PROTECTED SOURCE SCRIPT

Worstfx Fractal Sessions

🧩 Worstfx Fractal Sessions Public — Features & Purpose

✔️ Includes clean session structure • Simple confluence • Built-in guardrails for your psychology

Worstfx Fractal Sessions Public is a stripped-back, clean version of the full Worstfx framework.

It’s designed to give every trader the core advantages of the fractal system:

• clear session structure

• simple trend/confluence read

• context from Daily ATR

• basic order-flow sentiment

• an on-chart help panel so nobody gets lost

All without overwhelming settings or “indicator soup.”

Use it to see the day as a story: Asia range → London expansion → Pre-NY setup → NY confirmation or reversal.

⸻

⚙️ Main Features

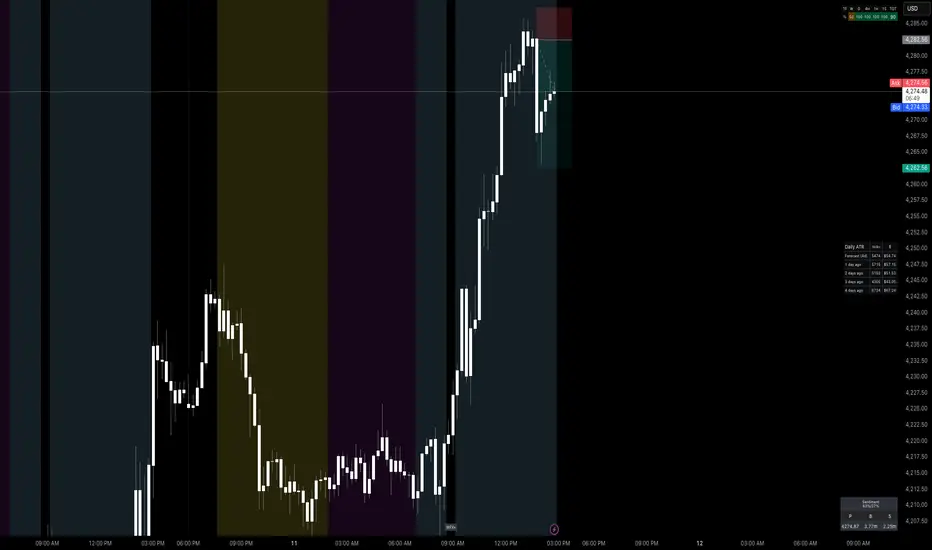

1️⃣ Session Shading (Asia / London / Pre NY / NY)

What it does

• Colors each session with soft, transparent shading:

• Asia – yellow tone

• London – purple tone

• Pre NY – light blue

• NY – light blue (separate time block)

• You can customize the session times and colors.

• Includes a 6:00 pm ET divider line to mark the start of a new “trading day” in your framework.

Why it matters (psychology)

• Your brain stops seeing random candles and starts seeing chapters:

• Asia = range / setup

• London = expansion / fakeouts

• NY = continuation / reversal

• This reduces FOMO and impulsive entries because you naturally ask:

“Which session am I in?”

“What is this session supposed to be doing?”

• The 6pm divider helps you mentally reset each day instead of carrying emotional baggage from yesterday into today.

⸻

2️⃣ Time-Frame Confluence Panel (Weekly → 15m)

What it does

• Checks a simple model on multiple timeframes (W, D, 4H, 1H, 15m):

• Above or below the 50 EMA

• RSI above or below 50

• Converts that into a 0–100% confluence score per TF.

• Gives a %TOTAL score that blends all TFs into a single number.

• Two display modes:

• Strip — horizontal bar with W/D/4H/1H/15m + %TOTAL

• Table — vertical list showing bull% / bear% per TF

• Mobile mode shrinks everything for smaller screens.

Why it matters (psychology)

• Instead of arguing with yourself about “trend,” you get a simple question:

“Are the higher timeframes mostly aligned or mixed?”

• Green/high %TOTAL = “permission” to press your bias, not to over-trade.

• Red/low %TOTAL = natural brake: “This is not the clean trend day. Size down or stay out.”

• It pulls you away from 1-minute tunnel vision and forces you to respect bigger structure.

⸻

3️⃣ Daily ATR Panel (Last 4–12 days + Forecast)

What it does

• Tracks true daily range (High–Low) over recent days.

• Shows:

• Last few days’ range in ticks and $

• Optional 4-day average forecast (projected typical daily move)

• Option to show just last 4 days, or full 12-day history.

• Two modes:

• Table – labeled rows with “ticks / $” columns

• Macro – compact text summary like “FC: 2000t | $20.00”

Why it matters (psychology)

• You stop expecting 5000-tick moves on a 600-tick average day.

• When the forecast is small, you naturally:

• avoid chasing huge targets

• respect partials

• recognize “maybe today just isn’t the big runner”

• On big ATR days, you recognize that volatility is here, so:

• you give your targets breathing room

• you’re less likely to panic when price swings

• This keeps your expectations in line with reality, which reduces tilt, frustration, and revenge trades.

⸻

4️⃣ Order-Flow Sentiment Panel (Compact OF Read)

What it does

• Estimates buy vs sell volume on the current and previous candles.

• Shows:

• Sentiment row with Buy% / Sell%

• Buy/Sell volumes (with “k/m” formatting if enabled)

• Optional extra rows for prior candles.

• Highlights imbalances when one side hits your imbalance threshold (e.g., 70%).

Why it matters (psychology)

• Gives you a quick “who’s in control right now” view without staring at raw volume.

• Imbalance flashes create micro-alerts:

• “This might be a stop run or strong continuation, pay attention.”

• Prevents you from blindly shorting into heavy buy pressure or buying into stacked sell pressure just because of greed or fear.

• Makes your entries feel more validated, which calms you during the trade.

⸻

🧠 Overall Psychological Goal

Worstfx Fractal Sessions Public is not just a visual skin for your charts.

It’s a behavior framework.

It tries to quietly enforce:

• Patience → by tying you to sessions and key time behavior.

• Selectivity → by checking multi-TF trend alignment.

• Realistic expectations → via ATR context.

• Non-impulsive entries → via order-flow imbalance checks.

• Accountability → via clear explanations and structure, not vibes.

Instead of chasing every move, you’re guided into a loop:

“What session am I in? What is ATR saying? Are TFs aligned? Is order-flow confirming? If not, I wait.”

🔋 The risk is minimized by structure & The reward is maximized by timing🔋

✔️ Includes clean session structure • Simple confluence • Built-in guardrails for your psychology

Worstfx Fractal Sessions Public is a stripped-back, clean version of the full Worstfx framework.

It’s designed to give every trader the core advantages of the fractal system:

• clear session structure

• simple trend/confluence read

• context from Daily ATR

• basic order-flow sentiment

• an on-chart help panel so nobody gets lost

All without overwhelming settings or “indicator soup.”

Use it to see the day as a story: Asia range → London expansion → Pre-NY setup → NY confirmation or reversal.

⸻

⚙️ Main Features

1️⃣ Session Shading (Asia / London / Pre NY / NY)

What it does

• Colors each session with soft, transparent shading:

• Asia – yellow tone

• London – purple tone

• Pre NY – light blue

• NY – light blue (separate time block)

• You can customize the session times and colors.

• Includes a 6:00 pm ET divider line to mark the start of a new “trading day” in your framework.

Why it matters (psychology)

• Your brain stops seeing random candles and starts seeing chapters:

• Asia = range / setup

• London = expansion / fakeouts

• NY = continuation / reversal

• This reduces FOMO and impulsive entries because you naturally ask:

“Which session am I in?”

“What is this session supposed to be doing?”

• The 6pm divider helps you mentally reset each day instead of carrying emotional baggage from yesterday into today.

⸻

2️⃣ Time-Frame Confluence Panel (Weekly → 15m)

What it does

• Checks a simple model on multiple timeframes (W, D, 4H, 1H, 15m):

• Above or below the 50 EMA

• RSI above or below 50

• Converts that into a 0–100% confluence score per TF.

• Gives a %TOTAL score that blends all TFs into a single number.

• Two display modes:

• Strip — horizontal bar with W/D/4H/1H/15m + %TOTAL

• Table — vertical list showing bull% / bear% per TF

• Mobile mode shrinks everything for smaller screens.

Why it matters (psychology)

• Instead of arguing with yourself about “trend,” you get a simple question:

“Are the higher timeframes mostly aligned or mixed?”

• Green/high %TOTAL = “permission” to press your bias, not to over-trade.

• Red/low %TOTAL = natural brake: “This is not the clean trend day. Size down or stay out.”

• It pulls you away from 1-minute tunnel vision and forces you to respect bigger structure.

⸻

3️⃣ Daily ATR Panel (Last 4–12 days + Forecast)

What it does

• Tracks true daily range (High–Low) over recent days.

• Shows:

• Last few days’ range in ticks and $

• Optional 4-day average forecast (projected typical daily move)

• Option to show just last 4 days, or full 12-day history.

• Two modes:

• Table – labeled rows with “ticks / $” columns

• Macro – compact text summary like “FC: 2000t | $20.00”

Why it matters (psychology)

• You stop expecting 5000-tick moves on a 600-tick average day.

• When the forecast is small, you naturally:

• avoid chasing huge targets

• respect partials

• recognize “maybe today just isn’t the big runner”

• On big ATR days, you recognize that volatility is here, so:

• you give your targets breathing room

• you’re less likely to panic when price swings

• This keeps your expectations in line with reality, which reduces tilt, frustration, and revenge trades.

⸻

4️⃣ Order-Flow Sentiment Panel (Compact OF Read)

What it does

• Estimates buy vs sell volume on the current and previous candles.

• Shows:

• Sentiment row with Buy% / Sell%

• Buy/Sell volumes (with “k/m” formatting if enabled)

• Optional extra rows for prior candles.

• Highlights imbalances when one side hits your imbalance threshold (e.g., 70%).

Why it matters (psychology)

• Gives you a quick “who’s in control right now” view without staring at raw volume.

• Imbalance flashes create micro-alerts:

• “This might be a stop run or strong continuation, pay attention.”

• Prevents you from blindly shorting into heavy buy pressure or buying into stacked sell pressure just because of greed or fear.

• Makes your entries feel more validated, which calms you during the trade.

⸻

🧠 Overall Psychological Goal

Worstfx Fractal Sessions Public is not just a visual skin for your charts.

It’s a behavior framework.

It tries to quietly enforce:

• Patience → by tying you to sessions and key time behavior.

• Selectivity → by checking multi-TF trend alignment.

• Realistic expectations → via ATR context.

• Non-impulsive entries → via order-flow imbalance checks.

• Accountability → via clear explanations and structure, not vibes.

Instead of chasing every move, you’re guided into a loop:

“What session am I in? What is ATR saying? Are TFs aligned? Is order-flow confirming? If not, I wait.”

🔋 The risk is minimized by structure & The reward is maximized by timing🔋

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.