OPEN-SOURCE SCRIPT

Telah dikemas kini Kyrie Crossover ( @zaytradellc )

Unlocking Market Dynamics: Kyrie Crossover Script by zaytradellc

personalized trading success with the "Kyrie Crossover" script, meticulously crafted by @zaytrade. This innovative Pine Script, tailored to the birthdays of Kyrie and the script creator, combines the power of technical analysis with a touch of personalization to revolutionize your trading experience.

**Exponential Moving Average (EMA) Crossover Strategy:**

At the heart of the "Kyrie Crossover" script lies a sophisticated EMA crossover strategy. By utilizing a 10-period EMA and a 323-period EMA (symbolizing long term price action ), the strategy effectively captures market trends with precision and insight.

- **Short-Term EMA (10-period):** This EMA reacts swiftly to recent price changes, offering heightened sensitivity to short-term fluctuations. It excels in identifying immediate shifts in market sentiment, making it invaluable for pinpointing short-lived trends and potential reversal points.

- **Long-Term EMA (323-period):** In contrast, the long-term EMA provides a broader perspective by smoothing out short-term noise and focusing on longer-term trend direction. Its extended length filters out market noise effectively, providing a clear representation of the underlying trend's momentum and sustainability.

**Directional Movement Index (DMI) Metrics:**

The "Kyrie Crossover" script goes beyond traditional indicators by incorporating DMI metrics across multiple timeframes. By assessing trend strength and direction, traders gain valuable insights into market dynamics, allowing for informed decision-making.

**Simple Instructions to Profit:**

1. **Identify EMA Crossovers:** Look for instances where the short-term EMA (10-period) crosses above the long-term EMA (323-period) for a bullish signal, indicating a potential buying opportunity. Conversely, a crossover where the short-term EMA crosses below the long-term EMA signals a bearish trend and a potential selling opportunity.

2. **Confirm with DMI Metrics:** Validate EMA crossovers by checking DMI metrics across different timeframes (5 minutes, 15 minutes, 30 minutes, and 1 hour). Pay attention to color-coded indicators, with green indicating a bullish trend, red indicating a bearish trend, and white indicating no clear trend.

3. **Manage Risk:** Implement proper risk management techniques, such as setting stop-loss orders and position sizing based on your risk tolerance and trading objectives.

4. **Stay Informed:** Regularly monitor market conditions and adjust your trading strategy accordingly based on new signals and emerging trends.

personalized trading success with the "Kyrie Crossover" script, meticulously crafted by @zaytrade. This innovative Pine Script, tailored to the birthdays of Kyrie and the script creator, combines the power of technical analysis with a touch of personalization to revolutionize your trading experience.

**Exponential Moving Average (EMA) Crossover Strategy:**

At the heart of the "Kyrie Crossover" script lies a sophisticated EMA crossover strategy. By utilizing a 10-period EMA and a 323-period EMA (symbolizing long term price action ), the strategy effectively captures market trends with precision and insight.

- **Short-Term EMA (10-period):** This EMA reacts swiftly to recent price changes, offering heightened sensitivity to short-term fluctuations. It excels in identifying immediate shifts in market sentiment, making it invaluable for pinpointing short-lived trends and potential reversal points.

- **Long-Term EMA (323-period):** In contrast, the long-term EMA provides a broader perspective by smoothing out short-term noise and focusing on longer-term trend direction. Its extended length filters out market noise effectively, providing a clear representation of the underlying trend's momentum and sustainability.

**Directional Movement Index (DMI) Metrics:**

The "Kyrie Crossover" script goes beyond traditional indicators by incorporating DMI metrics across multiple timeframes. By assessing trend strength and direction, traders gain valuable insights into market dynamics, allowing for informed decision-making.

**Simple Instructions to Profit:**

1. **Identify EMA Crossovers:** Look for instances where the short-term EMA (10-period) crosses above the long-term EMA (323-period) for a bullish signal, indicating a potential buying opportunity. Conversely, a crossover where the short-term EMA crosses below the long-term EMA signals a bearish trend and a potential selling opportunity.

2. **Confirm with DMI Metrics:** Validate EMA crossovers by checking DMI metrics across different timeframes (5 minutes, 15 minutes, 30 minutes, and 1 hour). Pay attention to color-coded indicators, with green indicating a bullish trend, red indicating a bearish trend, and white indicating no clear trend.

3. **Manage Risk:** Implement proper risk management techniques, such as setting stop-loss orders and position sizing based on your risk tolerance and trading objectives.

4. **Stay Informed:** Regularly monitor market conditions and adjust your trading strategy accordingly based on new signals and emerging trends.

Nota Keluaran

Updated Table Nota Keluaran

Overview of the TradingView Pine Script StrategyThis TradingView Pine Script strategy, named "Kyrie Crossover zaytrade," incorporates a combination of EMA (Exponential Moving Average) crossover signals and DMI (Directional Movement Index) analysis to generate trading signals and assess market conditions. Here’s a brief overview of the script’s functionality:

Input Parameters:

EMA Periods: The user can set the periods for the short-term and long-term EMAs.

Risk Percentage: A parameter to define the risk percentage for setting stop-loss levels based on the EMAs.

DMI Parameters: The ADX smoothing and DI length can be customized.

EMA Calculation:

The script calculates the short-term and long-term EMAs using the ta.ema function.

Trading Signals:

Long Condition: A long position is triggered when the short-term EMA crosses above the long-term EMA.

Short Condition: A short position is triggered when the short-term EMA crosses below the long-term EMA.

DMI and Trend Strength Analysis:

The script computes the DMI values, including the ADX, plus DI, and minus DI, to assess the trend strength and direction.

It defines trend indications (Bullish, Bearish, No Clear Trend) and categorizes trend strength from Very Weak to Very Strong.

Multiple Timeframe Analysis:

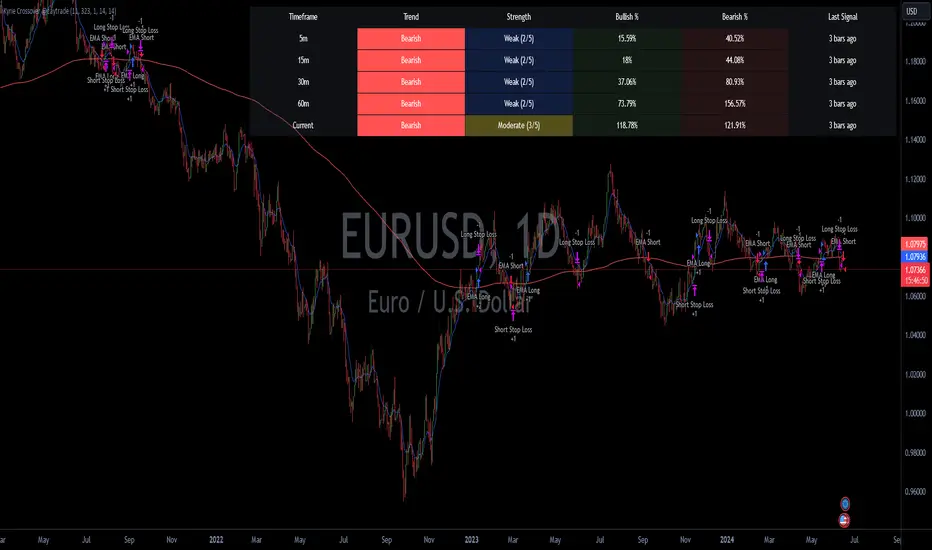

The script analyzes trends and strengths across multiple timeframes (5m, 15m, 30m, 60m) and the current timeframe.

It displays this information in a table, showing the trend, strength, bullish percentage, and bearish percentage for each timeframe.

Visual Elements:

Plots the short-term and long-term EMAs on the chart.

A table summarizing the trend and strength information for various timeframes is created and displayed on the chart.

Risk Management:

The script sets stop-loss levels based on the specified risk percentage and the average entry price of the position.

Strategy Execution:

Executes trades based on the EMA crossover conditions and manages positions with the defined stop-loss levels.

This strategy aims to provide a comprehensive analysis of market conditions by combining trend-following techniques (EMA crossovers) with momentum-based indicators (DMI), giving traders a robust tool for making informed trading decisions.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.