OPEN-SOURCE SCRIPT

Telah dikemas kini SUPeR TReND 2.718

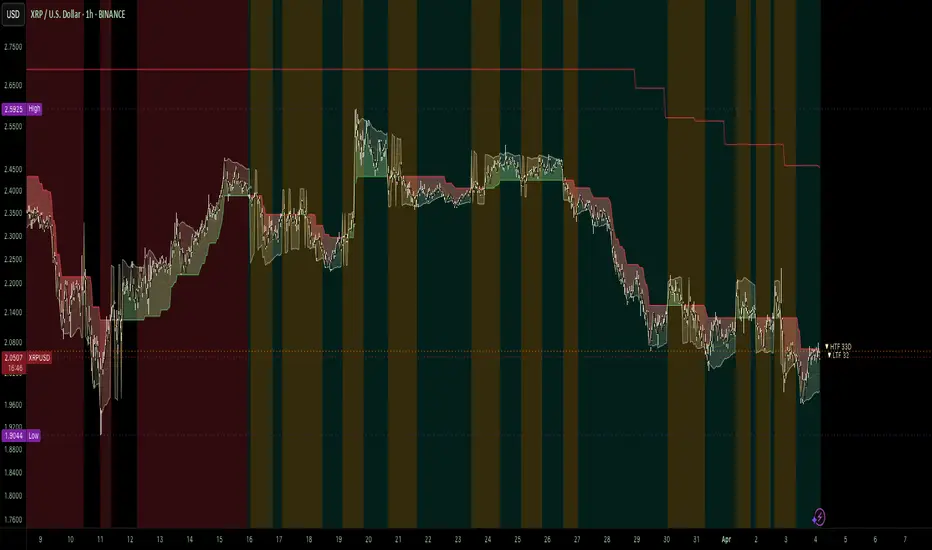

An evolved version of the classic Supertrend, SUPeR TReND 2.718 is built to deliver elegant, high-precision trend detection using Euler's constant (e = 2.718) as its default multiplier. Designed for clarity and visual flow, this indicator brings together smooth line work, intelligent color logic, and a minimalistic tally system that tracks trend persistence — all in a highly customizable, overlay-ready format.

Unlike traditional implementations, this version maintains line visibility regardless of fill opacity, ensuring crisp tracking even in complex environments. Ideal for traders who value both aesthetics and actionable structure.

__________________________________________________________

🔑 Key Features:

- 📐 ATR-based Supertrend with default multiplier = e (2.718)

- 📉 Dynamic trend line with optional fill beneath price

- ⏳ Trend duration tally label (count-only or full format)

- ⬆️ Higher-timeframe Supertrend overlay (optional)

- 🟢 Directional candle coloring for clarity

- 🟡 Subtle anchor line to guide perception without clutter

- ⚙️ PineScript v6 compliant, efficient and modular

__________________________________________________________

🧠 Interpretation Guide:

- The Supertrend line tracks trend support or resistance — beneath price in uptrends, above in downtrends.

- The shaded fill reflects direction with 70% transparency.

- The trend tally label counts how long the current trend has lasted.

- Candle colors confirm direction without overtaking price action.

- The optional HTF line shows higher-timeframe context.

- A soft yellow anchor line stabilizes the fill relationship without distraction.

__________________________________________________________

⚙️ Inputs & Controls:

- ✏️ ATR Length – Volatility lookback

- 🧮 Multiplier – Default = 2.718 (Euler's number)

- 🕰️ Higher Timeframe – Choose your bias frame

- 👁️ Show HTF / Main – Toggle each trend layer

- 🧾 Show Label / Simplify – Show trend duration, with or without arrows

- 🎨 Color Candles – Turn directional bar coloring on or off

- 🪄 Show Fill – Toggle the shaded visual rhythm

- 🎛️ All visuals use tuned colors and transparencies for clarity

__________________________________________________________

🚀 Best Practices:

- ✅ Works on any time frame; shines on 1h v. 1D

- 🔁 Use the HTF line for macro bias filtering

- 📊 Combine with volume or liquidity overlays for edge

- 🧱 Use as a structural base layer with minimalist stacks

__________________________________________________________

📈 Strategy Tips:

- 🧭 MTF Trend Alignment: Enable the HTF line to filter trades. If the HTF trend is up, only take longs on the lower frame, and vice versa.

- 🔁 Pullback Entries: During a strong trend, consider short-term dips below the Supertrend line as possible re-entry zones — only if HTF remains aligned.

- ⏳ Tally for Exhaustion: When the bar count exceeds 15+, look for confluence (volume divergence, key levels, reversal signals).

- ⚠️ HTF Flip + Extended Trend: When the HTF trend reverses while the main trend is extended, that may be a macro exit or fade signal.

- 🚫 Solo Mode: Disable HTF and use the main trend + tally as a standalone signal layer.

- 🧠 Swing Setup Friendly: Especially powerful on 1D or 1h in swing systems or trend-based grid strategies.

Unlike traditional implementations, this version maintains line visibility regardless of fill opacity, ensuring crisp tracking even in complex environments. Ideal for traders who value both aesthetics and actionable structure.

__________________________________________________________

🔑 Key Features:

- 📐 ATR-based Supertrend with default multiplier = e (2.718)

- 📉 Dynamic trend line with optional fill beneath price

- ⏳ Trend duration tally label (count-only or full format)

- ⬆️ Higher-timeframe Supertrend overlay (optional)

- 🟢 Directional candle coloring for clarity

- 🟡 Subtle anchor line to guide perception without clutter

- ⚙️ PineScript v6 compliant, efficient and modular

__________________________________________________________

🧠 Interpretation Guide:

- The Supertrend line tracks trend support or resistance — beneath price in uptrends, above in downtrends.

- The shaded fill reflects direction with 70% transparency.

- The trend tally label counts how long the current trend has lasted.

- Candle colors confirm direction without overtaking price action.

- The optional HTF line shows higher-timeframe context.

- A soft yellow anchor line stabilizes the fill relationship without distraction.

__________________________________________________________

⚙️ Inputs & Controls:

- ✏️ ATR Length – Volatility lookback

- 🧮 Multiplier – Default = 2.718 (Euler's number)

- 🕰️ Higher Timeframe – Choose your bias frame

- 👁️ Show HTF / Main – Toggle each trend layer

- 🧾 Show Label / Simplify – Show trend duration, with or without arrows

- 🎨 Color Candles – Turn directional bar coloring on or off

- 🪄 Show Fill – Toggle the shaded visual rhythm

- 🎛️ All visuals use tuned colors and transparencies for clarity

__________________________________________________________

🚀 Best Practices:

- ✅ Works on any time frame; shines on 1h v. 1D

- 🔁 Use the HTF line for macro bias filtering

- 📊 Combine with volume or liquidity overlays for edge

- 🧱 Use as a structural base layer with minimalist stacks

__________________________________________________________

📈 Strategy Tips:

- 🧭 MTF Trend Alignment: Enable the HTF line to filter trades. If the HTF trend is up, only take longs on the lower frame, and vice versa.

- 🔁 Pullback Entries: During a strong trend, consider short-term dips below the Supertrend line as possible re-entry zones — only if HTF remains aligned.

- ⏳ Tally for Exhaustion: When the bar count exceeds 15+, look for confluence (volume divergence, key levels, reversal signals).

- ⚠️ HTF Flip + Extended Trend: When the HTF trend reverses while the main trend is extended, that may be a macro exit or fade signal.

- 🚫 Solo Mode: Disable HTF and use the main trend + tally as a standalone signal layer.

- 🧠 Swing Setup Friendly: Especially powerful on 1D or 1h in swing systems or trend-based grid strategies.

Nota Keluaran

An evolved execution of a structural classic, SUPeR TReND 2.718 delivers clean, high-precision trend detection using Euler’s constant (e = 2.718) as its native volatility multiplier. Built for visual clarity and modular use, this overlay-ready indicator blends directional trails, trend persistence tallies, and projection bands to reveal momentum structure without noise.Unlike traditional Supertrend implementations, this edition decouples fill opacity from line visibility, ensuring trend clarity in layered or compressed environments. It supports dynamic candle coloring, anchored shading, and multi-timeframe overlays — all tuned for traders who value both signal and form.](<An evolved version of its classic namesake, SUPeR TReND 2.718 is built to deliver elegant, high-precision trend detection using Euler's constant (e = 2.718) as its default multiplier. Designed for clarity and visual flow, this indicator brings together smooth line work, intelligent color logic, and a minimalistic tally system that tracks trend persistence — all in a highly customizable, overlay-ready format.

Unlike traditional implementations, this version maintains line visibility regardless of fill opacity, ensuring crisp tracking even in complex environments. Ideal for traders who value both aesthetics and actionable structure.

The core line tracks trend using ±2.718 × ATR as a dynamic trail. This line acts as a real-time support or resistance boundary, with optional fill below price for visual rhythm. A secondary projection at ±1.618 × ATR (the golden ratio) offers an early look at where trends may stretch before exhausting.

Trend duration is actively tracked and displayed with minimal labels — directional triangles and timeframe tags tally how many bars the trend has persisted. This visual cue is crucial for timing entries, exits, or watching for exhaustion. HTF logic runs in parallel, with its own line, label, and optional macro backdrop shading.

Users can enable visual highlights when LTF and/or HTF trends extend beyond 13 bars. These show as faint red, yellow, or teal backgrounds depending on which trends persist — a soft but powerful signal of trend maturity or compression.

All elements are fully configurable. You can toggle fills, projection lines, tallies, and background logic independently. Colors, opacities, and overlay styles are exposed for tuning to any visual or structural framework.

Whether used as a standalone directional model or as the base layer of a broader system, SUPeR TReND 2.718 anchors trend logic with clarity, math, and rhythm — engineered for confluence, not chaos.

________________________________________________________________

🔑 Key Features:

- 📐 Supertrend logic using ±2.718 × ATR (Euler-native)

- 🟧 Optional golden projection band at ±1.618 × ATR

- ⏳ LTF and HTF trend duration tally with directional glyphs

- 🧭 HTF trend overlay with toggle and tally

- 🎨 Fully customizable trend body fill and continuity highlights

- 🔦 Dynamic background shading when trend exceeds 13 bars

- ⚙️ Pine Script v6, modular and performance-optimized

________________________________________________________________

🧠 Interpretation Guide:

- The **main trail** shows structural support or resistance, adapting to trend direction.

- The **lemon zone** projects potential exhaustion at ±2.718 × ATR.

- The **orange line** (golden projection) marks early stretch using ±1.618 × ATR.

- The **trend tally labels** mark how long LTF and HTF trends have run.

- The **HTF line** provides macro confirmation and continuity anchoring.

- Directional **candle colors** and **fill opacity** are independently configurable.

________________________________________________________________

⚙️ Controls:

- 🎛 ATR Length and Multiplier (default = 2.718)

- 🕰️ HTF Timeframe Selector

- 🪞 Toggle: HTF Trend, LTF Trend, Labels, Candle Colors

- 🧾 Toggle: Projection lines, fill zone, and trend highlight

- 🎨 User-defined color + opacity for all zones, fills, and tally visuals

________________________________________________________________

🚀 Usage Tips:

- ✅ Adaptable across all frames, ideal on 15m and 1h

- 🧠 Use HTF alignment to bias trades; HTF + LTF in agreement signals strong continuation

- 🌀 Look for re-entries on pullbacks to the main trail when trend is mature

- 🔁 Watch tally count for trend fatigue (13+ bars = potential climax zone)

- 🧱 Use as a structural base for liquidity, volume, or exhaustion overlays

Nota Keluaran

An evolved version of its classic namesake, SUPeR TReND 2.718 is built to deliver elegant, high-precision trend detection using Euler's constant (e = 2.718) as its default multiplier. Designed for clarity and visual flow, this indicator brings together smooth line work, intelligent color logic, and a minimalistic tally system that tracks trend persistence — all in a highly customizable, overlay-ready format. Unlike traditional implementations, this one maintains line visibility regardless of fill opacity, ensuring crisp tracking even in complex environments. Ideal for traders who value both aesthetics and actionable structure.

The core line tracks trend using ±2.718 × ATR as a dynamic trail. This line acts as a real-time support or resistance boundary, with optional fill below price for visual rhythm. A secondary projection at ±1.618 × ATR (the golden ratio) offers an early look at where trends may stretch before exhausting.

Trend duration is actively tracked and displayed with minimal labels — directional triangles and timeframe tags tally how many bars the trend has persisted. This visual cue is crucial for timing entries, exits, or watching for exhaustion. HTF logic runs in parallel, with its own line, label, and optional macro backdrop shading.

Users can enable visual highlights when LTF and/or HTF trends extend beyond 13 bars. These show as faint red, yellow, or teal backgrounds depending on which trends persist — a soft but powerful signal of trend maturity or compression.

All elements are fully configurable. You can toggle fills, projection lines, tallies, and background logic independently. Colors, opacities, and overlay styles are exposed for tuning to any visual or structural framework.

Whether used as a standalone directional model or as the base layer of a broader system, SUPeR TReND 2.718 anchors trend logic with clarity, math, and rhythm — engineered for confluence, not chaos.

---

🔑 Key Features:

- 📐 Supertrend logic using ±2.718 × ATR (Euler-native)

- 🟧 Optional golden projection band at ±1.618 × ATR

- ⏳ LTF and HTF trend duration tally with directional glyphs

- 🧭 HTF trend overlay with toggle and tally

- 🎨 Fully customizable trend body fill and continuity highlights

- 🔦 Dynamic background shading when trend exceeds 13 bars

- ⚙️ Pine Script v6, modular and performance-optimized

---

🧠 Interpretation Guide:

- The **main trail** shows structural support or resistance, adapting to trend direction.

- The **lemon zone** projects potential exhaustion at ±2.718 × ATR.

- The **orange line** (golden projection) marks early stretch using ±1.618 × ATR.

- The **trend tally labels** mark how long LTF and HTF trends have run.

- The **HTF line** provides macro confirmation and continuity anchoring.

- Directional **candle colors** and **fill opacity** are independently configurable.

---

⚙️ Controls:

- 🎛 ATR Length and Multiplier (default = 2.718)

- 🕰️ HTF Timeframe Selector

- 🪞 Toggle: HTF Trend, LTF Trend, Labels, Candle Colors

- 🧾 Toggle: Projection lines, fill zone, and trend highlight

- 🎨 User-defined color + opacity for all zones, fills, and tally visuals

---

🚀 Usage Tips:

- ✅ Adaptable across all frames, ideal on 15m and 1h

- 🧠 Use HTF alignment to bias trades; HTF + LTF in agreement signals strong continuation

- 🌀 Look for re-entries on pullbacks to the main trail when trend is mature

- 🔁 Watch tally count for trend fatigue (13+ bars = potential climax zone)

- 🧱 Use as a structural base for liquidity, volume, or exhaustion overlays

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

adrian dyer

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

adrian dyer

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.