OPEN-SOURCE SCRIPT

Telah dikemas kini Information Theory Market Analysis

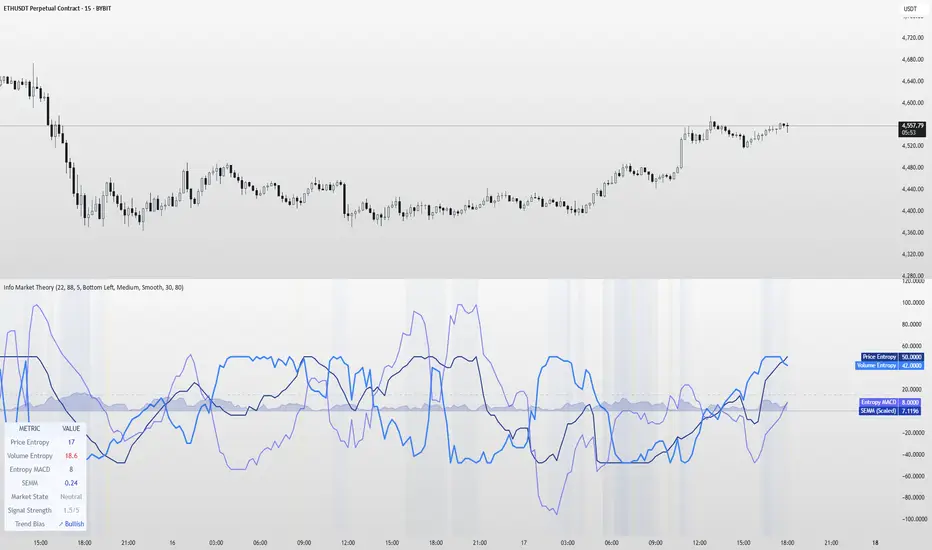

INFORMATION THEORY MARKET ANALYSIS

OVERVIEW

This indicator applies mathematical concepts from information theory to analyze market behavior, measuring the randomness and predictability of price and volume movements through entropy calculations. Unlike traditional technical indicators, it provides insight into market structure and regime changes.

KEY COMPONENTS

Four Main Signals:

• Price Entropy (Deep Blue): Measures randomness in price movements

• Volume Entropy (Bright Blue): Analyzes volume pattern predictability

• Entropy MACD (Purple): Shows relationship between price and volume entropy

• SEMM (Royal Blue): Stochastic Entropy Market Monitor - overall market randomness gauge

Market State Detection:

The indicator identifies seven distinct market states:

• Strong Trending (SEMM < 0.1)

• Weak Trending (0.1-0.2)

• Neutral (0.2-0.3)

• Moderate Random (0.3-0.5)

• High Randomness (0.5-0.8)

• Very Random (0.8-1.0)

• Chaotic (>1.0)

KEY FEATURES

Advanced Analytics:

• Signal Strength Confluence: 0-5 scale measuring alignment of multiple factors

• Entropy Crossovers: Detects shifts between accumulation and distribution phases

• Extreme Readings: Identifies statistical outliers for potential reversals

• Trend Bias Analysis: Directional momentum assessment

Information Dashboard:

• Real-time entropy values and market state

• Signal strength indicator with visual highlighting

• Trend bias with directional arrows

• Color-coded alerts for extreme conditions

Customizable Display:

• Adjustable SEMM scaling (5x to 100x) for optimal visibility

• Multiple line styles: Smooth, Stepped, Dotted

• 9 table positions with 3 size options

• Professional blue color scheme with transparency controls

Comprehensive Alert System - 15 Alert Types Including:

• Extreme entropy readings (price/volume)

• Crossover signals (dominance shifts)

• Market state changes (trending ↔ random)

• High confluence signals (3+ factors aligned)

HOW TO USE

Reading the Signals:

• Entropy Values > ±25: Strong structural signals

• Entropy Values > ±40: Extreme readings, potential reversals

• SEMM < 0.2: Trending market favors directional strategies

• SEMM > 0.5: Random market favors range/scalping strategies

Signal Confluence:

Look for multiple factors aligning:

• Signal Strength ≥ 3.0 for higher probability setups

• Background highlighting indicates confluence

• Table shows real-time strength assessment

Timeframe Optimization:

• Short-term (1m-15m): Entropy Length 14-22, Sensitivity 3-5

• Swing Trading (1H-4H): Default settings optimal

• Position Trading (Daily+): Entropy Length 34-55, Sensitivity 8-12

EDUCATIONAL APPLICATIONS

Market Structure Analysis:

• Understand when markets are trending vs. ranging

• Identify accumulation and distribution phases

• Recognize extreme market conditions

• Measure information content in price movements

Information Theory Concepts:

• Binary entropy calculations applied to financial data

• Probability distribution analysis of returns

• Statistical ranking and percentile analysis

• Momentum-adjusted randomness measurement

TECHNICAL DETAILS

Calculations:

• Uses binary entropy formula: -[p×log₂(p) + (1-p)×log₂(1-p)]

• Percentile ranking across multiple timeframes

• Volume-weighted probability distributions

• RSI-adjusted momentum entropy (SEMM)

Customization Options:

• Entropy Length: 5-100 bars (default: 22)

• Average Length: 10-200 bars (default: 88)

• Sensitivity: 1.0-20.0 (default: 5.0, lower = more sensitive)

• SEMM Scaling: 5.0-100.0x (default: 30.0)

IMPORTANT NOTES

Risk Considerations:

• Indicator measures probabilities, not certainties

• High SEMM values (>0.5) suggest increased market randomness

• Extreme readings may persist longer than expected

• Always combine with proper risk management

Educational Purpose:

This indicator is designed for:

• Market structure analysis and education

• Understanding information theory applications in finance

• Developing probabilistic thinking about markets

• Research and analytical purposes

Performance Tips:

• Allow 200+ bars for proper initialization

• Adjust scaling and transparency for optimal visibility

• Use confluence signals for higher probability analysis

• Consider multiple timeframes for comprehensive analysis

DISCLAIMER

This indicator is for educational and analytical purposes. It does not constitute financial advice. Past performance does not guarantee future results. Always conduct your own research and consider your risk tolerance before making trading decisions.

Version: 5.0

Category: Oscillators, Volume, Market Structure

Best For: All timeframes, trending and ranging markets

Complexity: Intermediate to Advanced

OVERVIEW

This indicator applies mathematical concepts from information theory to analyze market behavior, measuring the randomness and predictability of price and volume movements through entropy calculations. Unlike traditional technical indicators, it provides insight into market structure and regime changes.

KEY COMPONENTS

Four Main Signals:

• Price Entropy (Deep Blue): Measures randomness in price movements

• Volume Entropy (Bright Blue): Analyzes volume pattern predictability

• Entropy MACD (Purple): Shows relationship between price and volume entropy

• SEMM (Royal Blue): Stochastic Entropy Market Monitor - overall market randomness gauge

Market State Detection:

The indicator identifies seven distinct market states:

• Strong Trending (SEMM < 0.1)

• Weak Trending (0.1-0.2)

• Neutral (0.2-0.3)

• Moderate Random (0.3-0.5)

• High Randomness (0.5-0.8)

• Very Random (0.8-1.0)

• Chaotic (>1.0)

KEY FEATURES

Advanced Analytics:

• Signal Strength Confluence: 0-5 scale measuring alignment of multiple factors

• Entropy Crossovers: Detects shifts between accumulation and distribution phases

• Extreme Readings: Identifies statistical outliers for potential reversals

• Trend Bias Analysis: Directional momentum assessment

Information Dashboard:

• Real-time entropy values and market state

• Signal strength indicator with visual highlighting

• Trend bias with directional arrows

• Color-coded alerts for extreme conditions

Customizable Display:

• Adjustable SEMM scaling (5x to 100x) for optimal visibility

• Multiple line styles: Smooth, Stepped, Dotted

• 9 table positions with 3 size options

• Professional blue color scheme with transparency controls

Comprehensive Alert System - 15 Alert Types Including:

• Extreme entropy readings (price/volume)

• Crossover signals (dominance shifts)

• Market state changes (trending ↔ random)

• High confluence signals (3+ factors aligned)

HOW TO USE

Reading the Signals:

• Entropy Values > ±25: Strong structural signals

• Entropy Values > ±40: Extreme readings, potential reversals

• SEMM < 0.2: Trending market favors directional strategies

• SEMM > 0.5: Random market favors range/scalping strategies

Signal Confluence:

Look for multiple factors aligning:

• Signal Strength ≥ 3.0 for higher probability setups

• Background highlighting indicates confluence

• Table shows real-time strength assessment

Timeframe Optimization:

• Short-term (1m-15m): Entropy Length 14-22, Sensitivity 3-5

• Swing Trading (1H-4H): Default settings optimal

• Position Trading (Daily+): Entropy Length 34-55, Sensitivity 8-12

EDUCATIONAL APPLICATIONS

Market Structure Analysis:

• Understand when markets are trending vs. ranging

• Identify accumulation and distribution phases

• Recognize extreme market conditions

• Measure information content in price movements

Information Theory Concepts:

• Binary entropy calculations applied to financial data

• Probability distribution analysis of returns

• Statistical ranking and percentile analysis

• Momentum-adjusted randomness measurement

TECHNICAL DETAILS

Calculations:

• Uses binary entropy formula: -[p×log₂(p) + (1-p)×log₂(1-p)]

• Percentile ranking across multiple timeframes

• Volume-weighted probability distributions

• RSI-adjusted momentum entropy (SEMM)

Customization Options:

• Entropy Length: 5-100 bars (default: 22)

• Average Length: 10-200 bars (default: 88)

• Sensitivity: 1.0-20.0 (default: 5.0, lower = more sensitive)

• SEMM Scaling: 5.0-100.0x (default: 30.0)

IMPORTANT NOTES

Risk Considerations:

• Indicator measures probabilities, not certainties

• High SEMM values (>0.5) suggest increased market randomness

• Extreme readings may persist longer than expected

• Always combine with proper risk management

Educational Purpose:

This indicator is designed for:

• Market structure analysis and education

• Understanding information theory applications in finance

• Developing probabilistic thinking about markets

• Research and analytical purposes

Performance Tips:

• Allow 200+ bars for proper initialization

• Adjust scaling and transparency for optimal visibility

• Use confluence signals for higher probability analysis

• Consider multiple timeframes for comprehensive analysis

DISCLAIMER

This indicator is for educational and analytical purposes. It does not constitute financial advice. Past performance does not guarantee future results. Always conduct your own research and consider your risk tolerance before making trading decisions.

Version: 5.0

Category: Oscillators, Volume, Market Structure

Best For: All timeframes, trending and ranging markets

Complexity: Intermediate to Advanced

Nota Keluaran

Information Theory Market AnalysisOverview:

This indicator calculates entropy-based measures using price and volume data to create oscillating signals. The calculations apply binary entropy formulas to ranked price movements and volume patterns, producing multiple oscillators that attempt to quantify randomness in market data.

Technical Components:

Primary Calculations:

Price Entropy: Binary entropy calculation applied to ranked price changes over a specified period

Volume Entropy: Binary entropy calculation applied to volume distribution patterns

Entropy MACD: Moving average convergence/divergence of the entropy calculations

SEMM (Stochastic Entropy Market Monitor): RSI-adjusted entropy measurement scaled for visualization

Mathematical Methodology:

Uses binary entropy formula: -[p×log₂(p) + (1-p)×log₂(1-p)]

Applies percentile ranking to price and volume data

Calculates probability distributions based on historical patterns

Normalizes results to create oscillating signals

Parameters:

Entropy Length: Number of bars used for entropy calculations (5-100, default: 22)

Average Length: Period for moving average smoothing (10-200, default: 88)

Sensitivity: Scaling factor for signal amplitude (1.0-20.0, default: 5.0)

SEMM Scaling: Multiplier for SEMM visualization (5.0-100.0x, default: 30.0)

Display Features:

Four oscillating lines representing different entropy measurements

Information table showing current values and calculated market states

Background highlighting based on signal confluence

Customizable scaling and visual elements

Market State Classifications:

The indicator categorizes market conditions based on SEMM values:

Strong Trending (< 0.1)

Weak Trending (0.1-0.2)

Neutral (0.2-0.3)

Moderate Random (0.3-0.5)

High Randomness (0.5-0.8)

Very Random (0.8-1.0)

Chaotic (>1.0)

Important Limitations:

Entropy calculations are based on historical data and provide no predictive capability

Binary entropy applied to financial data does not constitute comprehensive information theory analysis

Market state classifications are subjective interpretations of calculated values

High entropy readings do not necessarily indicate trading opportunities

All signals are lagging indicators derived from past price and volume data

Technical Considerations:

Requires significant historical data (200+ bars) for stable calculations

Entropy values are relative to the specified lookback period and sensitivity settings

Market state boundaries are arbitrary thresholds rather than mathematically derived levels

Signal confluence does not improve predictive accuracy

Critical Warnings:

This indicator does not predict future price movements or market behavior

Entropy measurements do not guarantee the identification of market structure changes

High or low entropy readings may persist for extended periods

Should not be used as a standalone trading system

Past signal performance provides no indication of future effectiveness

Educational Note:

While this indicator applies mathematical concepts from information theory, the financial market applications represent simplified implementations rather than comprehensive information-theoretic analysis. Users should understand the distinction between mathematical entropy calculations and their practical utility in market analysis.

Disclaimer:

This indicator is intended for educational and analytical purposes. It does not constitute financial advice or trading recommendations. All calculations are based on historical data and cannot predict future market movements.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.