🔵 OVERVIEW

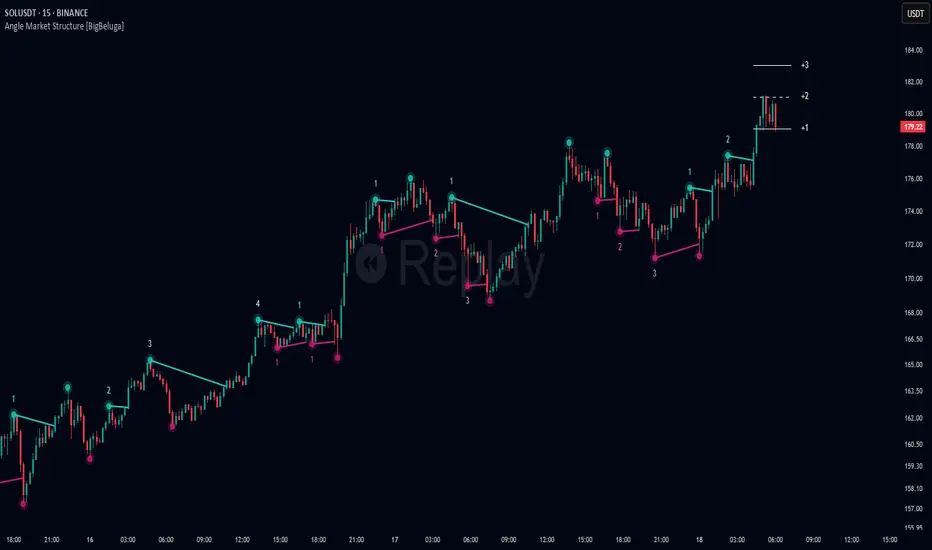

Angle Market Structure [BigBeluga] is a smart pivot-based tool that dynamically adapts to price action by accelerating breakout and breakdown detection. It draws market structure levels based on pivot highs/lows and gradually adjusts those levels closer to price using an angle threshold. Upon breakout, the indicator projects deviation zones with labeled levels (+1, +2, +3 or −1, −2, −3) to track price extension beyond structure.

🔵 CONCEPTS

🔵 FEATURES

🔵 HOW TO USE

🔵 CONCLUSION

Angle Market Structure [BigBeluga] enhances traditional pivot-based analysis by introducing breakout acceleration and structured deviation tracking. It’s a powerful tool for traders seeking a cleaner, faster read on market structure and momentum strength—especially during impulsive price moves or structural transitions.

Angle Market Structure [BigBeluga] is a smart pivot-based tool that dynamically adapts to price action by accelerating breakout and breakdown detection. It draws market structure levels based on pivot highs/lows and gradually adjusts those levels closer to price using an angle threshold. Upon breakout, the indicator projects deviation zones with labeled levels (+1, +2, +3 or −1, −2, −3) to track price extension beyond structure.

🔵 CONCEPTS

- Adaptive Market Structure: Uses pivots to define structure levels, which dynamically angle closer to price over time to capture breakouts sooner.

- Breakout Acceleration: Pivot high levels decrease and pivot low levels increase each bar using a user-defined angle (based on ATR), improving reactivity.

- Deviation Zones: Once a breakout or breakdown occurs, 3 deviation levels are projected to show how far price extends beyond the breakout point.

- Count Labels: Each successful structure break is numbered sequentially, giving traders insight into momentum and trend persistence.

- Visual Clarity: The script uses colored pivot points, trend lines, and extension labels for easy structural interpretation.

🔵 FEATURES

- Calculates pivot highs and lows using a customizable length.

- Applies an angle modifier (ATR-based) to gradually pull levels closer to price.

- Plots breakout and breakdown lines in distinct colors with automatic extension.

- Shows deviation zones (+1, +2, +3 or −1, −2, −3) after breakout with customizable size.

- Color-coded labels for trend break count (bullish or bearish).

- Dynamic label sizing and theme-aware colors.

- Smart label positioning to avoid chart clutter.

- Built-in limit for deviation zones to maintain clarity and performance.

🔵 HOW TO USE

- Use pivot-based market structure to identify breakout and breakdown zones.

- Watch for crossover (up) or crossunder (down) events as trend continuation or reversal signals.

- Observe +1/+2/+3 or -1/-2/-3 levels for overextension opportunities or trailing stop ideas.

- Use breakout count as a proxy for trend strength—multiple counts suggest momentum.

- Combine with volume or order flow tools for higher confidence entries at breakout points.

- Adjust the angle setting to fine-tune sensitivity based on market volatility.

🔵 CONCLUSION

Angle Market Structure [BigBeluga] enhances traditional pivot-based analysis by introducing breakout acceleration and structured deviation tracking. It’s a powerful tool for traders seeking a cleaner, faster read on market structure and momentum strength—especially during impulsive price moves or structural transitions.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

🔵Gain access to our powerful tools : bigbeluga.com/tv

🔵Join our free discord for updates : bigbeluga.com/discord

All scripts & content provided by BigBeluga are for informational & educational purposes only.

🔵Join our free discord for updates : bigbeluga.com/discord

All scripts & content provided by BigBeluga are for informational & educational purposes only.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

🔵Gain access to our powerful tools : bigbeluga.com/tv

🔵Join our free discord for updates : bigbeluga.com/discord

All scripts & content provided by BigBeluga are for informational & educational purposes only.

🔵Join our free discord for updates : bigbeluga.com/discord

All scripts & content provided by BigBeluga are for informational & educational purposes only.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.