OPEN-SOURCE SCRIPT

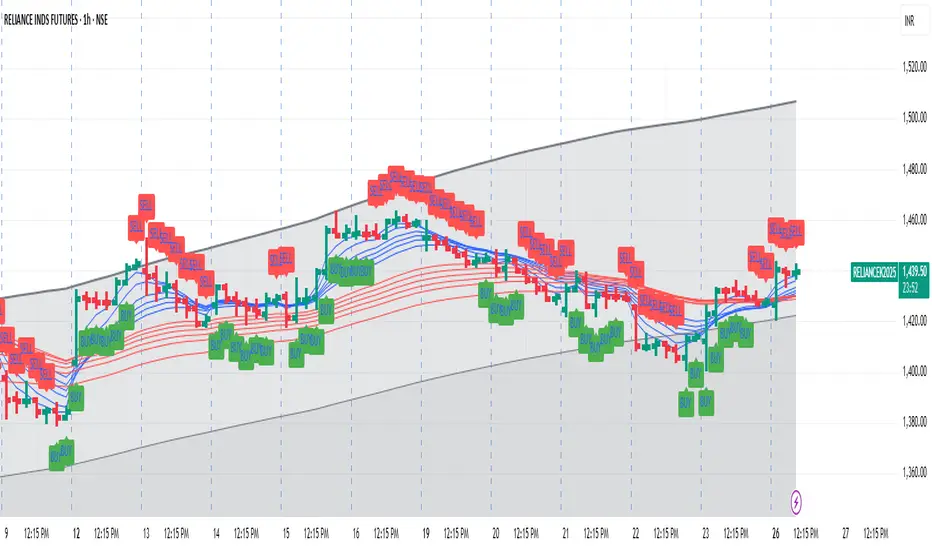

Mad Trading Scientist - Guppy MMA with Bollinger Bands

📘 Indicator Name:

Guppy MMA with Bollinger Bands

🔍 What This Indicator Does:

This TradingView indicator combines Guppy Multiple Moving Averages (GMMA) with Bollinger Bands to help you identify trend direction and volatility zones, ideal for spotting pullback entries within trending markets.

🔵 1. Guppy Multiple Moving Averages (GMMA):

✅ Short-Term EMAs (Blue) — represent trader sentiment:

EMA 3, 5, 8, 10, 12, 15

✅ Long-Term EMAs (Red) — represent investor sentiment:

EMA 30, 35, 40, 45, 50, 60

Usage:

When blue (short) EMAs are above red (long) EMAs and spreading → Strong uptrend

When blue EMAs cross below red EMAs → Potential downtrend

⚫ 2. Bollinger Bands (Volatility Envelopes):

Length: 300 (captures the longer-term price range)

Basis: 300-period SMA

Upper & Lower Bands:

±1 Standard Deviation (light gray zone)

±2 Standard Deviations (dark gray zone)

Fill Zones:

Highlights standard deviation ranges

Emphasizes extreme vs. normal price moves

Usage:

Price touching ±2 SD bands signals potential exhaustion

Price reverting to the mean suggests pullback or re-entry opportunity

💡 Important Note: Use With Momentum Filter

✅ For superior accuracy, this indicator should be combined with your invite-only momentum filter on TradingView.

This filter helps confirm whether the trend has underlying strength or is losing momentum, increasing the probability of successful entries and exits.

🕒 Recommended Timeframe:

📆 1-Hour Chart (60m)

This setup is optimized for short- to medium-term swing trading, where Guppy structures and Bollinger reversion work best.

🔧 Practical Strategy Example:

Long Trade Setup:

Short EMAs are above long EMAs (strong uptrend)

Price pulls back to the lower 1 or 2 SD band

Momentum filter confirms bullish strength

Short Trade Setup:

Short EMAs are below long EMAs (strong downtrend)

Price rises to the upper 1 or 2 SD band

Momentum filter confirms bearish strength

Guppy MMA with Bollinger Bands

🔍 What This Indicator Does:

This TradingView indicator combines Guppy Multiple Moving Averages (GMMA) with Bollinger Bands to help you identify trend direction and volatility zones, ideal for spotting pullback entries within trending markets.

🔵 1. Guppy Multiple Moving Averages (GMMA):

✅ Short-Term EMAs (Blue) — represent trader sentiment:

EMA 3, 5, 8, 10, 12, 15

✅ Long-Term EMAs (Red) — represent investor sentiment:

EMA 30, 35, 40, 45, 50, 60

Usage:

When blue (short) EMAs are above red (long) EMAs and spreading → Strong uptrend

When blue EMAs cross below red EMAs → Potential downtrend

⚫ 2. Bollinger Bands (Volatility Envelopes):

Length: 300 (captures the longer-term price range)

Basis: 300-period SMA

Upper & Lower Bands:

±1 Standard Deviation (light gray zone)

±2 Standard Deviations (dark gray zone)

Fill Zones:

Highlights standard deviation ranges

Emphasizes extreme vs. normal price moves

Usage:

Price touching ±2 SD bands signals potential exhaustion

Price reverting to the mean suggests pullback or re-entry opportunity

💡 Important Note: Use With Momentum Filter

✅ For superior accuracy, this indicator should be combined with your invite-only momentum filter on TradingView.

This filter helps confirm whether the trend has underlying strength or is losing momentum, increasing the probability of successful entries and exits.

🕒 Recommended Timeframe:

📆 1-Hour Chart (60m)

This setup is optimized for short- to medium-term swing trading, where Guppy structures and Bollinger reversion work best.

🔧 Practical Strategy Example:

Long Trade Setup:

Short EMAs are above long EMAs (strong uptrend)

Price pulls back to the lower 1 or 2 SD band

Momentum filter confirms bullish strength

Short Trade Setup:

Short EMAs are below long EMAs (strong downtrend)

Price rises to the upper 1 or 2 SD band

Momentum filter confirms bearish strength

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.