OPEN-SOURCE SCRIPT

Telah dikemas kini Risk Volume Calculator

Bid volume calculation from average volatility

On label (top to bot):

Percents - averaged by [smoothing] moving in timeframe resolution

Cash - selected risk volume in usdt

Lots - bid volume in lots wich moving in Percents with used leverage is Cash

U can switch on channels to visualise volatility*2 channel or stakan settings

On label (top to bot):

Percents - averaged by [smoothing] moving in timeframe resolution

Cash - selected risk volume in usdt

Lots - bid volume in lots wich moving in Percents with used leverage is Cash

U can switch on channels to visualise volatility*2 channel or stakan settings

Nota Keluaran

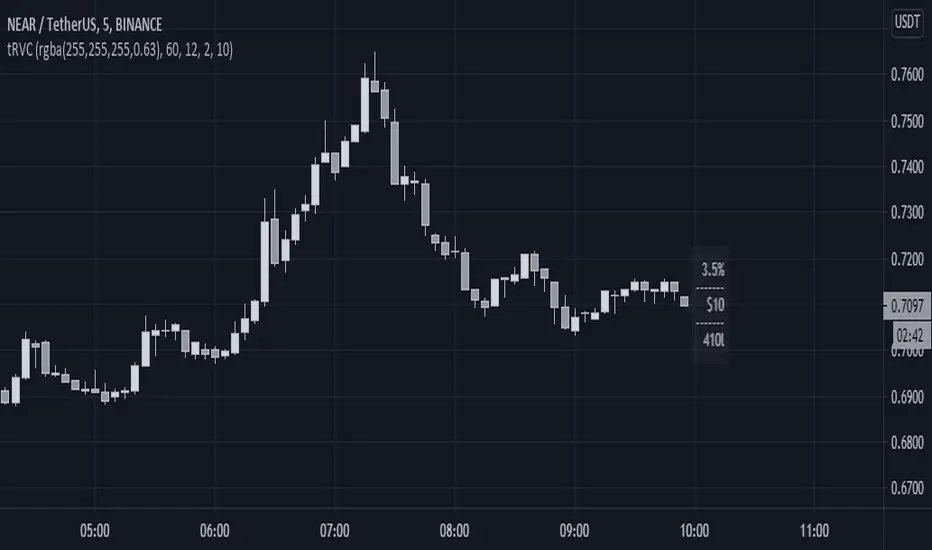

Position volume calculation based on the average instrument volatility and the amount of risk in base currencyOn label (top to bot):

Percents (0.6%) - average moving in selected resolution

Cash ($10) - risk volume in base currency

Lots (2.77l) - the volume of the bet with a 0.6% move will create a profit or loss of 10

U can switch on channels to visualise volatility*2 channel or stakan settings

Nota Keluaran

Position volume calculation based on the average instrument volatility as amount of risk in base currencyOn label (top to bot):

Percents (1.7%) - average moving in selected resolution (60)

Cash ($10) - risk amount in base currency

Lots (19.613l) - the volume of bet wich 1.7% moving create a profit or loss of $10

U can switch on channels to visualise volatility*2 channel

Nota Keluaran

Added smart lots volume rounderSkrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.