OPEN-SOURCE SCRIPT

Global Inflation Indicator

🔹 Overview:

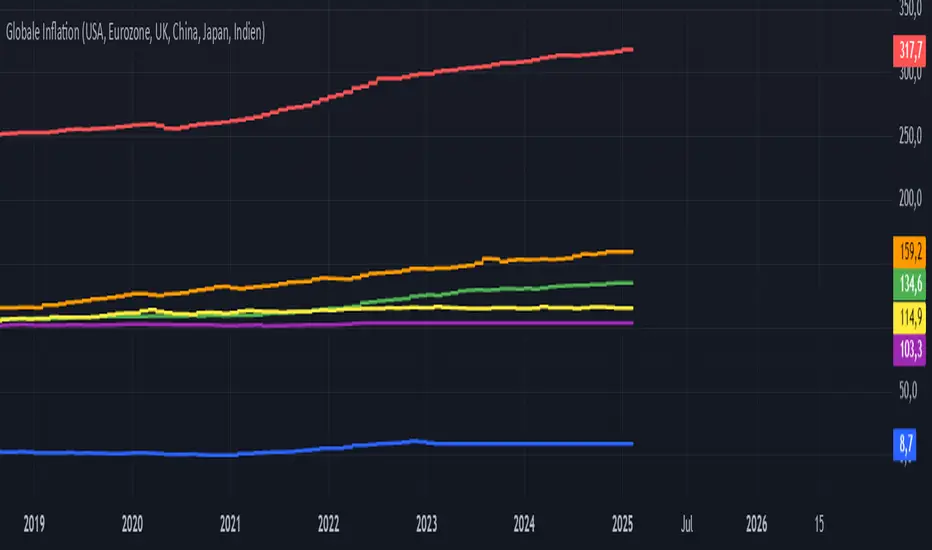

The Global Inflation Indicator is a macro-analysis tool designed to track and compare inflation trends across major economies. It pulls Consumer Price Index (CPI) data from multiple regions, helping traders and investors analyze how inflation impacts global markets, particularly gold, forex, and commodities.

📊 Key Features:

✅ Tracks inflation in six major economies:

🇺🇸 USA (CPIAUCSL) – Key driver for USD and gold prices

🇪🇺 Eurozone (CPHPTT01EZM659N) – Euro inflation impact

🇬🇧 United Kingdom (GBRCPIALLMINMEI) – GBP & economic trends

🇨🇳 China (CHNCPIALLMINMEI) – Emerging market impact

🇯🇵 Japan (JPNCPIALLMINMEI) – Yen & inflation control policies

🇮🇳 India (INDCPIALLMINMEI) – Key gold-consuming economy

✅ Real-time Inflation Trends:

Provides a visual comparison of inflation levels in different regions.

Helps traders identify inflationary cycles & their effect on global assets.

✅ Macro-Driven Trading Decisions:

Gold & Forex Correlation: High inflation may increase demand for gold.

Interest Rate Expectations: Central banks respond to inflation shifts.

Currency Strength: Inflation impacts USD, EUR, GBP, JPY, CNY, INR.

📉 How to Use It:

Gold traders can assess inflation trends to predict potential price movements.

Forex traders can compare inflation effects on major currency pairs (EUR/USD, USD/JPY, GBP/USD, etc.).

Stock investors can evaluate how inflation affects central bank policies and interest rates.

📌 Conclusion:

The Global Inflation Indicator is a powerful tool for macroeconomic analysis, providing real-time insights into global inflation trends. By integrating this indicator into your gold, forex, and commodity trading strategies, you can make more informed investment decisions in response to economic changes.

The Global Inflation Indicator is a macro-analysis tool designed to track and compare inflation trends across major economies. It pulls Consumer Price Index (CPI) data from multiple regions, helping traders and investors analyze how inflation impacts global markets, particularly gold, forex, and commodities.

📊 Key Features:

✅ Tracks inflation in six major economies:

🇺🇸 USA (CPIAUCSL) – Key driver for USD and gold prices

🇪🇺 Eurozone (CPHPTT01EZM659N) – Euro inflation impact

🇬🇧 United Kingdom (GBRCPIALLMINMEI) – GBP & economic trends

🇨🇳 China (CHNCPIALLMINMEI) – Emerging market impact

🇯🇵 Japan (JPNCPIALLMINMEI) – Yen & inflation control policies

🇮🇳 India (INDCPIALLMINMEI) – Key gold-consuming economy

✅ Real-time Inflation Trends:

Provides a visual comparison of inflation levels in different regions.

Helps traders identify inflationary cycles & their effect on global assets.

✅ Macro-Driven Trading Decisions:

Gold & Forex Correlation: High inflation may increase demand for gold.

Interest Rate Expectations: Central banks respond to inflation shifts.

Currency Strength: Inflation impacts USD, EUR, GBP, JPY, CNY, INR.

📉 How to Use It:

Gold traders can assess inflation trends to predict potential price movements.

Forex traders can compare inflation effects on major currency pairs (EUR/USD, USD/JPY, GBP/USD, etc.).

Stock investors can evaluate how inflation affects central bank policies and interest rates.

📌 Conclusion:

The Global Inflation Indicator is a powerful tool for macroeconomic analysis, providing real-time insights into global inflation trends. By integrating this indicator into your gold, forex, and commodity trading strategies, you can make more informed investment decisions in response to economic changes.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.