Vanguard Pro

Overview

This is a technical analysis tool designed to help identify the current market trend and high-probability momentum opportunities. It combines a unique core engine with a multi-stage confirmation framework and an at-a-glance dashboard to assist with your chart analysis.

Technical Features

The indicator is built on these main ideas:

1. The Vanguard Momentum Core (VMC) Engine: The VMC is a proprietary oscillator that generates the initial signals. It doesn't just look at price; it combines two key factors into a single momentum reading:

* Price Extension: It first calculates how far the current price has stretched from its recent average. This helps measure if a move is statistically significant.

* Volume Conviction: It then measures the power behind each price move by analyzing the volume. Moves supported by strong volume are given more weight, indicating higher conviction from market participants.

2. The Multi-Stage Confirmation Framework: A raw signal from the VMC engine is not enough. To be valid, it must pass through a logical sequence of filters to confirm it aligns with the broader market structure:

* ADX "Gatekeeper" Filter: Checks if the market has enough directional energy to support a trend. This helps avoid signals in choppy, sideways conditions.

* Multi-MA "Structure" Filter: Ensures the signal is aligned with the long-term market structure by checking the price's position relative to key moving averages (e.g., 20, 50, 200).

* EMA "Momentum Stack" Filter: Confirms immediate, short-term momentum by ensuring the price is breaking away decisively across a stack of faster exponential moving averages (8, 21, 50).

* Volume & Candle Body Filter: The final check requires the signal candle itself to show conviction with an above-average body size and supporting volume.

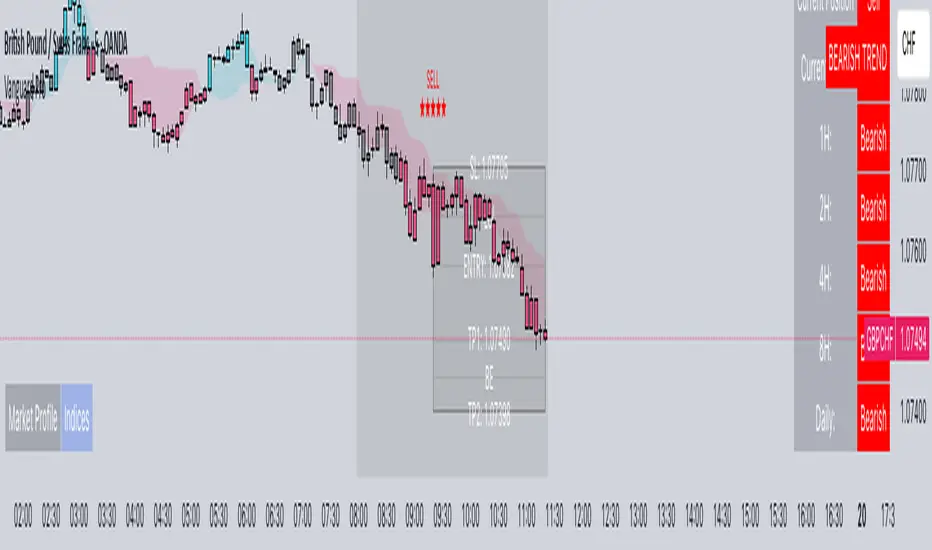

3. How it Grades Signal Quality (Star Rating): Every "BUY" or "SELL" signal receives a star rating from one (★☆☆☆☆) to five (★★★★★). This rating is calculated instantly based on Higher-Timeframe (HTF) confluence:

* The system checks the trend on the current timeframe plus the 1H, 2H, 4H, 8H, and Daily charts.

* The more timeframes that are aligned with the signal's direction, the higher the star rating. A 5-star signal indicates perfect alignment across the board, representing the highest probability setup according to the framework's logic.

4. How it Adapts to Different Markets: The settings include "Market Presets" for different asset classes (Forex, Indices, Crypto, etc.). Choosing a preset automatically adjusts the VMC engine's internal parameters to better fit that market's typical volatility and behavior.

5. Vanguard Trend Cloud: This feature adds a dynamic, color-coded cloud to the chart, similar in concept to the Ichimoku cloud. Its purpose is to provide an immediate visual understanding of the market's underlying trend and momentum.

* Bullish Cloud (Teal): When price is trading above the cloud, it suggests a bullish environment where long positions are generally favored.

* Bearish Cloud (Red): When price is trading below the cloud, it suggests a bearish environment where short positions are generally favored.

* The cloud itself is constructed from two unique components: a fast-moving momentum line (Hull Moving Average) and a slower, structural core trend line (based on the period's highest high and lowest low). The interaction between these two lines creates the cloud and determines its color.

6. Multi-Timeframe Trend Dashboard: The indicator includes an on-screen dashboard in the bottom-right corner that provides an at-a-glance view of the trend across multiple timeframes (1H, 2H, 4H, 8H, and Daily). This allows you to quickly assess the broader market alignment without switching charts.

How to Use This Indicator

1. Use the Feature Control Panel to Customize Your View: At the very top of the settings, you will find a control panel with checkboxes. This allows you to easily turn major visual components on or off to declutter your chart, including the Core Signals, Risk Management Box, Trend Cloud, and Dashboard.

2. Choose Your Market Preset: In the settings, select a preset that matches the asset you are trading. This is the most important first step for optimal performance.

3. Identify the Market Regime: Use the on-chart ADX Status table (top-right) and the candle coloring to understand the current trend conditions.

4. Watch for "BUY" or "SELL" Signals: When a signal appears, check its star rating below the text. A higher rating suggests a stronger, more confirmed setup.

5. Assess Broader Confluence: Use the Multi-Timeframe Trend Dashboard to confirm if the signal is aligned with the higher-timeframe trends.

6. Use the Trend Cloud for Context: If enabled, observe the price's relationship to the Vanguard Trend Cloud. A "BUY" signal that appears while the price is above a bullish (teal) cloud is considered to have stronger contextual support. Conversely, a "SELL" signal below a bearish (red) cloud is more confirmed.

7. Manage Your Trade: If enabled, the automatically drawn Risk Management Box provides a visual reference for potential Stop Loss and Take Profit levels based on current market volatility (ATR).

Intended Use & Limitations

* Recommended Assets: Designed for use on various assets. Performance will differ between markets. Presets for Forex, Indices, Crypto, Commodities, and Stocks are provided as starting points.

* Timeframes: Can be used on all timeframes. The default settings are primarily tuned for intraday charts.

Limitations:

* This is a tool to support analysis. It does not generate automatic buy or sell advice.

* The indicator is not a standalone strategy and does not guarantee results. Users are responsible for their own trading decisions.

* Past performance is not indicative of future results.

* Always use this tool in combination with your own analysis and a robust risk management plan.

We believe that no indicator is a magic solution. Technical analysis tools provide value through their convenience, adaptability, and unique logic. Combining these elements can help a trader make more educated and planned decisions, hopefully contributing to their overall success.

Skrip jemputan sahaja

Hanya pengguna yang diluluskan oleh penulis boleh mengakses skrip ini. Anda perlu memohon dan mendapatkan kebenaran untuk menggunakannya. Ini selalunya diberikan selepas pembayaran. Untuk lebih butiran, ikuti arahan penulis di bawah atau hubungi terus teamprofitsforex.

TradingView tidak menyarankan pembayaran untuk atau menggunakan skrip kecuali anda benar-benar mempercayai penulisnya dan memahami bagaimana ia berfungsi. Anda juga boleh mendapatkan alternatif sumber terbuka lain yang percuma dalam skrip komuniti kami.

Arahan penulis

Amaran: sila baca panduan kami untuk skrip jemputan sahaja sebelum memohon akses.

Penafian

Skrip jemputan sahaja

Hanya pengguna yang diluluskan oleh penulis boleh mengakses skrip ini. Anda perlu memohon dan mendapatkan kebenaran untuk menggunakannya. Ini selalunya diberikan selepas pembayaran. Untuk lebih butiran, ikuti arahan penulis di bawah atau hubungi terus teamprofitsforex.

TradingView tidak menyarankan pembayaran untuk atau menggunakan skrip kecuali anda benar-benar mempercayai penulisnya dan memahami bagaimana ia berfungsi. Anda juga boleh mendapatkan alternatif sumber terbuka lain yang percuma dalam skrip komuniti kami.

Arahan penulis

Amaran: sila baca panduan kami untuk skrip jemputan sahaja sebelum memohon akses.