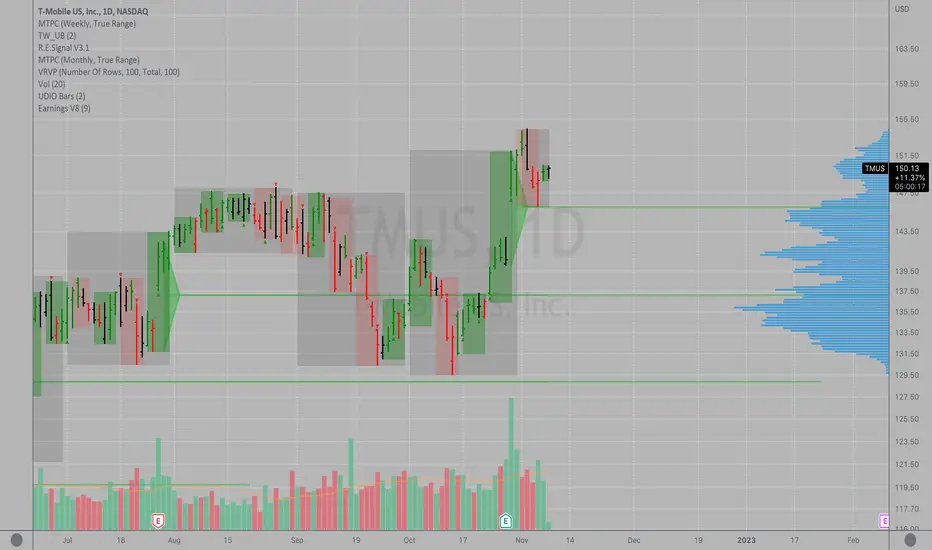

Key Earnings Level by Tim West

1. It is a composite price of an equity with a quarterly earnings report. The price line attempts to indicate the most important price for the release of earnings of that company. Only companies that have quarterly earnings will be able to have Key Earnings Levels. Indexes, commodities or other futures and crypto markets will not have these lines available.

After the earnings release (aka "ER"), the stock will tend to be supported by the price of the Key Earnings Level (KEL). If the stock is NOT supported at the KEL, then you can assume the stock is under distribution and one could further assume the earnings report was not accepted well by the market and the stock will likely continue to be sold in the future until the KEL no longer stops the advance of the stock.

2. The Earnings Level is designed to be plotted on the DAILY time frame only, and not the weekly or monthly time frames. It is also not designed for the hourly or any time other than daily.

3. Earnings Levels seem to be useful for a long period of time, perhaps up to a year or more based on the observations that I have done since 2012-2014 when I created the concept. I designed the software to allow you to advance the line forward in time by periods of 3 months, 6 months, 9 months and 12 months. The levels could last longer and you could add a "horizontal ray" at each earnings level so that it extends indefinitely into the future.

4. There are many additional uses of KEL's that include a combined KEL for an index, such as the DJIA, SP500 or any other basket of stocks if you combine all of the stocks KEL's together to form a market support/resistance level. I have published this research here at TradingView under the

5. The concept behind this EARNINGS RELEASE is to also see HOW VOLATILE a stock is on the day before, day of and day after the EARNINGS are released as a gauge of uncertainty in the stock. The larger the range of the stock price on an EARNINGS report, the more varied the opinions are of investors and the more uncertain analysts are on the valuation of the company or its future outlook. Volatility is an important concept for risk management in a stock and understanding how volatile a stock is on the 4 most important days of the year for any stock will help any investor understand more deeply about the risk of the stock itself.

6. I comment on stocks using the earnings levels concepts in chat room Key Hidden Levels here at TradingView for many years now. I am eager to hear your comments and success with this tool and others and hope you can pass it along to others to help them be informed too.

Skrip jemputan sahaja

Hanya pengguna disahkan oleh penulis boleh mengakses skrip ini. Anda perlu memohon dan mendapatkan kebenaran untuk menggunakannya. Keizinan selalunya diberikan selepas pembayaran. Untuk lebih butiran, ikuti arahan penulis di bawah atau hubungi timwest secara terus.

TradingView TIDAK menyarankan pembayaran atau penggunaan skrip kecuali anda mempercayai sepenuhnya penulis dan memahami bagaimana ia berfungsi. Anda juga boleh menjumpai alternatif sumber terbuka dan percuma yang lain di dalam skrip komuniti kami.

Arahan penulis

Penafian

Skrip jemputan sahaja

Hanya pengguna disahkan oleh penulis boleh mengakses skrip ini. Anda perlu memohon dan mendapatkan kebenaran untuk menggunakannya. Keizinan selalunya diberikan selepas pembayaran. Untuk lebih butiran, ikuti arahan penulis di bawah atau hubungi timwest secara terus.

TradingView TIDAK menyarankan pembayaran atau penggunaan skrip kecuali anda mempercayai sepenuhnya penulis dan memahami bagaimana ia berfungsi. Anda juga boleh menjumpai alternatif sumber terbuka dan percuma yang lain di dalam skrip komuniti kami.