PROTECTED SOURCE SCRIPT

Telah dikemas kini Position Size Calculator

Position Size Calculator - User Guide

Introduction

The Position Size Calculator is a TradingView indicator designed to help traders calculate the optimal position size for their trades based on account size and risk tolerance. This tool visually represents entry, stop loss, and take profit levels while automatically calculating the appropriate position size to maintain consistent risk management.

1. Getting Started

After adding the indicator to your chart, you'll see three horizontal lines representing:

The indicator automatically detects whether you're planning a Long or Short trade based on the position of your take profit relative to your entry.

2. Setting Up Your Account Parameters

In the "Position Calculator" settings group:

3. Setting Price Levels

In the "Price Levels" section:

If you set Entry Price to 0, it will default to the current price. If Stop Loss or Take Profit are set to 0, they'll default to 5% below or above entry price respectively.

4. Understanding the Visual Elements

5. Adjusting Your Trade on the Chart

The beauty of this tool is its interactivity:

This means you can quickly test different scenarios and see how they affect your position size and potential profit/loss.

6. Reading the Information Panel

The information panel displays:

Visual Settings

You can customize the appearance in the "Visual" settings group:

Practical Tips

Final Thoughts

This Position Size Calculator helps remove emotion from your trading by objectively calculating your position size based on your predefined risk parameters. It ensures that you maintain consistent risk across all your trades, regardless of the stop loss distance, which is a key component of successful risk management.

Remember: The most important goal in trading is capital preservation. This tool helps you ensure that each trade risks only what you've decided is acceptable for your trading strategy.

A simple tool to calculate optimal position size based on your risk preferences, visualize trade levels, and automatically determine trade direction.

Introduction

The Position Size Calculator is a TradingView indicator designed to help traders calculate the optimal position size for their trades based on account size and risk tolerance. This tool visually represents entry, stop loss, and take profit levels while automatically calculating the appropriate position size to maintain consistent risk management.

- Getting Started

- Setting Up Your Account Parameters

- Setting Price Levels

- Understanding the Visual Elements

- Adjusting Your Trade on the Chart

- Reading the Information Panel

1. Getting Started

After adding the indicator to your chart, you'll see three horizontal lines representing:

- Yellow line: Entry price

- Green line: Take profit price

- Red line: Stop loss price

The indicator automatically detects whether you're planning a Long or Short trade based on the position of your take profit relative to your entry.

2. Setting Up Your Account Parameters

In the "Position Calculator" settings group:

- Account Size: Enter your total account balance

- Account Currency: Set your account currency (USD, EUR, etc.)

- Risk (%): Enter the percentage of your account you're willing to risk per trade (e.g., 2%)

- Instrument Type: Select your trading instrument (Forex, Futures, Stocks, or Crypto)

- Value per 0.01 lot per tick: Enter the value of 0.01 lots per tick (for most Forex pairs, this is $1 per pip for 0.01 lot)

- Minimum Lot Size: Set the minimum lot size allowed by your broker (usually 0.01 for Forex)

3. Setting Price Levels

In the "Price Levels" section:

- Entry Price: The price at which you plan to enter the trade

- Stop Loss Price: Where you'll exit if the trade goes against you

- Take Profit Price: Your target price where you'll take profits

If you set Entry Price to 0, it will default to the current price. If Stop Loss or Take Profit are set to 0, they'll default to 5% below or above entry price respectively.

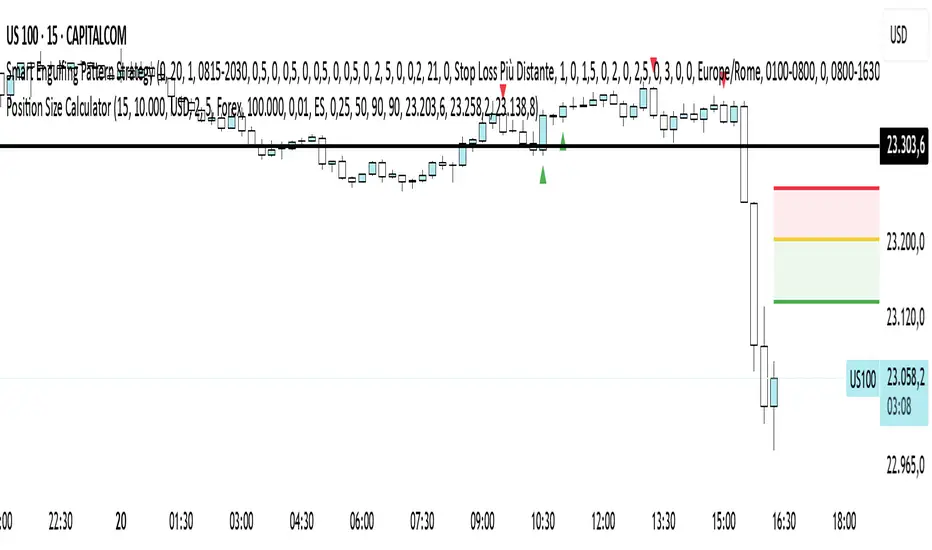

4. Understanding the Visual Elements

- Yellow line: Your entry price

- Green line: Your take profit level

- Red line: Your stop loss level

- Green zone: The profit zone (between entry and take profit)

- Red zone: The loss zone (between entry and stop loss)

- Information panel: Shows all calculations and trade details

5. Adjusting Your Trade on the Chart

The beauty of this tool is its interactivity:

- You can drag any of the lines directly on the chart to adjust entry, stop loss, or take profit

- If you drag the take profit above the entry, the indicator automatically sets up for a Long trade

- If you drag the take profit below the entry, it automatically configures for a Short trade

- All calculations and visuals update in real-time as you adjust the lines

This means you can quickly test different scenarios and see how they affect your position size and potential profit/loss.

6. Reading the Information Panel

The information panel displays:

- Account details: Your account size and currency

- Risk information: Your percentage risk and the equivalent monetary amount

- Position Size: The optimal lot size calculated based on your risk parameters

- Price levels: Entry, Stop Loss, and Take Profit with distances in ticks

- Risk/Reward ratio: Shown as 1:X (where X is the reward relative to 1 unit of risk)

- Potential outcomes: The exact amount you stand to gain or lose on this trade

- Trade direction: Whether this is a Long or Short trade

Visual Settings

You can customize the appearance in the "Visual" settings group:

- Adjust colors for profit and loss zones

- Change the transparency of colored zones

- Toggle the filling of spaces between lines

- Adjust how far the lines extend beyond the last candle

Practical Tips

- Always double-check your "Value per 0.01 lot per tick" setting for the specific instrument you're trading

- For Forex major pairs, the standard is usually $1 per pip for 0.01 lots

- For other instruments, consult your broker's specifications

- The indicator works best when you place your stop loss at a logical market level (support/resistance, swing high/low) rather than a fixed percentage

Final Thoughts

This Position Size Calculator helps remove emotion from your trading by objectively calculating your position size based on your predefined risk parameters. It ensures that you maintain consistent risk across all your trades, regardless of the stop loss distance, which is a key component of successful risk management.

Remember: The most important goal in trading is capital preservation. This tool helps you ensure that each trade risks only what you've decided is acceptable for your trading strategy.

Nota Keluaran

Position Size Calculator Update v1.2Important fixes to risk calculation and improved information display

- [] Fixed position size calculation to ensure actual risk never exceeds target risk when possible

[] Respects minimum lot size and broker's lot increment constraints

[] Added percentage values for both actual risk and potential profit relative to account size

[] Improved information panel display for better clarity

Nota Keluaran

Position Size Calculator Update v1.3Added proper support for futures contracts with custom minimum sizes

- Fixed calculation for futures contracts that use different minimum sizes

- Improved position sizing to respect futures-specific contract increments

- Display shows "contracts" instead of "lots" when trading futures

- Updated risk calculation to accurately reflect futures contract specifications

Nota Keluaran

Position Size Calculator - Update v2.0- Improved futures handling with automatic presets

- Added simplified display with labels on the lines (default)

- Implemented “Stop Profit” system for advanced stop loss management

- Fixed display of fixed P&L lines

Key Features:

- More intuitive simplified display

- Full support for 50+ futures contracts with pre-calculated values

- Option to use custom values by enabling “Use Custom Futures”

- Automatic retention of contracts/lots when the trailing stop becomes profitable

- Adaptive colors and display based on trade status

The tool is now even more versatile for all types of traders, with full support for futures, forex, crypto, and stocks. Simplified usage and precise results.

Nota Keluaran

v2.0 - Enhanced Forex/CFD calculation with professional formula, automatic currency conversion handling, RR display on entry label, removed obsolete parameters. Futures perfectly preserved.- Forex/CFD now more accurate and professional

- New features (RR display, multi-currency)

Nota Keluaran

Set as pubblicSkrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.