OPEN-SOURCE SCRIPT

Daily Investments Index Scalp

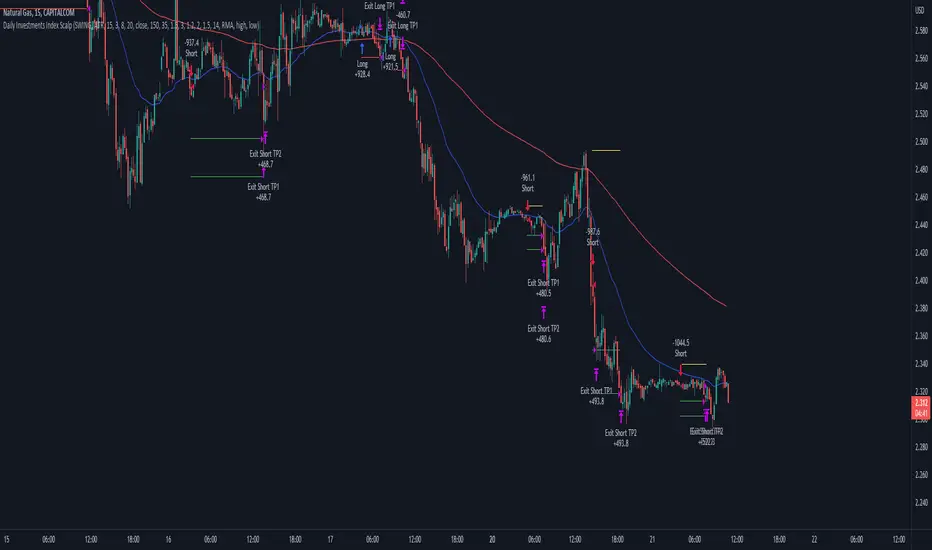

This strategy is based on the DIDI index with our own confirmations and calculated SL/TP .

You can change every setting if you want it to use for another pair, but this is fine tuned for NATURALGAS

The entries are taken when:

Long:

- Buy signal from the DIDI indicator

- Long EMA is underneath the Short EMA

- Price must be Above the Long EMA

- TP1 (default) - ATR based first TP is ATR * 1.2 Multiplier

- TP2 (default) - ATR based first TP is ATR * 2 Multiplier

- TP2 SL is the strategy entry price when we hit the first TP

- SL (default) - Latest swing low with a look back of 17 candles

Short:

- Sell signal from the DIDI indicator

- Long EMA is Above the Short EMA

- Price must be Below the Long EMA

- TP1 (default) - ATR based first TP is ATR * 1.2 Multiplier

- TP2 (default) - ATR based first TP is ATR * 2 Multiplier

- TP2 SL is the strategy entry price when we hit the first TP

- SL (default) - Latest swing low with a look back of 17 candles

It's fairly simple, and i think you can use this base so extend your own strategy

Good luck :)

If you have any questions, feel free to comment

You can change every setting if you want it to use for another pair, but this is fine tuned for NATURALGAS

The entries are taken when:

Long:

- Buy signal from the DIDI indicator

- Long EMA is underneath the Short EMA

- Price must be Above the Long EMA

- TP1 (default) - ATR based first TP is ATR * 1.2 Multiplier

- TP2 (default) - ATR based first TP is ATR * 2 Multiplier

- TP2 SL is the strategy entry price when we hit the first TP

- SL (default) - Latest swing low with a look back of 17 candles

Short:

- Sell signal from the DIDI indicator

- Long EMA is Above the Short EMA

- Price must be Below the Long EMA

- TP1 (default) - ATR based first TP is ATR * 1.2 Multiplier

- TP2 (default) - ATR based first TP is ATR * 2 Multiplier

- TP2 SL is the strategy entry price when we hit the first TP

- SL (default) - Latest swing low with a look back of 17 candles

It's fairly simple, and i think you can use this base so extend your own strategy

Good luck :)

If you have any questions, feel free to comment

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.