EPMA % Impulsive| QuantEdgeB

🔍 What Is EPMA % Impulsive?

A volatility‐standardized impulse oscillator built on a forward-projected, low-lag moving average baseline. It transforms raw price into a 0–100% “impulse meter” by:

1. Trend Projection: Smoothing price with a double-EMA and fitting a short-term regression line that’s extended forward to anticipate direction.

2. Volatility Normalization: Wrapping that projected level in dynamic standard-deviation bands, then scaling price within those bands to a percentage scale.

3. Impulse Thresholds: Offering fixed, percentile-based, or rolling-volatility triggers to distinguish genuine bursts from noise.

💡 Why It’s Special

• Forward-Looking Base: By projecting the regression line forward, it reduces lag and “chases” trends intelligently.

• Noise-Aware Scaling: Volatility bands adapt in real time—quiet markets tighten bands, explosive markets widen them—ensuring the % reading always reflects true impulse, not random jitter.

• Flexible Thresholds: Static levels for simplicity, percentile ranks for regime-aware signals, or full standard-deviation bands for a purely data-driven approach.

• Dual Signal Styles: “Impulsive” mode for raw crossovers; “Smooth” mode for filtered breakouts that favor trend persistence.

⚙️ Key Components (High-Level)

1. DEMA Regression Engine

o Smooths price with double-EMA, fits a rolling regression, then projects it forward.

2. Volatility Bands

o Computes ±N × SD around the projected line to capture current turbulence.

3. % Scaling & Smoothing

o Maps price into a 0–100% range within those bands, then applies a final EMA to stabilize.

4. Impulse Triggers

o Crosses of the % line vs. your chosen thresholds generate long/short flags.

5. Visualization & Alerts

o Color-coded candles, threshold lines, zone fills, arrow markers, plus alert conditions on crossover/crossunder.

💼 Use Cases & Advantages

• Swing-Entry Precision

Pinpoint true momentum bursts for tighter entries and stops—avoiding false breakouts in choppy environments.

• Trend Confirmation

Validate whether a breakout is a sustained impulse (e.g., > 75th percentile) or just a spike that quickly fades.

• Regime Adaptability

Automatically tune sensitivity in low-volatility consolidations versus high-volatility expansions—no manual adjustments needed.

• Multi-Asset Versatility

Works seamlessly on stocks, futures, FX, crypto, and commodities—because it normalizes entirely to volatility, not price scale.

• Clarity & Confidence

A single, easy-to-interpret % reading plus visual cues make momentum obvious at a glance—empowering quick, data-driven decisions.

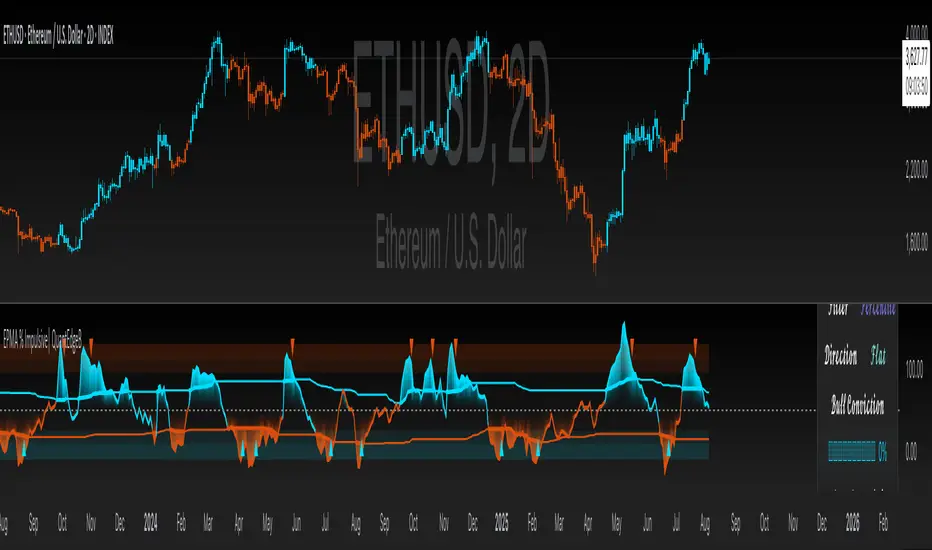

• Couple of charts examples.

BTC 1D

ETH 12H

SOL 8H

DOGE 4H

📌 Disclaimer:

Backtest results are based on past performance and do not guarantee future success. Always incorporate real-time validation and risk management in live trading.

🎨 Default Settings (Example)

• EPMA Lookback: 21 bars, forward-project 50 bars

• Volatility Band: ±2 × SD over 20 bars

• Threshold Type: Percentile 75/25 over 70 bars

• Signal Mode: Impulsive, Bar Color = On

📌 In Summary

EPMA % Impulsive | QuantEdgeB is your forward-projecting, volatility-aware momentum meter—combining regression forecasting with adaptive scaling to surface only the most meaningful impulse moves. Whether you’re timing swing entries or validating breakouts, it turns raw price into a clear, normalized impulse signal that adapts to any market regime.

🔹 Disclaimer: Past performance is not indicative of future results. No trading strategy can guarantee success in financial markets.

🔹 Strategic Advice: Always backtest, optimize, and align parameters with your trading objectives and risk tolerance before live trading.

Skrip jemputan sahaja

Hanya pengguna disahkan oleh penulis boleh mengakses skrip ini. Anda perlu memohon dan mendapatkan kebenaran untuk menggunakannya. Keizinan selalunya diberikan selepas pembayaran. Untuk lebih butiran, ikuti arahan penulis di bawah atau hubungi QuantEdgeB secara terus.

TradingView TIDAK menyarankan pembayaran atau penggunaan skrip kecuali anda mempercayai sepenuhnya penulis dan memahami bagaimana ia berfungsi. Anda juga boleh menjumpai alternatif sumber terbuka dan percuma yang lain di dalam skrip komuniti kami.

Arahan penulis

whop.com/quantedgeb/ 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

Penafian

Skrip jemputan sahaja

Hanya pengguna disahkan oleh penulis boleh mengakses skrip ini. Anda perlu memohon dan mendapatkan kebenaran untuk menggunakannya. Keizinan selalunya diberikan selepas pembayaran. Untuk lebih butiran, ikuti arahan penulis di bawah atau hubungi QuantEdgeB secara terus.

TradingView TIDAK menyarankan pembayaran atau penggunaan skrip kecuali anda mempercayai sepenuhnya penulis dan memahami bagaimana ia berfungsi. Anda juga boleh menjumpai alternatif sumber terbuka dan percuma yang lain di dalam skrip komuniti kami.

Arahan penulis

whop.com/quantedgeb/ 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only