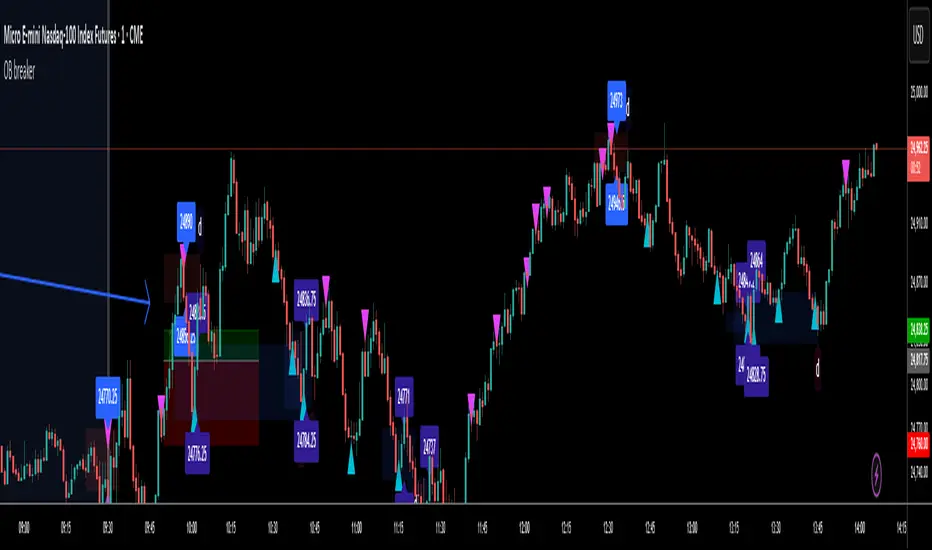

OB breaker

OB breaker is a system designed to trade either order blocks or breaker blocks (the opposite of the order block) as they are formed. The system detects order blocks through a very specific candle pattern to identify the order block zone. It then executes trades on either the creation of the order block or a re-test of the order block/breaker zone, whichever the user chooses.

Methodology & Core Concepts

Order blocks are formed on an ongoing basis, but they carry more weight when formed at extremes. The OB breaker will utilize a London session period defined by the user to begin drawing the order blocks and if the order blocks have not been breached, they will carry into the trade execution session and remain there until they are either destroyed or to the next London session start time where they will reset for the new day.

The London session begins drawing order blocks as defined. The pink and blue arrows represent areas where a potential order block may form based on the logic of the order block. A candle must have a wick high with a strong reversal for the order block to be created. If an order block is not destroyed, it will extend into the trade execution period.

Once an order block is created, it can trade off of the creation of the order block or on a re-test of the order block. Whichever is chosen.

Features And How They Work

When the “original" (disabled breaker) is checked, the strategy will look to take longs out of bullish order blocks and shorts out of bearish order blocks. When this is unchecked, it will trade on “breakers.” It will look to go long on the break of a bearish order block and short on the break of a bullish order block.

How the defined London Session Works

A user can set the London session start and end time to any trade window for the strategy to begin drawing new order blocks. If an order block is not destroyed it will carry into the trade execution time window. All order blocks are reset at the beginning of the next London session

Order Block Entries

Enter on OB creation or Re-test - When this is checked, the strategy will look to take a trade on the re-test of the order block

Entry Adjustment on Ticks - If using the entry on re-test, one can define how deep into the order block the strategy should enter on the re-test. “0” would be right at the order block line “-10” would be 10 ticks inside the order block.

If the Enter on OB creation or Re-test - is unchecked, the strategy will simply enter on the creation of the order block on candle close and not on the re-test

Trade Management

User can choose how many trades to execute within a trading window

Stop Loss

A user can choose a fixed stop, or the dynamic order block. The dynamic order block stop will simply be a stop blacked at the top or bottom of the order block.

Ticks extending beyond the stop loss

If a user is using a dynamic stop, they can adjust this to move the stop x value to a fixed point of ticks over or under the dynamic order block

Users can set the stop and break even to any tick value.

Enabling the trailing stop, a user can set the strategy at a tick value to begin trailing and then an offset value to trail by

Enabling the move to break even moves the stop to break even after the defined tick value

Take profit levels can be defined by a tick value, or a risk to reward value.

Force Session To Close Only End Matters

Defines the time period a user would like all positions to be flattened regardless if a tp or stop was hit.

Force Close At Session End

Flattens all positions at the end of the NY session

Enable Multiple Take Profits

A user can define the specific tick values to take profits at up to 3 different areas.

Disclaimer

This script is for educational and informational purposes only. It does not provide financial advice, and past performance does not guarantee future results. Trading carries risk, and all decisions are your responsibility. Redistribution or unauthorized use is strictly prohibited.

Skrip jemputan sahaja

Hanya pengguna yang diluluskan oleh penulis boleh mengakses skrip ini. Anda perlu memohon dan mendapatkan kebenaran untuk menggunakannya. Ini selalunya diberikan selepas pembayaran. Untuk lebih butiran, ikuti arahan penulis di bawah atau hubungi terus sp33dr4ge.

TradingView tidak menyarankan pembayaran untuk atau menggunakan skrip kecuali anda benar-benar mempercayai penulisnya dan memahami bagaimana ia berfungsi. Anda juga boleh mendapatkan alternatif sumber terbuka lain yang percuma dalam skrip komuniti kami.

Arahan penulis

Penafian

Skrip jemputan sahaja

Hanya pengguna yang diluluskan oleh penulis boleh mengakses skrip ini. Anda perlu memohon dan mendapatkan kebenaran untuk menggunakannya. Ini selalunya diberikan selepas pembayaran. Untuk lebih butiran, ikuti arahan penulis di bawah atau hubungi terus sp33dr4ge.

TradingView tidak menyarankan pembayaran untuk atau menggunakan skrip kecuali anda benar-benar mempercayai penulisnya dan memahami bagaimana ia berfungsi. Anda juga boleh mendapatkan alternatif sumber terbuka lain yang percuma dalam skrip komuniti kami.