PROTECTED SOURCE SCRIPT

VT - Dashboard04

🚀Overview

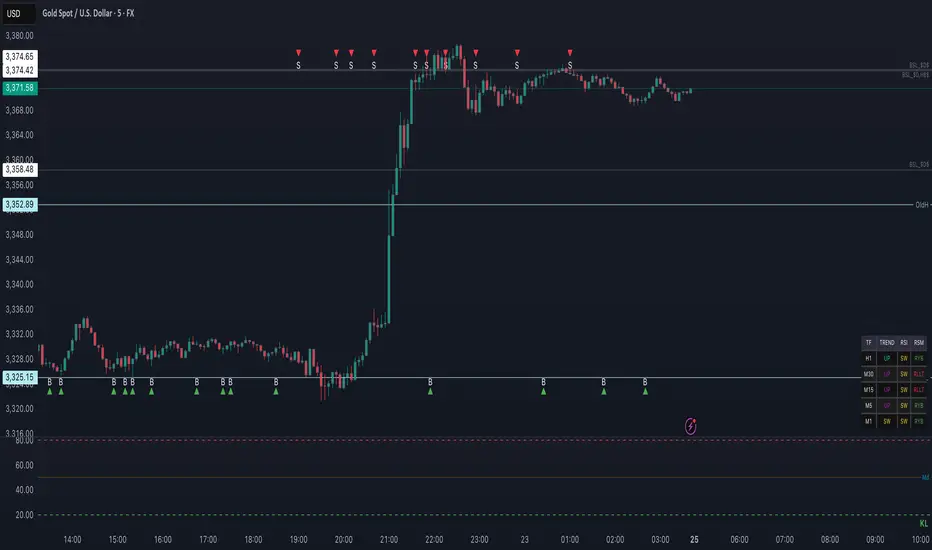

The VT - Dashboard04 is an all-in-one technical analysis powerhouse designed for traders who demand clarity and confluence. This tool eliminates the need to flip between timeframes by providing a real-time snapshot of trend, momentum, and RSI conditions across five key timeframes (H1, M30, M15, M5, M1) in a single, sleek dashboard. Simultaneously, it scans the current chart for high-probability candlestick rejection patterns, generating precise buy and sell signals when confirmed by the underlying trend structure. It's your ultimate multi-timeframe trading assistant.

✨ Key Features

📊 Multi-Timeframe Dashboard: Instantly view Trend, RSI State, and RSM Momentum for H1, M30, M15, M5, and M1.

🎯 Smart Pattern Recognition: Advanced algorithm detects three types of rejection patterns (Type 1, Type 2, Pin Bars) for high-quality entry signals.

⚡ Confluence-Based Logic: Signals only trigger when rejection patterns are confirmed by the EMA trend (cross or alignment), ensuring higher-probability setups.

⚙️ Full Customization: Adjust the dashboard's position, toggle compact mode, and fine-tune all strategy parameters (EMA lengths, RSI levels) to fit your style.

🔔 Built-In Alert Conditions: Pre-configured alerts for "Buy Alert" and "Sell Alert" mean you never miss a trading opportunity.

🛠How to Use

Apply the indicator to any chart.

Glance at the dashboard to assess multi-timeframe momentum alignment (e.g., all timeframes in "UP" trend).

Watch for "B" (Bullish Rejection) or "S" (Bearish Rejection) labels printed on the chart.

A full Buy Signal (green arrow) appears for a confirmed bullish setup. A Sell Signal (red arrow) appears for a confirmed bearish setup.

Use the provided alerts to get notified of new signals automatically.

⚙️ Settings

Dashboard Settings: Choose from 4 screen positions and enable 50% smaller compact mode.

EMA Logic: Adjust the lengths of the Fast and Slow EMAs.

RSI Logic: Customize the RSI Length and Overbought/Oversold levels.

RSM Logic: Tune the RSI Length and EMA Smoothing for the momentum oscillator.

📈Trading Concepts

This indicator synthesizes several powerful concepts:

Multi-Timeframe Analysis: Confirming the trend across higher timeframes increases the probability of a successful trade on a lower timeframe.

Trend Following: Using a stacked EMA (Fast > Mid > Slow) system to define bullish and bearish market bias.

Momentum: Using the RSI to identify overbought and oversold conditions and its own EMA for momentum direction.

Price Action: Identifying key reversal patterns where price has been "rejected" from a level, indicating a potential change in direction.

Note: This is a technical analysis tool. Always practice proper risk management and combine with other analysis techniques for best results.

Category: Technical Analysis

Version: 1.0

Developer: VT

The VT - Dashboard04 is an all-in-one technical analysis powerhouse designed for traders who demand clarity and confluence. This tool eliminates the need to flip between timeframes by providing a real-time snapshot of trend, momentum, and RSI conditions across five key timeframes (H1, M30, M15, M5, M1) in a single, sleek dashboard. Simultaneously, it scans the current chart for high-probability candlestick rejection patterns, generating precise buy and sell signals when confirmed by the underlying trend structure. It's your ultimate multi-timeframe trading assistant.

✨ Key Features

📊 Multi-Timeframe Dashboard: Instantly view Trend, RSI State, and RSM Momentum for H1, M30, M15, M5, and M1.

🎯 Smart Pattern Recognition: Advanced algorithm detects three types of rejection patterns (Type 1, Type 2, Pin Bars) for high-quality entry signals.

⚡ Confluence-Based Logic: Signals only trigger when rejection patterns are confirmed by the EMA trend (cross or alignment), ensuring higher-probability setups.

⚙️ Full Customization: Adjust the dashboard's position, toggle compact mode, and fine-tune all strategy parameters (EMA lengths, RSI levels) to fit your style.

🔔 Built-In Alert Conditions: Pre-configured alerts for "Buy Alert" and "Sell Alert" mean you never miss a trading opportunity.

🛠How to Use

Apply the indicator to any chart.

Glance at the dashboard to assess multi-timeframe momentum alignment (e.g., all timeframes in "UP" trend).

Watch for "B" (Bullish Rejection) or "S" (Bearish Rejection) labels printed on the chart.

A full Buy Signal (green arrow) appears for a confirmed bullish setup. A Sell Signal (red arrow) appears for a confirmed bearish setup.

Use the provided alerts to get notified of new signals automatically.

⚙️ Settings

Dashboard Settings: Choose from 4 screen positions and enable 50% smaller compact mode.

EMA Logic: Adjust the lengths of the Fast and Slow EMAs.

RSI Logic: Customize the RSI Length and Overbought/Oversold levels.

RSM Logic: Tune the RSI Length and EMA Smoothing for the momentum oscillator.

📈Trading Concepts

This indicator synthesizes several powerful concepts:

Multi-Timeframe Analysis: Confirming the trend across higher timeframes increases the probability of a successful trade on a lower timeframe.

Trend Following: Using a stacked EMA (Fast > Mid > Slow) system to define bullish and bearish market bias.

Momentum: Using the RSI to identify overbought and oversold conditions and its own EMA for momentum direction.

Price Action: Identifying key reversal patterns where price has been "rejected" from a level, indicating a potential change in direction.

Note: This is a technical analysis tool. Always practice proper risk management and combine with other analysis techniques for best results.

Category: Technical Analysis

Version: 1.0

Developer: VT

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya dengan percuma dan tanpa had – ketahui lebih lanjut di sini.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya dengan percuma dan tanpa had – ketahui lebih lanjut di sini.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.