PROTECTED SOURCE SCRIPT

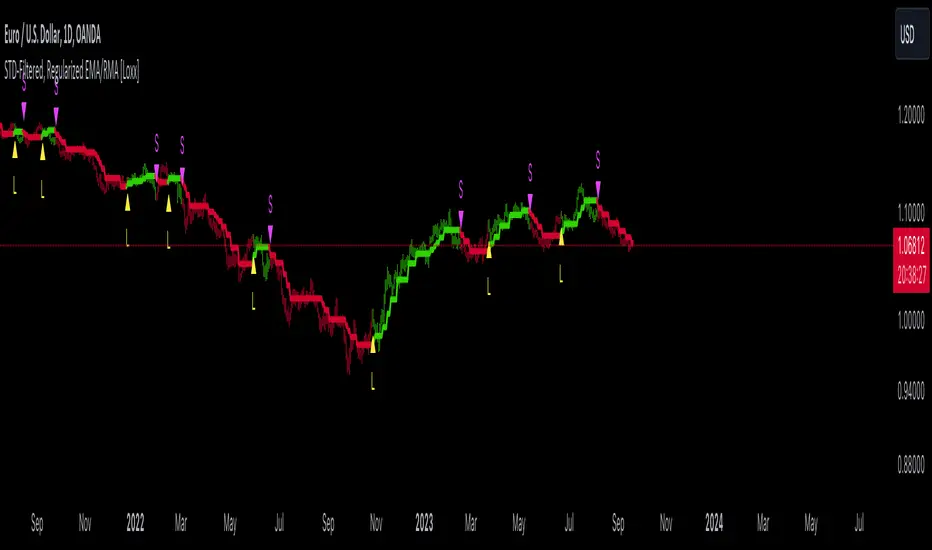

STD-Filtered, Regularized EMA/RMA [Loxx]

STD-Filtered, Regularized EMA/RMA calculates and visualizes a standard deviation (STD) filtered, regularized version of the Exponential Moving Average (EMA) or Regular Moving Average (RMA) on a trading chart.

█ Understanding the Regularized Moving Average

The Regularized Moving Average, as conceptualized by Chris Satchwell, offers a more responsive interpretation compared to traditional moving averages. By incorporating a smoothing mechanism using "Lambda", this approach reduces lag without compromising the data's integrity.

In the realm of technical analysis, many regard it as a preferred alternative to the standard Moving Average and Exponential Moving Average.

█ How Does It Stand Out from Other Moving Averages?

While analysts traditionally shorten an indicator's length or period to minimize lag, the Regularized Moving Average uses a unique approach. By embedding "Regularization" within its computation, this method introduces Lambda (often symbolized as λ-calculus). This mathematical factor tames the moving average's undue fluctuations, offering more stability through its Lambda adjustments.

Pro Tip: For those analyzing smaller intraday timeframes, consider ramping up the Lambda setting to 6.0 or even higher. When tweaking these settings, always remember to backtest and observe how it impacts signal accuracy and noise filtering.

█ Standard Deviation Filtering:

By applying this filter, minor price variations within the threshold are disregarded, resulting in a smoother representation of the price data.

█ Moving Average Calculation:

The script provides an option to calculate either a regularized Exponential Moving Average (EMA) or a Regular Moving Average (RMA). Here's how these are approached:

Both these averages then undergo a regularization process. Regularization, in this context, refers to adjusting the moving average using a factor to make it potentially more sensitive or responsive to price changes.

This regularized moving average can offer a refined perspective on price trends by being more adaptive to recent changes, potentially highlighting turning points or trend continuations more effectively.

█ Extras

█ Understanding the Regularized Moving Average

The Regularized Moving Average, as conceptualized by Chris Satchwell, offers a more responsive interpretation compared to traditional moving averages. By incorporating a smoothing mechanism using "Lambda", this approach reduces lag without compromising the data's integrity.

In the realm of technical analysis, many regard it as a preferred alternative to the standard Moving Average and Exponential Moving Average.

█ How Does It Stand Out from Other Moving Averages?

While analysts traditionally shorten an indicator's length or period to minimize lag, the Regularized Moving Average uses a unique approach. By embedding "Regularization" within its computation, this method introduces Lambda (often symbolized as λ-calculus). This mathematical factor tames the moving average's undue fluctuations, offering more stability through its Lambda adjustments.

Pro Tip: For those analyzing smaller intraday timeframes, consider ramping up the Lambda setting to 6.0 or even higher. When tweaking these settings, always remember to backtest and observe how it impacts signal accuracy and noise filtering.

█ Standard Deviation Filtering:

- This filtering mechanism is designed to smoothen price data by eliminating minor fluctuations that might be considered "noise". Here's how the process works:

- For every data point, the standard deviation of prices over a specified period is calculated.

- This standard deviation is then multiplied by a user-defined value to determine a threshold. This threshold defines the magnitude of change required in the price for it to be considered significant.

- For each price, if the absolute difference between its current and previous value is less than this threshold, the price is kept unchanged (considered insignificant and thus filtered). If the difference exceeds the threshold, the price is considered significant and remains as is.

By applying this filter, minor price variations within the threshold are disregarded, resulting in a smoother representation of the price data.

█ Moving Average Calculation:

The script provides an option to calculate either a regularized Exponential Moving Average (EMA) or a Regular Moving Average (RMA). Here's how these are approached:

- If the EMA option is selected: A weighted formula is used where more recent prices have a higher influence on the average than older prices. This is achieved by applying a fraction that's inversely related to the chosen period. The outcome is an average that reacts more quickly to recent price changes.

- If the RMA option is selected: The average is computed by giving equal weight to all prices within the chosen period.

Both these averages then undergo a regularization process. Regularization, in this context, refers to adjusting the moving average using a factor to make it potentially more sensitive or responsive to price changes.

This regularized moving average can offer a refined perspective on price trends by being more adaptive to recent changes, potentially highlighting turning points or trend continuations more effectively.

█ Extras

- Signals

- Alerts

- Bar coloring

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

Public Telegram Group, t.me/algxtrading_public

VIP Membership Info: patreon.com/algxtrading/membership

VIP Membership Info: patreon.com/algxtrading/membership

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

Public Telegram Group, t.me/algxtrading_public

VIP Membership Info: patreon.com/algxtrading/membership

VIP Membership Info: patreon.com/algxtrading/membership

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.