OPEN-SOURCE SCRIPT

Pivot Channel Breaks [BigBeluga]

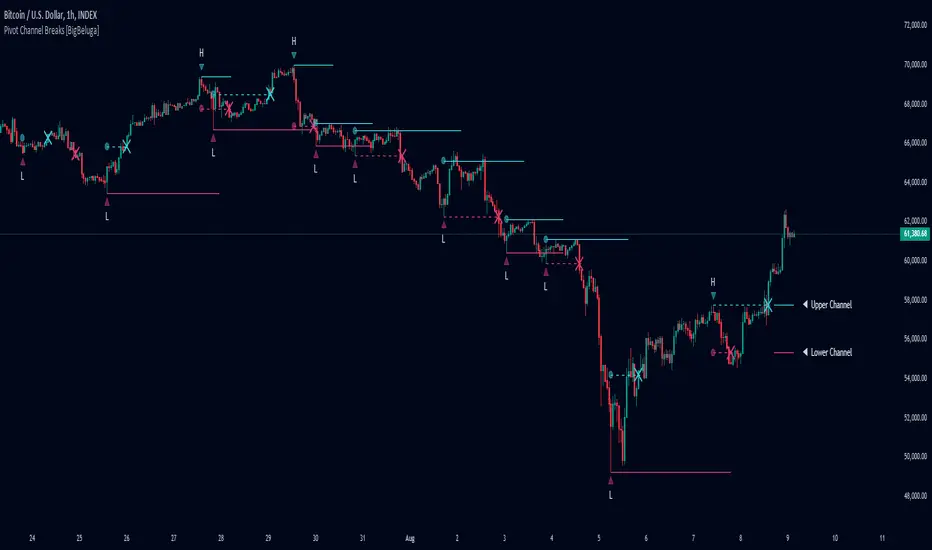

Pivot Channel Break

The Pivot Channel Break indicator identifies key pivot points and creates a dynamic channel based on these pivots. It detects breakouts from this channel, providing potential entry and exit signals for traders.

🔵How to Use

🔵Customization

• Pivot Right: Lookback period for pivot detection (default: 10)

• Pivot Left: Forward period for pivot confirmation (default: 40)

• Channel Width: Multiplier for channel width calculation (default: 1.0)

• Support & Resistance Signals: Toggle additional touch signals

• Bar Color: Enable/disable trend-based bar coloring

Calculation:

The Pivot Channel Break indicator offers a dynamic approach to identifying potential trend changes and breakout opportunities. It combines pivot point analysis with a flexible channel calculation, providing traders with a visual tool for market structure analysis. Use this indicator in conjunction with other technical analysis methods to confirm signals and manage risk effectively.

The Pivot Channel Break indicator identifies key pivot points and creates a dynamic channel based on these pivots. It detects breakouts from this channel, providing potential entry and exit signals for traders.

🔵How to Use

- Channel Identification:

- Upper and lower channel lines drawn based on pivot highs and lows

- Channel width dynamically adjusted using ATR-like calculation - Breakout Signals:

- Upward breakout: Price closes above upper channel line

- Downward breakout: Price closes below lower channel line

- Signals shown as X marks on the chart - Pivot Points:

- High pivots marked with "H" triangles

- Low pivots marked with "L" triangles - Support & Resistance:

- Optional signals when price touches but doesn't break channel lines - Trend Visualization:

- Optional bar coloring based on the most recent breakout direction

🔵Customization

• Pivot Right: Lookback period for pivot detection (default: 10)

• Pivot Left: Forward period for pivot confirmation (default: 40)

• Channel Width: Multiplier for channel width calculation (default: 1.0)

• Support & Resistance Signals: Toggle additional touch signals

• Bar Color: Enable/disable trend-based bar coloring

Calculation:

- Detect pivot highs and lows using specified lookback periods

- Calculate channel basis using 10-period SMA of close prices

- Determine channel width using ATR-like calculation: RMA(high - low, 10) * width multiplier

- Set channel lines based on pivot points and calculated deviations

- Identify breakouts when price crosses beyond channel lines

The Pivot Channel Break indicator offers a dynamic approach to identifying potential trend changes and breakout opportunities. It combines pivot point analysis with a flexible channel calculation, providing traders with a visual tool for market structure analysis. Use this indicator in conjunction with other technical analysis methods to confirm signals and manage risk effectively.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

🔵Gain access to our powerful tools : bigbeluga.com/tv

🔵Join our free discord for updates : bigbeluga.com/discord

All scripts & content provided by BigBeluga are for informational & educational purposes only.

🔵Join our free discord for updates : bigbeluga.com/discord

All scripts & content provided by BigBeluga are for informational & educational purposes only.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

🔵Gain access to our powerful tools : bigbeluga.com/tv

🔵Join our free discord for updates : bigbeluga.com/discord

All scripts & content provided by BigBeluga are for informational & educational purposes only.

🔵Join our free discord for updates : bigbeluga.com/discord

All scripts & content provided by BigBeluga are for informational & educational purposes only.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.