OPEN-SOURCE SCRIPT

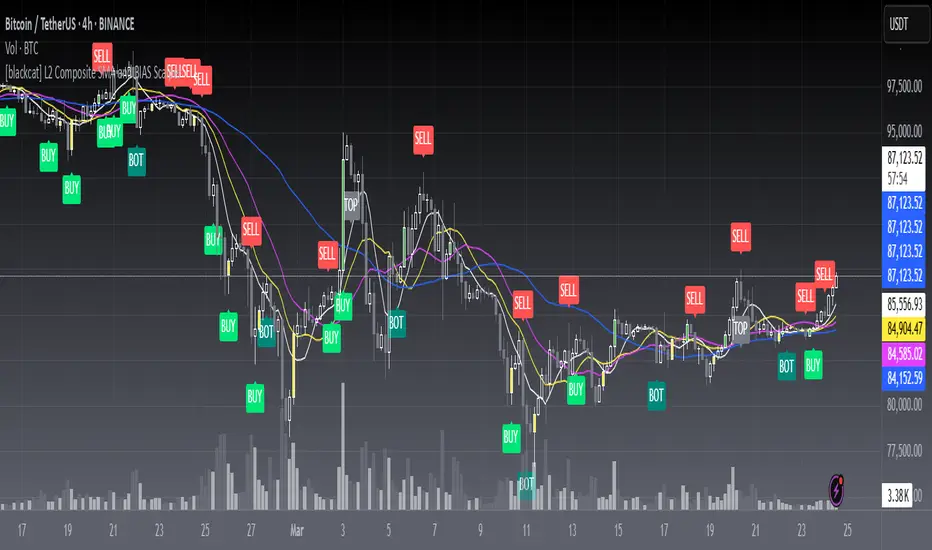

Telah dikemas kini [blackcat] L2 Composite SMA and BIAS Scalper

Level: 2

Background

A simple moving average (SMA) calculates the average of a selected price range, usually closing prices, based on the number of periods in that range. A simple moving average is a technical indicator that can be used to determine whether an asset price is holding a bull, a bear, or is reversing.

The bias shows the moving average rate of deviation. Also known as the rate of deviation, or y-value for short, is an indicator that reflects the degree of deviation between the price and the SMA over a given period by calculating the percentage difference between the market index or the closing price and a moving average to allow for receive that the price reverses or recovers due to a deviation from the moving average trend with strong fluctuations and the price moves within the normal fluctuation range Build credibility to continue the original potential.

Function

[blackcat] L2 Composite SMA and BIAS Scalper is mainly based on a cluster of simple moving averages and their bias values to produce long and short entry points. Three different strategy to generate long and short entries are demostrated together. That is why this is called "Composite".

Key Signal

botsig --> indicating bottom zone

topsig --> indicating top zone

buysigI --> long entry type I

buysigII --> long entry type II

buysigIII --> long entry type III

selsigI --> short entry type I

selsigII --> short entry type II

selsigIII --> short entry type III

Pros and Cons

Pros:

1. common sma(), rsi() and bias() are utizlied to generate exact long and short entries

2. alerts for bottom and top zones

Cons:

1. SMA parameters may need optimization for specific trading pairs

2. No stop loss or take profit scheme is introduced.

Remarks

This is promising but need efforts to refine it.

Readme

In real life, I am a prolific inventor. I have successfully applied for more than 60 international and regional patents in the past 12 years. But in the past two years or so, I have tried to transfer my creativity to the development of trading strategies. Tradingview is the ideal platform for me. I am selecting and contributing some of the hundreds of scripts to publish in Tradingview community. Welcome everyone to interact with me to discuss these interesting pine scripts.

The scripts posted are categorized into 5 levels according to my efforts or manhours put into these works.

Level 1 : interesting script snippets or distinctive improvement from classic indicators or strategy. Level 1 scripts can usually appear in more complex indicators as a function module or element.

Level 2 : composite indicator/strategy. By selecting or combining several independent or dependent functions or sub indicators in proper way, the composite script exhibits a resonance phenomenon which can filter out noise or fake trading signal to enhance trading confidence level.

Level 3 : comprehensive indicator/strategy. They are simple trading systems based on my strategies. They are commonly containing several or all of entry signal, close signal, stop loss, take profit, re-entry, risk management, and position sizing techniques. Even some interesting fundamental and mass psychological aspects are incorporated.

Level 4 : script snippets or functions that do not disclose source code. Interesting element that can reveal market laws and work as raw material for indicators and strategies. If you find Level 1~2 scripts are helpful, Level 4 is a private version that took me far more efforts to develop.

Level 5 : indicator/strategy that do not disclose source code. private version of Level 3 script with my accumulated script processing skills or a large number of custom functions. I had a private function library built in past two years. Level 5 scripts use many of them to achieve private trading strategy.

Background

A simple moving average (SMA) calculates the average of a selected price range, usually closing prices, based on the number of periods in that range. A simple moving average is a technical indicator that can be used to determine whether an asset price is holding a bull, a bear, or is reversing.

The bias shows the moving average rate of deviation. Also known as the rate of deviation, or y-value for short, is an indicator that reflects the degree of deviation between the price and the SMA over a given period by calculating the percentage difference between the market index or the closing price and a moving average to allow for receive that the price reverses or recovers due to a deviation from the moving average trend with strong fluctuations and the price moves within the normal fluctuation range Build credibility to continue the original potential.

Function

[blackcat] L2 Composite SMA and BIAS Scalper is mainly based on a cluster of simple moving averages and their bias values to produce long and short entry points. Three different strategy to generate long and short entries are demostrated together. That is why this is called "Composite".

Key Signal

botsig --> indicating bottom zone

topsig --> indicating top zone

buysigI --> long entry type I

buysigII --> long entry type II

buysigIII --> long entry type III

selsigI --> short entry type I

selsigII --> short entry type II

selsigIII --> short entry type III

Pros and Cons

Pros:

1. common sma(), rsi() and bias() are utizlied to generate exact long and short entries

2. alerts for bottom and top zones

Cons:

1. SMA parameters may need optimization for specific trading pairs

2. No stop loss or take profit scheme is introduced.

Remarks

This is promising but need efforts to refine it.

Readme

In real life, I am a prolific inventor. I have successfully applied for more than 60 international and regional patents in the past 12 years. But in the past two years or so, I have tried to transfer my creativity to the development of trading strategies. Tradingview is the ideal platform for me. I am selecting and contributing some of the hundreds of scripts to publish in Tradingview community. Welcome everyone to interact with me to discuss these interesting pine scripts.

The scripts posted are categorized into 5 levels according to my efforts or manhours put into these works.

Level 1 : interesting script snippets or distinctive improvement from classic indicators or strategy. Level 1 scripts can usually appear in more complex indicators as a function module or element.

Level 2 : composite indicator/strategy. By selecting or combining several independent or dependent functions or sub indicators in proper way, the composite script exhibits a resonance phenomenon which can filter out noise or fake trading signal to enhance trading confidence level.

Level 3 : comprehensive indicator/strategy. They are simple trading systems based on my strategies. They are commonly containing several or all of entry signal, close signal, stop loss, take profit, re-entry, risk management, and position sizing techniques. Even some interesting fundamental and mass psychological aspects are incorporated.

Level 4 : script snippets or functions that do not disclose source code. Interesting element that can reveal market laws and work as raw material for indicators and strategies. If you find Level 1~2 scripts are helpful, Level 4 is a private version that took me far more efforts to develop.

Level 5 : indicator/strategy that do not disclose source code. private version of Level 3 script with my accumulated script processing skills or a large number of custom functions. I had a private function library built in past two years. Level 5 scripts use many of them to achieve private trading strategy.

Nota Keluaran

OVERVIEWThis script provides a multi-layered technical analysis framework called [blackcat] L2 Composite SMA and BIAS Scalper. It combines Simple Moving Averages (SMAs), BIAS metrics, and customized signal triggers to identify intraday trading opportunities via momentum shifts and trend reversals.

FEATURES

• Core Indicators:

• Four SMA periods (7,13,21,49 bars) plotted with distinct colors

• Volumetric BIAS deviation tracking with statistical normalization

• Dual RSI variants (standard and weighted smoothing)

• Signal Types:

▪️ Level I: Basic RSI crossovers (buy @ 11, sell 84)

▪️ Level II: EMA divergence with volume confirmation

▪️ Level III: Adaptive linear regression-based price dynamics

• Visual Markers:

✔️ Multi-colored alert shapes ("BOT","TOP","BUY","SELL")

✔️ Trendline overlays showing smoothed price trajectories

✔️ Dynamically colored candles highlighting critical turning points

HOW TO USE

Overlay onto any timeframe chart (default overlay enabled)

Monitor convergence/divergence between SMAs:

• Uptrend confirmed when shorter SMAs > longer terms

• Downtrend signaled when SMA21

Prioritize actions meeting multiple criteria:

Concurrent activation of two+ signal types

Confirmation from both price action and volatility bands

Adjust parameter lengths based on market volatility patterns

LIMITATIONS

• Relies heavily on lookback period settings (fixed values in codebase)

• High false positives during sideways markets due to overlapping signals

• Timeframe-dependent effectiveness requires calibration

NOTES

• Key variables like sma7/sma13 act as dynamic support/resistance levels

• The exponential_smoothing function uses volume-derived coefficients

• All alerts share identical visual styling (tiny icons) for consistency

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.