PROTECTED SOURCE SCRIPT

ICT Key Levels Suite |MC|

Parts of this script were created by TheTickMagnet, Bankulov, and others. Many thanks to them; credit is due to all of you. I simply compiled them into a suite...

🌟 Overview 🌟

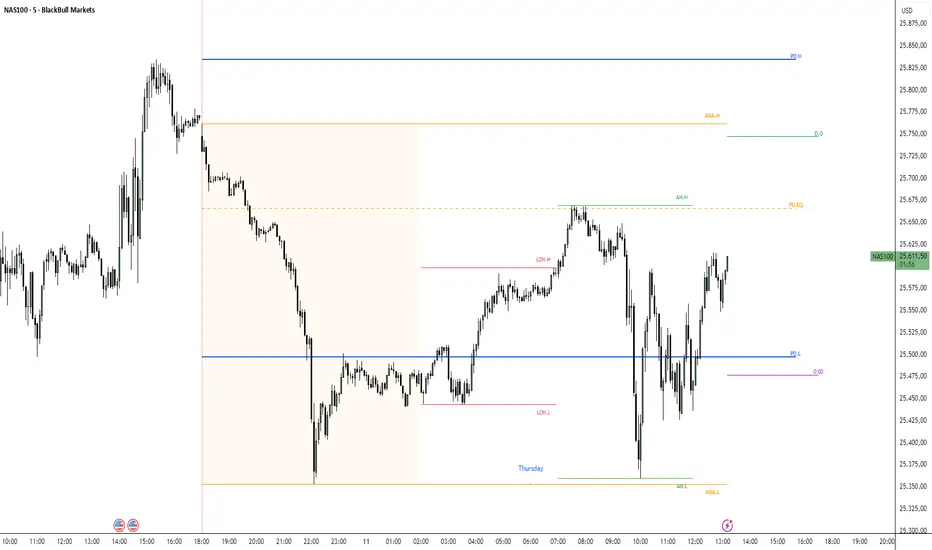

This tool highlights key price levels, such as highs, lows, and session opens, that can influence market movements. Based on ICT concepts, these levels help traders spot potential areas for market reversals or trend continuations.

🌟 Key Levels 🌟

🔹 Week Open (at Sunday 6:00pm EST for Futures)

Marks the start of the trading week. This level helps track price direction and is useful for framing the weekly candle formation using ICT’s Power of 3.

🔹 (Trading) Day Open: 6:00pm EST for Futures or 5:00pm EST for Forex.

🔹 Midnight Open (True Day Open) (00:00 EST)

The Midnight Open (MNOP) marks the start of the new trading day. Price often retraces to this level for liquidity grabs, setting up larger moves in the daily trend. It's also key for framing the Daily Power of 3 and spotting possible market manipulation.

🔹 Previous Day High/Low (customizable)

These levels show where liquidity remains, often serving as targets for price revisits, ideal for reversals or continuation trades.

🔹 Daily divider lines with Weekday label (customizable)

🌟 Overview 🌟

The ICT Sessions & Ranges Indicator helps traders identify key intraday price levels by marking custom session highs/lows and opening ranges.

It helps traders spot potential liquidity grabs, reversals, and breakout zones by tracking price behavior around these key areas

🌟 Session Highs & Lows – Liquidity Zones 🌟

Session highs and lows often attract price due to stop orders resting above or below them. These levels are frequently targeted during high-volatility moves.

🔹 Asia session

- Usually ranges in low volatility.

- Highs/lows often get swept during early London.

- Price may raid these levels, then reverse.

🔹 London session

- First major volatility of the day.

- Highs/lows often tested or swept in New York.

- Commonly forms the day's true high or low.

🔹 NY AM, Lunch & PM Session

🌟 Customizable Settings 🌟

The indicator includes 5 configurable ranges, each with:

Start & End Time – Set any custom time window.

Display Type – Choose Box (highlight range) or Lines (mark high/low) or both (Box and extended Lines).

Color Settings – Set custom colors for boxes and lines.

🌟 Default Settings (according to ICT) 🌟

Range 1: 6:00pm - 2:00am (Asia Session)

Range 2: 02:00 - 07:00 (London Session)

Range 3: 07:00 - 12:00 (NY AM Session)

Range 4: 12:00 - 1:30pm (NY Lunch Session)

Range 5: 1:30pm - 5:00pm (NY PM Session)

Happy trading!

🌟 Overview 🌟

This tool highlights key price levels, such as highs, lows, and session opens, that can influence market movements. Based on ICT concepts, these levels help traders spot potential areas for market reversals or trend continuations.

🌟 Key Levels 🌟

🔹 Week Open (at Sunday 6:00pm EST for Futures)

Marks the start of the trading week. This level helps track price direction and is useful for framing the weekly candle formation using ICT’s Power of 3.

🔹 (Trading) Day Open: 6:00pm EST for Futures or 5:00pm EST for Forex.

🔹 Midnight Open (True Day Open) (00:00 EST)

The Midnight Open (MNOP) marks the start of the new trading day. Price often retraces to this level for liquidity grabs, setting up larger moves in the daily trend. It's also key for framing the Daily Power of 3 and spotting possible market manipulation.

🔹 Previous Day High/Low (customizable)

These levels show where liquidity remains, often serving as targets for price revisits, ideal for reversals or continuation trades.

🔹 Daily divider lines with Weekday label (customizable)

🌟 Overview 🌟

The ICT Sessions & Ranges Indicator helps traders identify key intraday price levels by marking custom session highs/lows and opening ranges.

It helps traders spot potential liquidity grabs, reversals, and breakout zones by tracking price behavior around these key areas

🌟 Session Highs & Lows – Liquidity Zones 🌟

Session highs and lows often attract price due to stop orders resting above or below them. These levels are frequently targeted during high-volatility moves.

🔹 Asia session

- Usually ranges in low volatility.

- Highs/lows often get swept during early London.

- Price may raid these levels, then reverse.

🔹 London session

- First major volatility of the day.

- Highs/lows often tested or swept in New York.

- Commonly forms the day's true high or low.

🔹 NY AM, Lunch & PM Session

🌟 Customizable Settings 🌟

The indicator includes 5 configurable ranges, each with:

Start & End Time – Set any custom time window.

Display Type – Choose Box (highlight range) or Lines (mark high/low) or both (Box and extended Lines).

Color Settings – Set custom colors for boxes and lines.

🌟 Default Settings (according to ICT) 🌟

Range 1: 6:00pm - 2:00am (Asia Session)

Range 2: 02:00 - 07:00 (London Session)

Range 3: 07:00 - 12:00 (NY AM Session)

Range 4: 12:00 - 1:30pm (NY Lunch Session)

Range 5: 1:30pm - 5:00pm (NY PM Session)

Happy trading!

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.