OPEN-SOURCE SCRIPT

Mariam Ichimoku Dashboard

Purpose

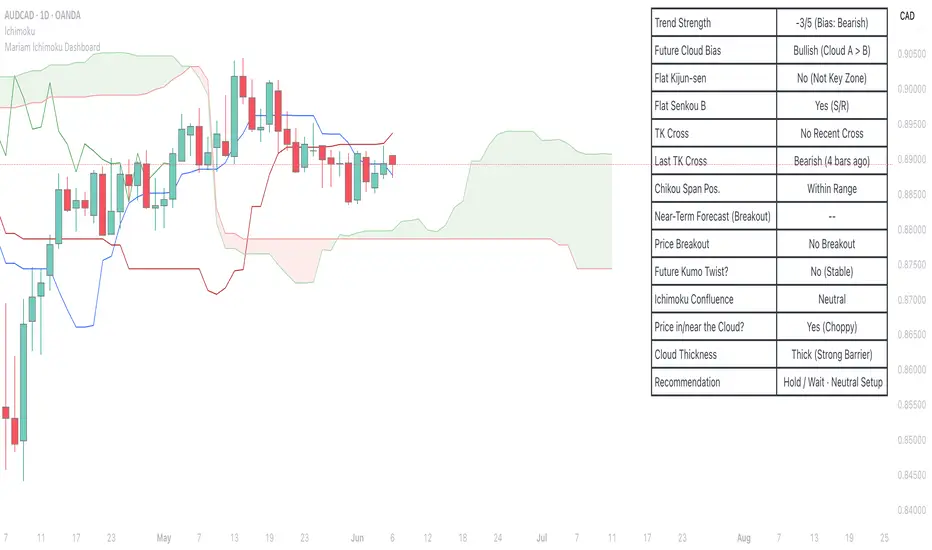

The Mariam Ichimoku Dashboard is designed to simplify the Ichimoku trading system for both beginners and experienced traders. It provides a complete view of trend direction, strength, momentum, and key signals all in one compact dashboard on your chart. This tool helps traders make faster and more confident decisions without having to interpret every Ichimoku element manually.

How It Works

1. Trend Strength Score

Calculates a score from -5 to +5 based on Ichimoku components.

A high positive score means strong bullish momentum.

A low negative score shows strong bearish conditions.

A near-zero score indicates a sideways or unclear market.

2. Future Cloud Bias

Looks 26 candles ahead to determine if the future cloud is bullish or bearish.

This helps identify the longer-term directional bias of the market.

3. Flat Kijun / Flat Senkou B

Detects flat zones in the Kijun or Senkou B lines.

These flat areas act as strong support or resistance and can attract price.

4. TK Cross

Identifies Tenkan-Kijun crosses:

Bullish Cross means Tenkan crosses above Kijun

Bearish Cross means Tenkan crosses below Kijun

5. Last TK Cross Info

Shows whether the last TK cross was bullish or bearish and how many candles ago it happened.

Helps track trend development and timing.

6. Chikou Span Position

Checks if the Chikou Span is above, below, or inside past price.

Above means bullish momentum

Below means bearish momentum

Inside means mixed or indecisive

7. Near-Term Forecast (Breakout)

Warns when price is near the edge of the cloud, preparing for a potential breakout.

Useful for anticipating price moves.

8. Price Breakout

Shows if price has recently broken above or below the cloud.

This can confirm the start of a new trend.

9. Future Kumo Twist

Detects upcoming twists in the cloud, which often signal potential trend reversals.

10. Ichimoku Confluence

Measures how many key Ichimoku signals are in agreement.

The more signals align, the stronger the trend confirmation.

11. Price in or Near the Cloud

Displays if the price is inside the cloud, which often indicates low clarity or a choppy market.

12. Cloud Thickness

Shows whether the cloud is thin or thick.

Thick clouds provide stronger support or resistance.

Thin clouds may allow easier breakouts.

13. Recommendation

Gives a simple trading suggestion based on all major signals.

Strong Buy, Strong Sell, or Hold.

Helps simplify decision-making at a glance.

Features

All major Ichimoku signals summarized in one panel

Real-time trend strength scoring

Detects flat zones, crosses, cloud twists, and breakouts

Visual alerts for trend alignment and signal confluence

Compact, clean design

Built with simplicity in mind for beginner traders

Tips

Best used on 15-minute to 1-hour charts for short-term trading

Avoid entering trades when price is inside the cloud because the market is often indecisive

Wait for alignment between trend score, TK cross, cloud bias, and confluence

Use the dashboard to support your trading strategy, not replace it

Enable alerts for major confluence or upcoming Kumo twists

The Mariam Ichimoku Dashboard is designed to simplify the Ichimoku trading system for both beginners and experienced traders. It provides a complete view of trend direction, strength, momentum, and key signals all in one compact dashboard on your chart. This tool helps traders make faster and more confident decisions without having to interpret every Ichimoku element manually.

How It Works

1. Trend Strength Score

Calculates a score from -5 to +5 based on Ichimoku components.

A high positive score means strong bullish momentum.

A low negative score shows strong bearish conditions.

A near-zero score indicates a sideways or unclear market.

2. Future Cloud Bias

Looks 26 candles ahead to determine if the future cloud is bullish or bearish.

This helps identify the longer-term directional bias of the market.

3. Flat Kijun / Flat Senkou B

Detects flat zones in the Kijun or Senkou B lines.

These flat areas act as strong support or resistance and can attract price.

4. TK Cross

Identifies Tenkan-Kijun crosses:

Bullish Cross means Tenkan crosses above Kijun

Bearish Cross means Tenkan crosses below Kijun

5. Last TK Cross Info

Shows whether the last TK cross was bullish or bearish and how many candles ago it happened.

Helps track trend development and timing.

6. Chikou Span Position

Checks if the Chikou Span is above, below, or inside past price.

Above means bullish momentum

Below means bearish momentum

Inside means mixed or indecisive

7. Near-Term Forecast (Breakout)

Warns when price is near the edge of the cloud, preparing for a potential breakout.

Useful for anticipating price moves.

8. Price Breakout

Shows if price has recently broken above or below the cloud.

This can confirm the start of a new trend.

9. Future Kumo Twist

Detects upcoming twists in the cloud, which often signal potential trend reversals.

10. Ichimoku Confluence

Measures how many key Ichimoku signals are in agreement.

The more signals align, the stronger the trend confirmation.

11. Price in or Near the Cloud

Displays if the price is inside the cloud, which often indicates low clarity or a choppy market.

12. Cloud Thickness

Shows whether the cloud is thin or thick.

Thick clouds provide stronger support or resistance.

Thin clouds may allow easier breakouts.

13. Recommendation

Gives a simple trading suggestion based on all major signals.

Strong Buy, Strong Sell, or Hold.

Helps simplify decision-making at a glance.

Features

All major Ichimoku signals summarized in one panel

Real-time trend strength scoring

Detects flat zones, crosses, cloud twists, and breakouts

Visual alerts for trend alignment and signal confluence

Compact, clean design

Built with simplicity in mind for beginner traders

Tips

Best used on 15-minute to 1-hour charts for short-term trading

Avoid entering trades when price is inside the cloud because the market is often indecisive

Wait for alignment between trend score, TK cross, cloud bias, and confluence

Use the dashboard to support your trading strategy, not replace it

Enable alerts for major confluence or upcoming Kumo twists

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.