OPEN-SOURCE SCRIPT

Telah dikemas kini [blackcat] L2 Ehlers Decycler Oscillator

Level: 2

Background

John F. Ehlers introuced Decycler Oscillator in his "Cycle Analytics for Traders" chapter 4 on 2004.

Function

A decycler oscillator is created by subtracting the output of a high-pass filter having a shorter cutoff period from the output of another high-pass filter having a longer cutoff period. This way, both elements have a zero in their transfer responses at zero frequency. Thus, the very, very long cycle components (and the static term) are removed. There is a finite difference between the output of the two filters in the frequency range between their cutoff periods, but shorter cycle components are still removed by cancellation. As a result, the trend line is displayed as an oscillator.

Key Signal

Decycler ---> Decycler Oscillator fast line

Trigger ---> Decycler Oscillator slow line

Pros and Cons

100% John F. Ehlers definition translation of original work, even variable names are the same. This help readers who would like to use pine to read his book. If you had read his works, then you will be quite familiar with my code style.

Remarks

The 37th script for Blackcat1402 John F. Ehlers Week publication.

Readme

In real life, I am a prolific inventor. I have successfully applied for more than 60 international and regional patents in the past 12 years. But in the past two years or so, I have tried to transfer my creativity to the development of trading strategies. Tradingview is the ideal platform for me. I am selecting and contributing some of the hundreds of scripts to publish in Tradingview community. Welcome everyone to interact with me to discuss these interesting pine scripts.

The scripts posted are categorized into 5 levels according to my efforts or manhours put into these works.

Level 1 : interesting script snippets or distinctive improvement from classic indicators or strategy. Level 1 scripts can usually appear in more complex indicators as a function module or element.

Level 2 : composite indicator/strategy. By selecting or combining several independent or dependent functions or sub indicators in proper way, the composite script exhibits a resonance phenomenon which can filter out noise or fake trading signal to enhance trading confidence level.

Level 3 : comprehensive indicator/strategy. They are simple trading systems based on my strategies. They are commonly containing several or all of entry signal, close signal, stop loss, take profit, re-entry, risk management, and position sizing techniques. Even some interesting fundamental and mass psychological aspects are incorporated.

Level 4 : script snippets or functions that do not disclose source code. Interesting element that can reveal market laws and work as raw material for indicators and strategies. If you find Level 1~2 scripts are helpful, Level 4 is a private version that took me far more efforts to develop.

Level 5 : indicator/strategy that do not disclose source code. private version of Level 3 script with my accumulated script processing skills or a large number of custom functions. I had a private function library built in past two years. Level 5 scripts use many of them to achieve private trading strategy.

Background

John F. Ehlers introuced Decycler Oscillator in his "Cycle Analytics for Traders" chapter 4 on 2004.

Function

A decycler oscillator is created by subtracting the output of a high-pass filter having a shorter cutoff period from the output of another high-pass filter having a longer cutoff period. This way, both elements have a zero in their transfer responses at zero frequency. Thus, the very, very long cycle components (and the static term) are removed. There is a finite difference between the output of the two filters in the frequency range between their cutoff periods, but shorter cycle components are still removed by cancellation. As a result, the trend line is displayed as an oscillator.

Key Signal

Decycler ---> Decycler Oscillator fast line

Trigger ---> Decycler Oscillator slow line

Pros and Cons

100% John F. Ehlers definition translation of original work, even variable names are the same. This help readers who would like to use pine to read his book. If you had read his works, then you will be quite familiar with my code style.

Remarks

The 37th script for Blackcat1402 John F. Ehlers Week publication.

Readme

In real life, I am a prolific inventor. I have successfully applied for more than 60 international and regional patents in the past 12 years. But in the past two years or so, I have tried to transfer my creativity to the development of trading strategies. Tradingview is the ideal platform for me. I am selecting and contributing some of the hundreds of scripts to publish in Tradingview community. Welcome everyone to interact with me to discuss these interesting pine scripts.

The scripts posted are categorized into 5 levels according to my efforts or manhours put into these works.

Level 1 : interesting script snippets or distinctive improvement from classic indicators or strategy. Level 1 scripts can usually appear in more complex indicators as a function module or element.

Level 2 : composite indicator/strategy. By selecting or combining several independent or dependent functions or sub indicators in proper way, the composite script exhibits a resonance phenomenon which can filter out noise or fake trading signal to enhance trading confidence level.

Level 3 : comprehensive indicator/strategy. They are simple trading systems based on my strategies. They are commonly containing several or all of entry signal, close signal, stop loss, take profit, re-entry, risk management, and position sizing techniques. Even some interesting fundamental and mass psychological aspects are incorporated.

Level 4 : script snippets or functions that do not disclose source code. Interesting element that can reveal market laws and work as raw material for indicators and strategies. If you find Level 1~2 scripts are helpful, Level 4 is a private version that took me far more efforts to develop.

Level 5 : indicator/strategy that do not disclose source code. private version of Level 3 script with my accumulated script processing skills or a large number of custom functions. I had a private function library built in past two years. Level 5 scripts use many of them to achieve private trading strategy.

Nota Keluaran

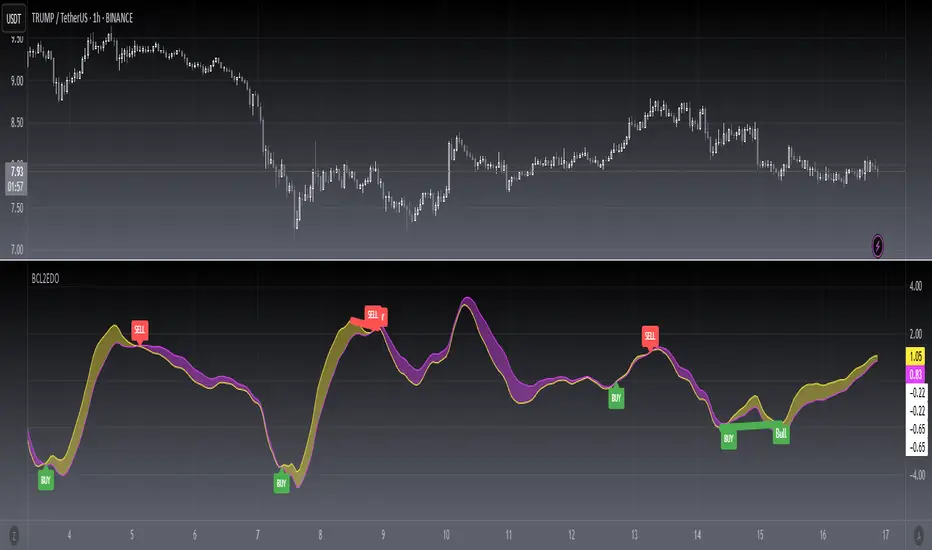

OVERVIEW The L2 Ehlers Decycler Oscillator is an advanced technical indicator that combines the Ehlers Decycler method with divergence detection to identify potential trading opportunities. It features customizable parameters and visual alerts for both bullish and bearish divergences.FEATURES

• Dual high-pass filter decycler oscillator

• Customizable period settings (High Pass Period 1 & 2)

• Visual buy/sell signals with colored labels

• Divergence detection for four types:

Regular Bullish

Hidden Bullish

Regular Bearish

Hidden Bearish • Alert conditions for all divergence types • Configurable lookback periods and range settings

HOW TO USE

Adjust the High Pass Period inputs to fine-tune sensitivity

Configure divergence detection parameters: • Pivot Lookback Right/Left • Max/Min Lookback Range • Plot options for each divergence type

Monitor the oscillator line and trigger line for crossovers

Watch for labeled signals (BUY/SELL) at crossover points

Use divergence alerts to confirm trading opportunities

LIMITATIONS

• Results depend on proper parameter configuration

• False signals may occur during trending markets

• Best used in conjunction with other analysis tools

NOTES

• The indicator overlays the main chart by default

• Color coding helps distinguish between bullish (green) and bearish (red) signals

• Alerts can be customized through TradingView's alert system

Nota Keluaran

OVERVIEW This indicator implements the Ehlers Decycler Oscillator using a Layer 2 approach, featuring dual oscillators with customizable parameters. It provides trading signals through crossover events and identifies divergences between price and oscillator movements.FEATURES

• Dual-decycler oscillator system with adjustable periods and sensitivity factors

• Buy/Sell signals based on fast and slow oscillator crossovers

• Divergence detection including regular and hidden bullish/bearish patterns

• Customizable alert conditions for all trading signals

• Visual representation with colored fills between oscillators

HOW TO USE

Adjust the following inputs:

Fast_HPPeriod: Period for fast oscillator (default: 100)

Slow_HPPeriod: Period for slow oscillator (default: 125)

Fast_K & Slow_K: Sensitivity multipliers (default: 1.2)

Divergence lookback settings (Pivot Lookback Right/Left, Range Upper/Lower)

Monitor the following signals:

• Green/Buy signal: Fast oscillator crosses above slow oscillator

• Red/Sell signal: Fast oscillator crosses below slow oscillator

• Divergence signals: Bullish/Bearish patterns indicated by colored labels

LIMITATIONS

• Requires sufficient historical data for accurate calculations

• May generate false signals during choppy market conditions

• Performance depends on parameter tuning for specific markets/timeframes

NOTES

• Color coding:

Yellow: Fast oscillator line

Fuchsia: Slow oscillator line

Green: Bullish signals

Red: Bearish signals

• Alert conditions are included for all trading signals

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.