PROTECTED SOURCE SCRIPT

ZTCRYPTOLAB - Oscillator Matrix

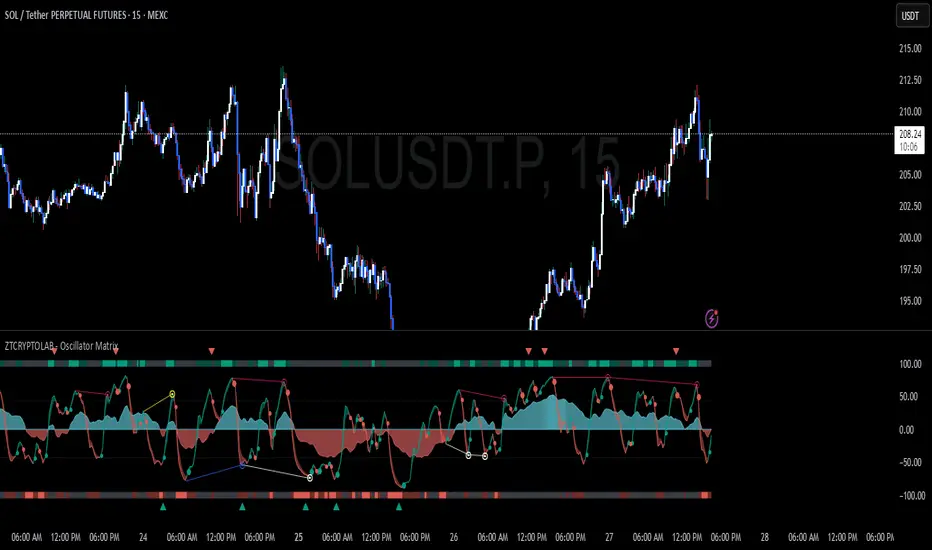

ZTCRYPTOLAB – Oscillator Matrix is a momentum and market-strength oscillator designed to help traders identify overbought/oversold conditions, divergences, and potential reversal points with enhanced visual clarity.

🔹 Core Logic

This oscillator blends multiple momentum measures into a single framework:

RSI (Relative Strength Index) for directional momentum.

MFI (Money Flow Index) with dual fast/slow lengths for flow balance.

Stochastic smoothing for short-term acceleration.

These are normalized, transformed, and combined into two smoothed signal lines (fast vs. slow average) that form the backbone of the oscillator.

🔹 Visual Components

Histogram (Money Flow Cloud): Displays directional flow. As price pushes further into overbought/oversold zones, the histogram cloud brightens in intensity, making strong conditions stand out.

Signal Lines: Two smoothed oscillator curves, with crossovers and relative position highlighting momentum shifts.

Reversal Dots: Circles appear when the oscillator detects exhaustion in OB/OS territory, giving early reversal signals.

Status Line Bands: A confluence score (0–3) plots colored bands at the top/bottom of the panel, showing the current strength of bullish or bearish conditions.

🔹 Divergence Engine

The script includes a custom divergence detector that compares oscillator pivots with price pivots:

Regular divergences highlight momentum weakening against price extremes.

Hidden divergences signal continuation potential when momentum recovers faster than price.

The engine applies strict pivot distance rules and checks for line-cross violations, which reduces noise and false signals.

🔹 Take-Profit Signals

TP markers appear when the oscillator forms exhaustion pivots beyond ±50 zones, helping traders spot where momentum may fade after a run.

🔹 Alerts & Automation

All major events can be linked to TradingView alerts, including:

Signal line crossovers

Reversal dots

Divergences (regular + hidden)

Take-profit signals

Confluence score changes

Additionally, a Custom Alert Builder lets traders define multi-step conditions (e.g., “Money Flow cross + Reversal Dot + Divergence”) and trigger alerts only when sequences are met.

🔹 How to Use

Trend Confirmation: Use the histogram and signal lines to confirm market bias.

Reversals: Watch for dots + divergences near extremes.

Exits / Scaling: TP markers and bright clouds highlight when momentum is stretched.

Alerts: Configure the builder to align with your trading plan (scalping, swing, trend-following).

🔹 Core Logic

This oscillator blends multiple momentum measures into a single framework:

RSI (Relative Strength Index) for directional momentum.

MFI (Money Flow Index) with dual fast/slow lengths for flow balance.

Stochastic smoothing for short-term acceleration.

These are normalized, transformed, and combined into two smoothed signal lines (fast vs. slow average) that form the backbone of the oscillator.

🔹 Visual Components

Histogram (Money Flow Cloud): Displays directional flow. As price pushes further into overbought/oversold zones, the histogram cloud brightens in intensity, making strong conditions stand out.

Signal Lines: Two smoothed oscillator curves, with crossovers and relative position highlighting momentum shifts.

Reversal Dots: Circles appear when the oscillator detects exhaustion in OB/OS territory, giving early reversal signals.

Status Line Bands: A confluence score (0–3) plots colored bands at the top/bottom of the panel, showing the current strength of bullish or bearish conditions.

🔹 Divergence Engine

The script includes a custom divergence detector that compares oscillator pivots with price pivots:

Regular divergences highlight momentum weakening against price extremes.

Hidden divergences signal continuation potential when momentum recovers faster than price.

The engine applies strict pivot distance rules and checks for line-cross violations, which reduces noise and false signals.

🔹 Take-Profit Signals

TP markers appear when the oscillator forms exhaustion pivots beyond ±50 zones, helping traders spot where momentum may fade after a run.

🔹 Alerts & Automation

All major events can be linked to TradingView alerts, including:

Signal line crossovers

Reversal dots

Divergences (regular + hidden)

Take-profit signals

Confluence score changes

Additionally, a Custom Alert Builder lets traders define multi-step conditions (e.g., “Money Flow cross + Reversal Dot + Divergence”) and trigger alerts only when sequences are met.

🔹 How to Use

Trend Confirmation: Use the histogram and signal lines to confirm market bias.

Reversals: Watch for dots + divergences near extremes.

Exits / Scaling: TP markers and bright clouds highlight when momentum is stretched.

Alerts: Configure the builder to align with your trading plan (scalping, swing, trend-following).

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya dengan percuma dan tanpa had – ketahui lebih lanjut di sini.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya dengan percuma dan tanpa had – ketahui lebih lanjut di sini.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.