Clear visual representation with customizable colors and transparency

Zone Extension: Projects zones forward for future reference

Dynamic Trendline Analysis

Multi-Touch Trendline Detection: Identifies significant support and resistance trendlines with configurable minimum touch requirements

Automatic Trendline Drawing: Draws and extends trendlines automatically with custom colors

Deviation Tolerance: Configurable deviation percentage for trendline validation

Breakout & Retest Signals: Detects trendline breakouts and subsequent pullback retests

Advanced Signal Generation

Dual Signal Types:

Zone Reversal Signals: Based on supply/demand zone interactions

Trendline Breakout Signals: Based on trendline breaks with pullback confirmation

Multi-Confirmation System:

Volume confirmation (optional)

RSI filter integration

Candlestick pattern confirmation

Pullback verification

Professional Trade Management

Multiple Stop Loss Methods:

ATR-based dynamic stops

Zone-based stops

Fixed point stops

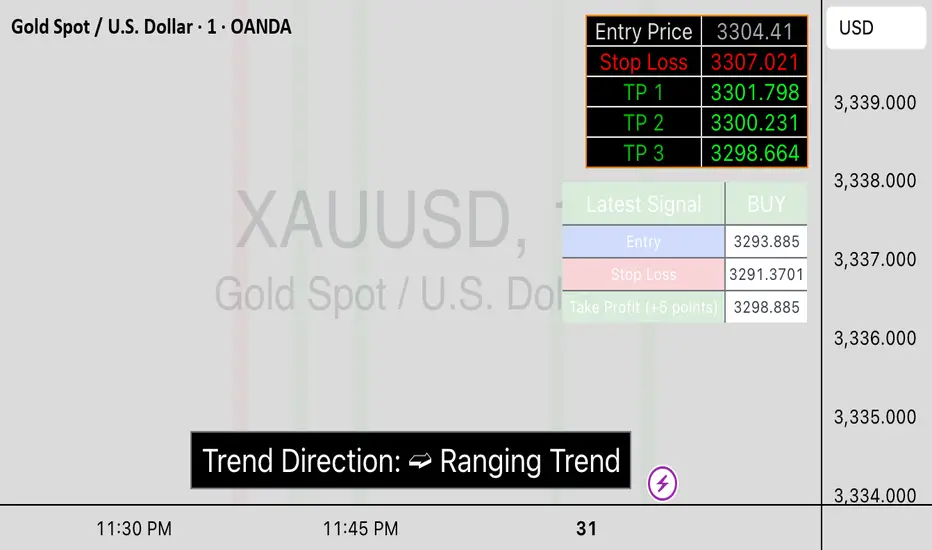

Automatic Level Calculation: Entry, stop-loss, and take-profit levels calculated automatically

Real-Time Trade Table: Live display of current trade levels and parameters

Customizable Table Position: Place trade information anywhere on your chart

Alert System

Comprehensive Alerts: Get notified instantly when signals are generated

Detailed Alert Messages: Include entry price, stop-loss, and take-profit levels

Frequency Control: Once-per-bar alert frequency to avoid spam

📊 How It Works

Signal Logic

Zone Analysis: The indicator scans for areas where price has repeatedly found support or resistance

Trendline Detection: Identifies significant trend lines by connecting pivot points with multiple touches

Confirmation Process: Multiple filters ensure signal quality:

Price action confirmation (multiple bullish/bearish candles)

Volume above average (optional)

RSI oversold/overbought conditions (optional)

Entry Timing: Signals are generated when all confirmations align

Buy Signals Generated When:

Price reaches a demand zone with bullish reversal confirmation, OR

Price breaks above resistance trendline and retests successfully

Sell Signals Generated When:

Price reaches a supply zone with bearish reversal confirmation, OR

Price breaks below support trendline and retests successfully

⚙️ Configuration Options

Supply/Demand Settings

Zone Strength: Minimum touches required (2-10)

Lookback Period: Historical bars to analyze (10-100)

Zone Extension: Forward projection length (1-20 bars)

Trendline Settings

Lookback Period: Historical analysis range (20-200 bars)

Minimum Touches: Required pivot connections (2-5)

Deviation Tolerance: Allowable price variance (0.01-1.0%)

Signal Filters

Reversal Confirmation: Required confirmation candles (1-5)

Pullback Confirmation: Retest validation period (1-5)

Volume Filter: Above-average volume requirement

RSI Filter: Overbought/oversold confirmation

Trade Management

Stop Loss Methods: ATR, Zone-based, or Fixed points

ATR Multiplier: Risk adjustment (0.5-5.0x)

Take Profit: Fixed point target (1.0-50.0 points)

📈 Best Practices

Recommended Settings

For Scalping: Lower zone strength (2-3), shorter lookback periods

For Swing Trading: Higher zone strength (4-6), longer lookback periods

For Trend Following: Enable trendline signals, use ATR-based stops

Risk Management

Always use the provided stop-loss levels

Consider position sizing based on stop-loss distance

Monitor the trade table for real-time level updates

Use alerts to avoid missing opportunities

🎨 Visual Elements

Supply Zones: Red semi-transparent rectangles

Demand Zones: Green semi-transparent rectangles

Resistance Lines: Red trendlines

Support Lines: Green trendlines

Buy Signals: Green "BUY" labels below bars

Sell Signals: Red "SELL" labels above bars

Trade Table: Comprehensive trade information display

💡 Tips for Success

Combine with Market Structure: Use on clean trends and at key support/resistance levels

Multiple Timeframe Analysis: Confirm signals on higher timeframes

Volume Confirmation: Enable volume filter for higher quality signals

Risk Management: Never risk more than 1-2% per trade

Backtesting: Test settings on historical data before live trading

⚠️ Important Notes

This indicator works best in trending markets

Signals are more reliable when multiple confirmations align

Always consider fundamental analysis and market conditions

Past performance does not guarantee future results

Practice proper risk management at all times

🔧 Technical Specifications

Pine Script Version: 6

Overlay: Yes

Max Objects: 500 boxes, 500 lines

Performance: Optimized for real-time analysis

Compatibility: Works on all timeframes and instruments

Developed by BrenFX | Advanced Trading Signals for Professional Traders

Remember: Trading involves risk. This indicator is a tool to assist in analysis and should not be the sole basis for trading decisions. Always use proper risk management and consider your financial situation before trading.

Overview

The Superdupermegadeduper Signals indicator is a comprehensive trading system that combines multiple advanced technical analysis concepts to identify high-probability trading opportunities. This indicator integrates supply/demand zone analysis, dynamic trendline detection, and multi-confirmation signal generation to provide traders with precise entry, stop-loss, and take-profit levels.

🎯 Key Features

Supply & Demand Zone Detection

Intelligent Zone Identification: Automatically detects high-probability supply and demand zones based on price action and touch frequency

Customizable Zone Strength: Set minimum touches required for zone validation (2-10 touches)

Visual Zone Display: Clear visual representation with customizable colors and transparency

Zone Extension: Projects zones forward for future reference

Dynamic Trendline Analysis

Multi-Touch Trendline Detection: Identifies significant support and resistance trendlines with configurable minimum touch requirements

Automatic Trendline Drawing: Draws and extends trendlines automatically with custom colors

Deviation Tolerance: Configurable deviation percentage for trendline validation

Breakout & Retest Signals: Detects trendline breakouts and subsequent pullback retests

Advanced Signal Generation

Dual Signal Types:

Zone Reversal Signals: Based on supply/demand zone interactions

Trendline Breakout Signals: Based on trendline breaks with pullback confirmation

Multi-Confirmation System:

Volume confirmation (optional)

RSI filter integration

Candlestick pattern confirmation

Pullback verification

Professional Trade Management

Multiple Stop Loss Methods:

ATR-based dynamic stops

Zone-based stops

Fixed point stops

Automatic Level Calculation: Entry, stop-loss, and take-profit levels calculated automatically

Real-Time Trade Table: Live display of current trade levels and parameters

Customizable Table Position: Place trade information anywhere on your chart

Alert System

Comprehensive Alerts: Get notified instantly when signals are generated

Detailed Alert Messages: Include entry price, stop-loss, and take-profit levels

Frequency Control: Once-per-bar alert frequency to avoid spam

📊 How It Works

Signal Logic

Zone Analysis: The indicator scans for areas where price has repeatedly found support or resistance

Trendline Detection: Identifies significant trend lines by connecting pivot points with multiple touches

Confirmation Process: Multiple filters ensure signal quality:

Price action confirmation (multiple bullish/bearish candles)

Volume above average (optional)

RSI oversold/overbought conditions (optional)

Entry Timing: Signals are generated when all confirmations align

Buy Signals Generated When:

Price reaches a demand zone with bullish reversal confirmation, OR

Price breaks above resistance trendline and retests successfully

Sell Signals Generated When:

Price reaches a supply zone with bearish reversal confirmation, OR

Price breaks below support trendline and retests successfully

⚙️ Configuration Options

Supply/Demand Settings

Zone Strength: Minimum touches required (2-10)

Lookback Period: Historical bars to analyze (10-100)

Zone Extension: Forward projection length (1-20 bars)

Trendline Settings

Lookback Period: Historical analysis range (20-200 bars)

Minimum Touches: Required pivot connections (2-5)

Deviation Tolerance: Allowable price variance (0.01-1.0%)

Signal Filters

Reversal Confirmation: Required confirmation candles (1-5)

Pullback Confirmation: Retest validation period (1-5)

Volume Filter: Above-average volume requirement

RSI Filter: Overbought/oversold confirmation

Trade Management

Stop Loss Methods: ATR, Zone-based, or Fixed points

ATR Multiplier: Risk adjustment (0.5-5.0x)

Take Profit: Fixed point target (1.0-50.0 points)

📈 Best Practices

Recommended Settings

For Scalping: Lower zone strength (2-3), shorter lookback periods

For Swing Trading: Higher zone strength (4-6), longer lookback periods

For Trend Following: Enable trendline signals, use ATR-based stops

Risk Management

Always use the provided stop-loss levels

Consider position sizing based on stop-loss distance

Monitor the trade table for real-time level updates

Use alerts to avoid missing opportunities

🎨 Visual Elements

Supply Zones: Red semi-transparent rectangles

Demand Zones: Green semi-transparent rectangles

Resistance Lines: Red trendlines

Support Lines: Green trendlines

Buy Signals: Green "BUY" labels below bars

Sell Signals: Red "SELL" labels above bars

Trade Table: Comprehensive trade information display

💡 Tips for Success

Combine with Market Structure: Use on clean trends and at key support/resistance levels

Multiple Timeframe Analysis: Confirm signals on higher timeframes

Volume Confirmation: Enable volume filter for higher quality signals

Risk Management: Never risk more than 1-2% per trade

Backtesting: Test settings on historical data before live trading

⚠️ Important Notes

This indicator works best in trending markets

Signals are more reliable when multiple confirmations align

Always consider fundamental analysis and market conditions

Past performance does not guarantee future results

Practice proper risk management at all times

🔧 Technical Specifications

Pine Script Version: 6

Overlay: Yes

Max Objects: 500 boxes, 500 lines

Performance: Optimized for real-time analysis

Compatibility: Works on all timeframes and instruments

Developed by BrenFX | Advanced Trading Signals for Professional Traders

Remember: Trading involves risk. This indicator is a tool to assist in analysis and should not be the sole basis for trading decisions. Always use proper risk management and consider your financial situation before trading.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.