PROTECTED SOURCE SCRIPT

[iQ]PRO Quantum LagMan+

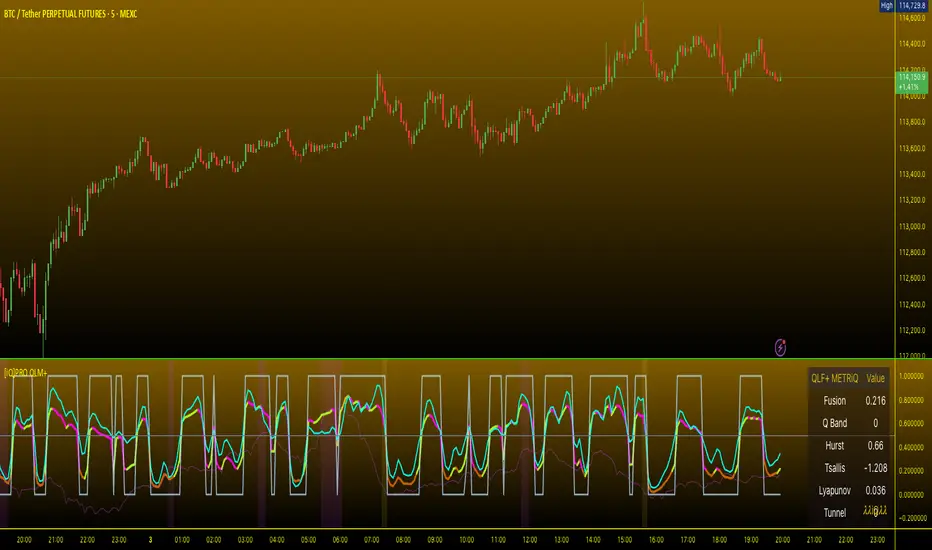

[MMiQ] PRO Quantum LagMan+ (QLM+) — A Fusion Oscillator for Regime-Aware Entries

Overview

[MMiQ] PRO Quantum LagMan+ is a next‑generation oscillator built for precision timing in dynamic markets. It blends advanced signal processing (multi-mode Laguerre smoothing) with physics-inspired analytics (Tsallis entropy, Hurst exponent, Lyapunov dynamics, and a tunneling probability model) to create a single fusion signal designed to adapt across regimes. The result is an actionable, regime-aware oscillator with adaptive thresholds, quantum energy band context, volatility gating, and optional trend filtering—complete with alerts, signal markers, and an information panel.

What it does

Normalizes momentum: Converts a Laguerre-based oscillator to a stable 0–1 scale for clear, cross-market comparability.

Maps “quantum” states: Assigns the oscillator to discrete energy bands to estimate state transitions and momentum intensity.

Fuses chaos and structure: Blends oscillator intensity, quantum momentum, and measured complexity/entropy into a single fusion line.

Filters by regime: Volatility and trend filters aim to suppress low-quality signals in quiet or unfavorable conditions.

Generates clean signals: Adaptive long/short thresholds with cooldown logic and coherence checks to reduce noise.

Explains itself: An info table displays fusion value, band index, entropy and chaos metrics, tunneling probability, and filter status.

Core components

Laguerre Multi-Mode Engine

Function: and1lag computes an ultimate smoother (ult), optional blended Laguerre filters, and a robust z-scored oscillator.

Control: period, lag, lagmode [0–4], RMSP add flexibility across timeframes and instruments.

Quantum Engine

Quantum Energy Levels: Discrete “bands” derived from normalized oscillator statistics.

Quantum Momentum: A 0–1 measure based on the current band position to capture intensity of state.

Coherence: Proximity between the oscillator and its active band (higher coherence = higher confidence).

Tunneling Probability: A barrier-like model that estimates the probability of a transition through local resistance/support structure.

Advanced Physics Layer (optional, heavy CPU)

Tsallis Entropy: A generalized entropy measure; elevated values can correspond to more complex or uncertain dynamics.

Lyapunov Exponent: A proxy for local sensitivity to initial conditions; higher values suggest chaotic/unstable behavior.

Hurst Exponent: A measure of persistence vs. mean reversion (H > 0.5 persistent, H < 0.5 mean-reverting).

These terms are summarized for trader context; the script uses bounded, practical implementations tuned for charting.

Fusion Oscillator

Composition: 50% normalized oscillator + 25% quantum momentum + 25% chaos/entropy blend.

Range: Constrained to [0, 1] for intuitive thresholds and consistent interpretation.

Regime Filters and Signals

Trend Filter: trendEMA with configurable trendLen to align signals with primary direction.

Volatility Filter: ATR-based gating with atrMultMin/atrMultMax bands, focusing on tradable volatility.

Adaptive Thresholds: Dynamic long/short thresholds scale with observed volatility.

Cooldown: signalCooldownBars limits rapid-fire signals to reduce whipsaw.

Alerts: Built-in alertcondition for automated notifications.

Visuals and UI

Main plots:

Fusion (thick, color-changing by state)

Norm Laguerre Osc (baseline momentum)

Quantum Momentum (band-based intensity)

Chaos Resonance (entropy/chaos contribution)

Bands and zones:

Quantum band visualization for context

Entropy zones via background shading (high/low extremes)

Info Table (showInfoTable):

Fusion, Quantum Band index, Hurst, Tsallis, Lyapunov, Tunneling Probability, Coherence, Volatility OK

Signal Markers:

Long: triangle up at bottoms

Short: triangle down at tops

Suggested usage

Entries:

Long bias when Fusion rises from low zones toward midline with high coherence, tunnel probability above threshold, trend filter positive, and volatility OK.

Short bias when Fusion falls from high zones with similar filter alignment and coherence.

Exits:

Consider scaling out near extremes (Fusion > 0.8 or < 0.2), during entropy spikes, or when coherence weakens.

Regime awareness:

Adjust trendLen for your timeframe.

Tighten atrMultMin to avoid low-vol chop.

Use adaptiveThresholds for cross-asset consistency.

Key inputs

Quantum Core: quantumLevels, planckConst, massDensity, tunnelThreshold

Advanced Physics: enableAdvanced, tsallisQ, lyapunovDim, entropyLength

Filters: useTrendFilter, trendLen, useVolFilter, atrLen, atrMultMin, atrMultMax

Signals: adaptiveThresholds, signalCooldownBars, showSignals

Display: showQuantumBands, showComponents, showEntropyZones, showInfoTable

Lag Options: source, period, lag, lagmode, RMSP

One glance clarity: A single Fusion line encapsulates momentum, state, and complexity.

Regime-adaptive: Thresholds and filters tune to volatility and trend.

Signal discipline: Coherence and cooldown aim to reduce false triggers.

Transparent context: The info table tells you why a signal is firing, not just that it is.

Notes and best practices

Multi-timeframe confirmation is recommended for higher-conviction entries.

The Advanced Physics layer can be CPU heavy; disable it for lightweight scanning or enable for precision.

Optimize inputs per asset class and timeframe (crypto vs FX vs equities).

This is an analytical tool, not financial advice. Always validate with risk management.

Alerts

Hybrid QLF Long: triggers on qualified long conditions

Hybrid QLF Short: triggers on qualified short conditions

Attribution and license

Pine Script code is licensed under the Mozilla Public License 2.0.

© MarketMakerIQ

Quick start

Add to chart and enable showInfoTable to understand live readings.

Start with defaults; toggle useTrendFilter and useVolFilter to match your style.

If performance allows, enable Advanced Physics and tune tsallisQ, lyapunovDim, entropyLength.

Set alerts on the included conditions and forward-test across sessions.

Overview

[MMiQ] PRO Quantum LagMan+ is a next‑generation oscillator built for precision timing in dynamic markets. It blends advanced signal processing (multi-mode Laguerre smoothing) with physics-inspired analytics (Tsallis entropy, Hurst exponent, Lyapunov dynamics, and a tunneling probability model) to create a single fusion signal designed to adapt across regimes. The result is an actionable, regime-aware oscillator with adaptive thresholds, quantum energy band context, volatility gating, and optional trend filtering—complete with alerts, signal markers, and an information panel.

What it does

Normalizes momentum: Converts a Laguerre-based oscillator to a stable 0–1 scale for clear, cross-market comparability.

Maps “quantum” states: Assigns the oscillator to discrete energy bands to estimate state transitions and momentum intensity.

Fuses chaos and structure: Blends oscillator intensity, quantum momentum, and measured complexity/entropy into a single fusion line.

Filters by regime: Volatility and trend filters aim to suppress low-quality signals in quiet or unfavorable conditions.

Generates clean signals: Adaptive long/short thresholds with cooldown logic and coherence checks to reduce noise.

Explains itself: An info table displays fusion value, band index, entropy and chaos metrics, tunneling probability, and filter status.

Core components

Laguerre Multi-Mode Engine

Function: and1lag computes an ultimate smoother (ult), optional blended Laguerre filters, and a robust z-scored oscillator.

Control: period, lag, lagmode [0–4], RMSP add flexibility across timeframes and instruments.

Quantum Engine

Quantum Energy Levels: Discrete “bands” derived from normalized oscillator statistics.

Quantum Momentum: A 0–1 measure based on the current band position to capture intensity of state.

Coherence: Proximity between the oscillator and its active band (higher coherence = higher confidence).

Tunneling Probability: A barrier-like model that estimates the probability of a transition through local resistance/support structure.

Advanced Physics Layer (optional, heavy CPU)

Tsallis Entropy: A generalized entropy measure; elevated values can correspond to more complex or uncertain dynamics.

Lyapunov Exponent: A proxy for local sensitivity to initial conditions; higher values suggest chaotic/unstable behavior.

Hurst Exponent: A measure of persistence vs. mean reversion (H > 0.5 persistent, H < 0.5 mean-reverting).

These terms are summarized for trader context; the script uses bounded, practical implementations tuned for charting.

Fusion Oscillator

Composition: 50% normalized oscillator + 25% quantum momentum + 25% chaos/entropy blend.

Range: Constrained to [0, 1] for intuitive thresholds and consistent interpretation.

Regime Filters and Signals

Trend Filter: trendEMA with configurable trendLen to align signals with primary direction.

Volatility Filter: ATR-based gating with atrMultMin/atrMultMax bands, focusing on tradable volatility.

Adaptive Thresholds: Dynamic long/short thresholds scale with observed volatility.

Cooldown: signalCooldownBars limits rapid-fire signals to reduce whipsaw.

Alerts: Built-in alertcondition for automated notifications.

Visuals and UI

Main plots:

Fusion (thick, color-changing by state)

Norm Laguerre Osc (baseline momentum)

Quantum Momentum (band-based intensity)

Chaos Resonance (entropy/chaos contribution)

Bands and zones:

Quantum band visualization for context

Entropy zones via background shading (high/low extremes)

Info Table (showInfoTable):

Fusion, Quantum Band index, Hurst, Tsallis, Lyapunov, Tunneling Probability, Coherence, Volatility OK

Signal Markers:

Long: triangle up at bottoms

Short: triangle down at tops

Suggested usage

Entries:

Long bias when Fusion rises from low zones toward midline with high coherence, tunnel probability above threshold, trend filter positive, and volatility OK.

Short bias when Fusion falls from high zones with similar filter alignment and coherence.

Exits:

Consider scaling out near extremes (Fusion > 0.8 or < 0.2), during entropy spikes, or when coherence weakens.

Regime awareness:

Adjust trendLen for your timeframe.

Tighten atrMultMin to avoid low-vol chop.

Use adaptiveThresholds for cross-asset consistency.

Key inputs

Quantum Core: quantumLevels, planckConst, massDensity, tunnelThreshold

Advanced Physics: enableAdvanced, tsallisQ, lyapunovDim, entropyLength

Filters: useTrendFilter, trendLen, useVolFilter, atrLen, atrMultMin, atrMultMax

Signals: adaptiveThresholds, signalCooldownBars, showSignals

Display: showQuantumBands, showComponents, showEntropyZones, showInfoTable

Lag Options: source, period, lag, lagmode, RMSP

One glance clarity: A single Fusion line encapsulates momentum, state, and complexity.

Regime-adaptive: Thresholds and filters tune to volatility and trend.

Signal discipline: Coherence and cooldown aim to reduce false triggers.

Transparent context: The info table tells you why a signal is firing, not just that it is.

Notes and best practices

Multi-timeframe confirmation is recommended for higher-conviction entries.

The Advanced Physics layer can be CPU heavy; disable it for lightweight scanning or enable for precision.

Optimize inputs per asset class and timeframe (crypto vs FX vs equities).

This is an analytical tool, not financial advice. Always validate with risk management.

Alerts

Hybrid QLF Long: triggers on qualified long conditions

Hybrid QLF Short: triggers on qualified short conditions

Attribution and license

Pine Script code is licensed under the Mozilla Public License 2.0.

© MarketMakerIQ

Quick start

Add to chart and enable showInfoTable to understand live readings.

Start with defaults; toggle useTrendFilter and useVolFilter to match your style.

If performance allows, enable Advanced Physics and tune tsallisQ, lyapunovDim, entropyLength.

Set alerts on the included conditions and forward-test across sessions.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

ADVM

discord.gg/U9bNveK5 free and pro access

website rebuild use patreon x discord for access to pro+

discord.gg/U9bNveK5 free and pro access

website rebuild use patreon x discord for access to pro+

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

ADVM

discord.gg/U9bNveK5 free and pro access

website rebuild use patreon x discord for access to pro+

discord.gg/U9bNveK5 free and pro access

website rebuild use patreon x discord for access to pro+

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.