PROTECTED SOURCE SCRIPT

Order Imbalance Radar

🧭 Overview

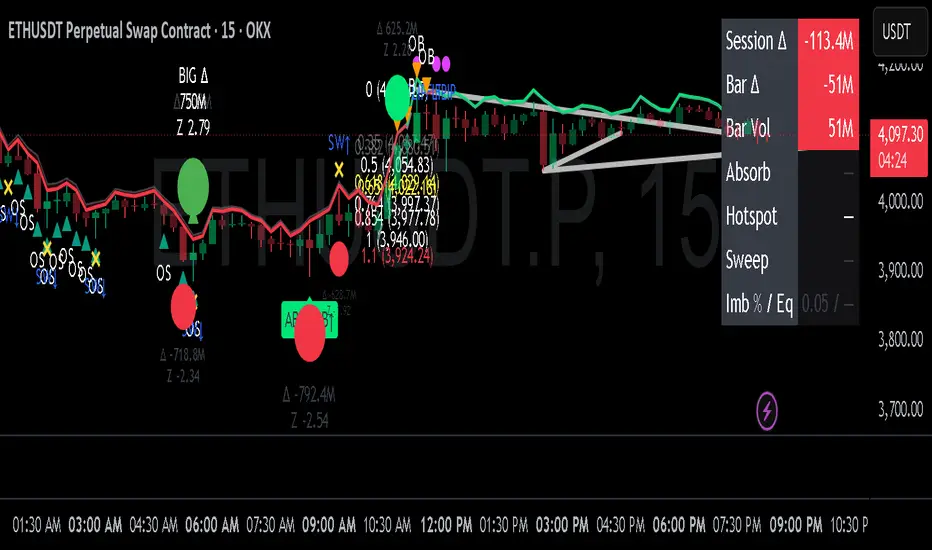

Order Imbalance Radar is a sophisticated volume–flow and imbalance detection system designed to visualize real-time shifts in buyer–seller dominance, absorption events, and market equilibrium. It combines delta-volume analysis, volatility filtering, and orderflow-style signals to help identify high-probability zones of reversal, continuation, or liquidity imbalance.

The indicator includes a top-right analytical dashboard, visual imbalance bubbles, and multiple overlays (absorption, overbought/oversold hotspots, equilibrium ribbon, liquidity sweeps, and session delta tracking).

⚙️ Core Logic & Signal Framework

1. Delta Volume Z-Score Model

Calculates delta (buy vs. sell volume) per bar based on directional close changes.

Uses a z-score normalization of delta over a user-defined lookback (zLookback) to detect statistically significant imbalances.

Highlights two tiers of imbalance:

Normal Imbalance (|z| ≥ zThresh1)

Big Imbalance (|z| ≥ zThresh2)

Filters results by requiring volume ≥ moving average × minVolMul.

Optionally limits signals to volatility squeeze conditions (via Bollinger Band width).

Visual Output:

✅ Green/red bar tints show intensity of buyer/seller imbalance.

🟢/🔴 Circle bubbles with Δ and Z-score values mark detected imbalances.

2. Absorption Detection

Detects bars where price rejects continuation despite high delta extremes, suggesting absorption of aggressive orders by passive liquidity.

Conditions:

|zΔ| exceeds absorbZ threshold

Candle body ≤ % of total range

Opposite wick ≥ % of range

Markers:

🟢 “ABSORB↑” below bars = buyer absorption (sellers absorbed)

🔴 “ABSORB↓” above bars = seller absorption (buyers absorbed)

3. OB/OS Hotspots

Integrates RSI and Bollinger Band positioning to identify volume-confirmed overbought/oversold zones.

Overbought → RSI ≥ rsiOB and price above upper band or high volume.

Oversold → RSI ≤ rsiOS and price below lower band or high volume.

Markers:

🔶 “OB” for overbought zones

🟩 “OS” for oversold zones

These can indicate short-term exhaustion points, particularly when confluenced with imbalance or absorption.

4. Liquidity Sweeps

Identifies stop-hunts / failed breakouts within recent swing lookback:

Sweep Up: Price makes a higher high but closes below previous swing → likely liquidity grab above highs.

Sweep Down: Price makes a lower low but closes above previous swing → liquidity grab below lows.

Markers:

“SW↑” (yellow) = bullish sweep

“SW↓” (yellow) = bearish sweep

5. Equilibrium Map & Ribbon

Analyzes rolling imbalance ratio (Δ / total volume) over a sliding window to gauge market equilibrium vs. imbalance bias.

Plots a dynamic ribbon above price scaled by ATR.

Ribbon color:

🟢 = buyer-dominant imbalance

🔴 = seller-dominant imbalance

Gray band marks the equilibrium zone (|imbalance| ≤ eqBand).

Fuchsia “FLIP” marker signals a change in imbalance polarity.

This provides a macro order-flow bias visualization.

6. Session Dashboard (Top-Right)

Compact dashboard showing real-time flow metrics within a defined trading session (e.g., 09:30–16:00):

Metric Description

Session Δ Total cumulative delta since session start

Bar Δ Current bar delta (buy vs. sell flow)

Bar Vol Bar volume relative to average

Absorb “BUY” / “SELL” / “—”

Hotspot “OB” / “OS” / “—”

Sweep “UP” / “DN” / “—”

Imb % / Eq Imbalance ratio & equilibrium state

Colors dynamically adapt to flow direction (green/red/fuchsia/gray).

7. CumDelta Line

Optional cumulative delta plot for continuous volume-flow tracking.

Helps confirm bias shifts and divergence vs. price.

🧩 Alerts

Pre-built alert conditions for all key events:

Buyer/Seller Imbalances

BIG Buyer/Seller Imbalances

Absorption (Buy/Sell)

Hotspot Overbought/Oversold

Liquidity Sweeps (Up/Down)

Equilibrium Flips

These allow automated alerts for advanced orderflow setups or backtesting triggers.

For More Premium Indicators please visit whop.com/ztcryptolab

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya dengan percuma dan tanpa had – ketahui lebih lanjut di sini.

Make your Money work for you !

Don’t worry — you don’t need to be a pro to start. I’ve got a community and tools that make it super easy to learn and actually understand what’s going on in the markets.

Check it out here 👉 whop.com/ztcryptolab/

Don’t worry — you don’t need to be a pro to start. I’ve got a community and tools that make it super easy to learn and actually understand what’s going on in the markets.

Check it out here 👉 whop.com/ztcryptolab/

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya dengan percuma dan tanpa had – ketahui lebih lanjut di sini.

Make your Money work for you !

Don’t worry — you don’t need to be a pro to start. I’ve got a community and tools that make it super easy to learn and actually understand what’s going on in the markets.

Check it out here 👉 whop.com/ztcryptolab/

Don’t worry — you don’t need to be a pro to start. I’ve got a community and tools that make it super easy to learn and actually understand what’s going on in the markets.

Check it out here 👉 whop.com/ztcryptolab/

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.