OPEN-SOURCE SCRIPT

Rolling Point of Control (POC) [AlgoAlpha]

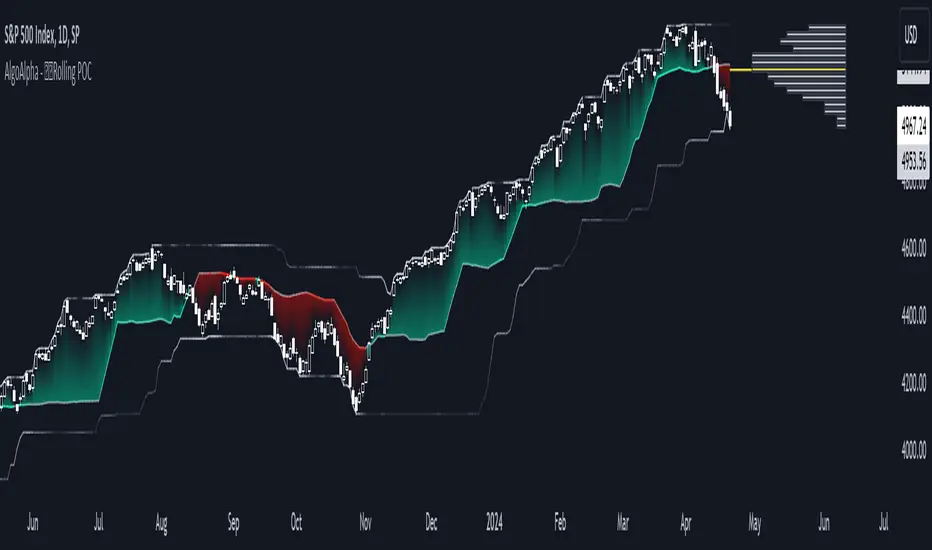

Enhance your trading decisions with the Rolling Point of Control (POC) Indicator designed by AlgoAlpha! This powerful tool displays a dynamic Point of Control based on volume or price profiles directly on your chart, providing a vivid depiction of dominant price levels according to historical data. 🌟📈

🚀 Key Features:

🖥️ How to Use:

🛠 Add the Indicator:

Add the indicator to favorites and customize settings like profile type, lookback period, and resolution to fit your trading style.

📊 Market Analysis:

Monitor the POC line for significant price levels. Use the histogram to understand price distributions and locate major market pivots.

🔔 Alerts Setup:

Enable alerts for price crossing over or under the POC, as well as for trend changes, to stay ahead of market movements without constant chart monitoring.

🛠️ How It Works:

The Rolling POC indicator dynamically calculates the Point of Control either based on volume or price within a user-defined lookback period. It plots a histogram (profile) that highlights the level at which the most trading activity has occurred, helping to identify key support and resistance levels.

Basic Logic Overview:

- Data Compilation: Gathers high, low, and volume (if volume profile selected) data within the lookback period.

- Histogram Calculation: Divides the price range into bins (as specified by resolution), counting hits in each bin to find the most frequented price level.

- POC Identification: The price level with the highest concentration of hits (or volume) is marked as the POC.

- Trend MA (Optional): If enabled, the indicator plots a moving average of the POC for trend analysis.

By integrating the Rolling Point of Control into your charting toolkit, you can significantly enhance your market analysis and potentially increase the accuracy of your trading decisions. Whether you're day trading or looking at longer time frames, this indicator offers a detailed, customizable perspective on market dynamics. 🌍💹

🚀 Key Features:

- Profile Type Selection: Choose between Volume Profile and Price Profile to best suit your analysis needs.

- Adjustable Lookback Period: Modify the lookback period to consider more or less historical data for your profile.

- Customizable Resolution and Scale: Tailor the resolution and horizontal scale of the profile for precision and clarity.

- Trend Analysis Tools: Enable trend analysis with the option to display a weighted moving average of the POC.

- Color-Coded Feedback: Utilize color gradients to quickly identify bullish and bearish conditions relative to the POC.

- Interactive Visuals: Dynamic rendering of profiles and alerts for crossing events enhances visual feedback and responsiveness.

- Multiple Customization Options: Smooth the POC line, toggle profile and fill visibility, and choose custom colors for various elements.

🖥️ How to Use:

🛠 Add the Indicator:

Add the indicator to favorites and customize settings like profile type, lookback period, and resolution to fit your trading style.

📊 Market Analysis:

Monitor the POC line for significant price levels. Use the histogram to understand price distributions and locate major market pivots.

🔔 Alerts Setup:

Enable alerts for price crossing over or under the POC, as well as for trend changes, to stay ahead of market movements without constant chart monitoring.

🛠️ How It Works:

The Rolling POC indicator dynamically calculates the Point of Control either based on volume or price within a user-defined lookback period. It plots a histogram (profile) that highlights the level at which the most trading activity has occurred, helping to identify key support and resistance levels.

Basic Logic Overview:

- Data Compilation: Gathers high, low, and volume (if volume profile selected) data within the lookback period.

- Histogram Calculation: Divides the price range into bins (as specified by resolution), counting hits in each bin to find the most frequented price level.

- POC Identification: The price level with the highest concentration of hits (or volume) is marked as the POC.

- Trend MA (Optional): If enabled, the indicator plots a moving average of the POC for trend analysis.

By integrating the Rolling Point of Control into your charting toolkit, you can significantly enhance your market analysis and potentially increase the accuracy of your trading decisions. Whether you're day trading or looking at longer time frames, this indicator offers a detailed, customizable perspective on market dynamics. 🌍💹

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

🚨Get premium (50% OFF DISCOUNT EXPIRES SOON): algoalpha.io

🛜Get FREE signals: discord.gg/xCmqTVRexz

💡Tutorials: youtube.com/@AlgoAlpha

🛜Get FREE signals: discord.gg/xCmqTVRexz

💡Tutorials: youtube.com/@AlgoAlpha

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

🚨Get premium (50% OFF DISCOUNT EXPIRES SOON): algoalpha.io

🛜Get FREE signals: discord.gg/xCmqTVRexz

💡Tutorials: youtube.com/@AlgoAlpha

🛜Get FREE signals: discord.gg/xCmqTVRexz

💡Tutorials: youtube.com/@AlgoAlpha

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.