OPEN-SOURCE SCRIPT

Telah dikemas kini ORB with 100 EMA

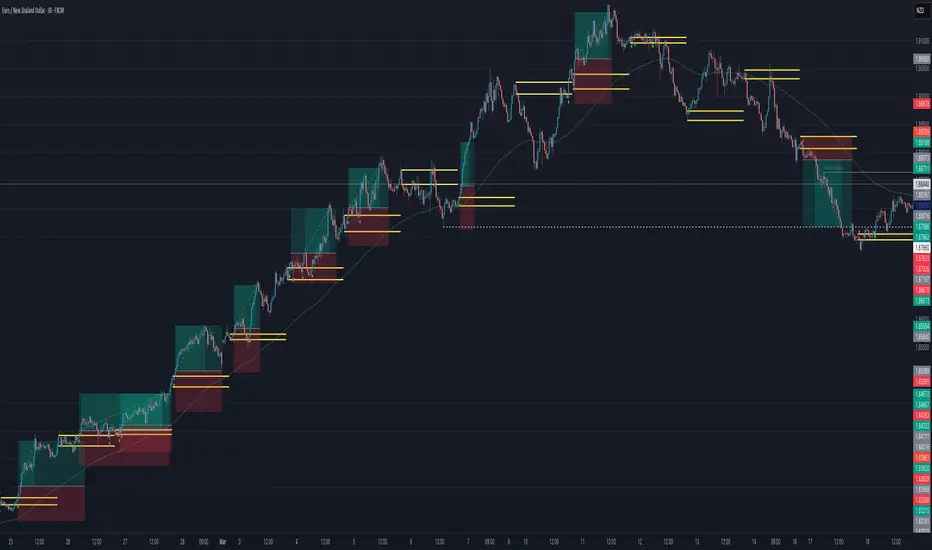

ORB Trading Strategy for FX Pairs on the 30-Minute Time Frame

Overview

This Opening Range Breakout (ORB) strategy is designed for trading FX pairs on the 30-minute time frame. The strategy is structured to take advantage of price momentum while aligning trades with the overall trend using the 100-period Exponential Moving Average (100EMA). The primary objective is to enter trades when price breaks and closes above or below the Opening Range (OR), with additional confirmation from a retest of the OR level if the initial entry is missed.

Strategy Rules

1. Defining the Opening Range (OR)

- The OR is determined by the high and low of the first 30-minute candle after market open.

- This range acts as the key level for breakout trading.

2. Trend Confirmation Using the 100EMA

- The 100EMA serves as a filter to determine trade direction:

- Buy Setup: Only take buy trades when the OR is above the 100EMA.

- Sell Setup: Only take sell trades when the OR is below the 100EMA.

3. Entry Criteria

- Buy Trade: Enter a long position when a candle breaks and closes above the OR high, confirming the breakout.

- Sell Trade: Enter a short position when a candle breaks and closes below the OR low, confirming the breakout.

- Retest Entry: If the initial entry is missed, wait for a price retest of the OR level for a secondary entry opportunity.

4. Risk-to-Reward Ratio (R2R)

- The goal is to target a 1:1 Risk-to-Reward (R2R) ratio.

- Stop-loss placement:

- Buy Trade: Place stop-loss just below the OR low.

- Sell Trade: Place stop-loss just above the OR high.

- Take profit at a distance equal to the stop-loss for a 1:1 R2R.

5. Risk Management

- Risk per trade should be based on personal risk tolerance.

- Adjust lot sizes accordingly to maintain a controlled risk percentage of account balance.

- Avoid over-leveraging, and consider moving stop-loss to breakeven if the price moves favourably.

Additional Considerations

- Avoid trading during major news events that may cause high volatility and unpredictable price movements.

- Monitor market conditions to ensure breakout confirmation with strong momentum rather than false breakouts.

- Use additional confluences such as candlestick patterns, support/resistance zones, or volume analysis for stronger trade validation.

This ORB strategy is designed to provide structured trade opportunities by combining breakout momentum with trend confirmation via the 100EMA. The strategy is straightforward, allowing traders to capitalise on clear breakout movements while implementing effective risk management practices. While the 1:1 R2R target provides a balanced approach, traders should always adapt their risk tolerance and market conditions to optimise trade performance.

By following these rules and maintaining discipline, traders can use this strategy effectively across various FX pairs on the 30-minute time frame.

Overview

This Opening Range Breakout (ORB) strategy is designed for trading FX pairs on the 30-minute time frame. The strategy is structured to take advantage of price momentum while aligning trades with the overall trend using the 100-period Exponential Moving Average (100EMA). The primary objective is to enter trades when price breaks and closes above or below the Opening Range (OR), with additional confirmation from a retest of the OR level if the initial entry is missed.

Strategy Rules

1. Defining the Opening Range (OR)

- The OR is determined by the high and low of the first 30-minute candle after market open.

- This range acts as the key level for breakout trading.

2. Trend Confirmation Using the 100EMA

- The 100EMA serves as a filter to determine trade direction:

- Buy Setup: Only take buy trades when the OR is above the 100EMA.

- Sell Setup: Only take sell trades when the OR is below the 100EMA.

3. Entry Criteria

- Buy Trade: Enter a long position when a candle breaks and closes above the OR high, confirming the breakout.

- Sell Trade: Enter a short position when a candle breaks and closes below the OR low, confirming the breakout.

- Retest Entry: If the initial entry is missed, wait for a price retest of the OR level for a secondary entry opportunity.

4. Risk-to-Reward Ratio (R2R)

- The goal is to target a 1:1 Risk-to-Reward (R2R) ratio.

- Stop-loss placement:

- Buy Trade: Place stop-loss just below the OR low.

- Sell Trade: Place stop-loss just above the OR high.

- Take profit at a distance equal to the stop-loss for a 1:1 R2R.

5. Risk Management

- Risk per trade should be based on personal risk tolerance.

- Adjust lot sizes accordingly to maintain a controlled risk percentage of account balance.

- Avoid over-leveraging, and consider moving stop-loss to breakeven if the price moves favourably.

Additional Considerations

- Avoid trading during major news events that may cause high volatility and unpredictable price movements.

- Monitor market conditions to ensure breakout confirmation with strong momentum rather than false breakouts.

- Use additional confluences such as candlestick patterns, support/resistance zones, or volume analysis for stronger trade validation.

This ORB strategy is designed to provide structured trade opportunities by combining breakout momentum with trend confirmation via the 100EMA. The strategy is straightforward, allowing traders to capitalise on clear breakout movements while implementing effective risk management practices. While the 1:1 R2R target provides a balanced approach, traders should always adapt their risk tolerance and market conditions to optimise trade performance.

By following these rules and maintaining discipline, traders can use this strategy effectively across various FX pairs on the 30-minute time frame.

Nota Keluaran

UPDATE:Restrict signals based on the 100 EMA position within the opening range.

Prevents any buy or sell signals from appearing when the 100 EMA is inside the opening range.

This restriction applies to all signals except the modified Signal 2.

Adjust Signal 2:

Buy Signal 2 will now only trigger after at least one candle has retested the opening range high.

Sell Signal 2 will only trigger after at least one candle has retested the opening range low.

Nota Keluaran

UPDATE:The indicator now supports three selectable sessions:

Session One

Session Two

Session Three

You can easily change the times for each session and choose the active one using the Select Session dropdown in the settings panel.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.