Simple VIDYA Smooth | QuantEdgeB

🔍 What Is Simple VIDYA Smooth?

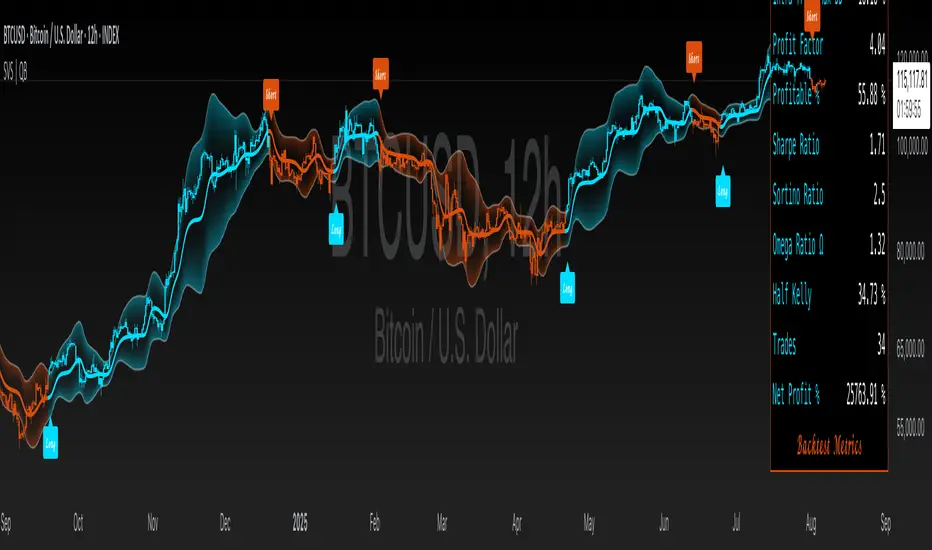

SVS is a smoothed, volatility-adaptive trend filter that blends a Gaussian-pre-filtered, low-lag moving average with dynamic standard-deviation bands. It identifies trends by measuring when price moves decisively above or below a normalized VIDYA (Variable Index Dynamic Average) baseline—filtering out noise and adapting to changing market turbulence.

⚙️ Core Components

1. DEMA Pre-Filter

o A double-EMA smoothing to reduce initial noise before further processing.

2. Gaussian Smoothing

o Applies a small-kernel Gaussian filter to produce a cleaner input series that suppresses rapid spikes.

3. VIDYA Adaptive Average

o Computes a dynamic EMA whose smoothing constant adjusts according to the ratio of short- and long-term standard deviations—making it inherently responsive in volatile times and smooth in calmer periods.

4. Volatility Bands

o Surrounds the VIDYA line with ±N×SD bands (separate multipliers for upper and lower) to capture current market volatility, yielding dynamic thresholds for trend detection.

5. Trend Signal

o Generates a “long” when price closes above the upper band, a “short” when it closes below the lower band, otherwise stays neutral.

💡 Why It’s Special

• Adaptive Responsiveness: VIDYA’s volatility-weighted smoothing constant speeds up trend recognition in choppy markets and slows in quiet ones, avoiding whipsaws.

• Multi-Stage Filtering: The DEMA→Gaussian→VIDYA sequence ensures both rapid noise suppression and flexible trend adaptation.

• Asymmetric Bands: Separate multipliers for the upper and lower volatility bands let you fine-tune sensitivity to bullish versus bearish impulses.

• Visual Clarity: Color-coded candles and filled bands highlight trending phases at a glance, while backtest tables quantify performance.

📊 Backtest Mode

AVBO includes an optional backtest table, enabling traders to assess its historical effectiveness before applying it in live trading conditions.

🔹 Backtest Metrics Displayed:

• Equity Max Drawdown → Largest historical loss from peak equity.

• Profit Factor → Ratio of total profits to total losses, measuring system efficiency.

• Sharpe Ratio → Assesses risk-adjusted return performance.

• Sortino Ratio → Focuses on downside risk-adjusted returns.

• Omega Ratio → Evaluates return consistency & performance asymmetry.

• Half Kelly → Optimal position sizing based on risk/reward analysis.

• Total Trades & Win Rate → Assess historical success rate.

BTC

ETH

📌 Disclaimer:

Backtest results are based on past performance and do not guarantee future success. Always incorporate real-time validation and risk management in live trading.

💼 Ideal Use Cases

• Trend Identification: Pinpoint reliable trend starts and exits in stocks, FX, or crypto—minimizing lag and false breakouts.

• Volatility Regimes: Automatically adjust to quiet vs. explosive markets—no manual parameter tweaks needed.

• Multitimeframe Alignment: Use SVS on multiple timeframes to confirm trend direction before entering positions.

• System Building Block: Embed SVS as a robust, adaptive filter within larger strategies (e.g., to trigger entries or to validate signals from other indicators).

🎨 Default Configuration

• DEMA Length: 7

• Gaussian Kernel: length = 4, sigma = 2.0

• VIDYA Lengths: fast = 9, slow = 24 (or use presets Set1–Set4)

• Volatility Bands: SD length = 40

📌 In Summary

Simple VIDYA Smooth | QuantEdgeB is an adaptive trend-filtering indicator that layers multiple noise-suppressing and volatility-adjusting techniques to deliver clear, reliable trend signals. By marrying DEMA, Gaussian filtering, VIDYA’s volatility-driven smoothing, and dynamic SD bands, SVS excels at separating genuine directional moves from market noise—across any asset or timeframe.

🔹 Disclaimer: Past performance is not indicative of future results. Always backtest and align AVBO’s settings with your risk tolerance and market objectives before live trading.

🔹 Strategic Advice: Always backtest, optimize, and align parameters with your trading objectives and risk tolerance before live trading.

Skrip jemputan sahaja

Hanya pengguna yang diluluskan oleh penulis boleh mengakses skrip ini. Anda perlu memohon dan mendapatkan kebenaran untuk menggunakannya. Ini selalunya diberikan selepas pembayaran. Untuk lebih butiran, ikuti arahan penulis di bawah atau hubungi terus QuantEdgeB.

TradingView tidak menyarankan pembayaran untuk atau menggunakan skrip kecuali anda benar-benar mempercayai penulisnya dan memahami bagaimana ia berfungsi. Anda juga boleh mendapatkan alternatif sumber terbuka lain yang percuma dalam skrip komuniti kami.

Arahan penulis

whop.com/quantedgeb/ 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

Penafian

Skrip jemputan sahaja

Hanya pengguna yang diluluskan oleh penulis boleh mengakses skrip ini. Anda perlu memohon dan mendapatkan kebenaran untuk menggunakannya. Ini selalunya diberikan selepas pembayaran. Untuk lebih butiran, ikuti arahan penulis di bawah atau hubungi terus QuantEdgeB.

TradingView tidak menyarankan pembayaran untuk atau menggunakan skrip kecuali anda benar-benar mempercayai penulisnya dan memahami bagaimana ia berfungsi. Anda juga boleh mendapatkan alternatif sumber terbuka lain yang percuma dalam skrip komuniti kami.

Arahan penulis

whop.com/quantedgeb/ 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only