OPEN-SOURCE SCRIPT

Telah dikemas kini Triple EMA Crossover Strategy

Triple EMA Crossover Strategy

Overview

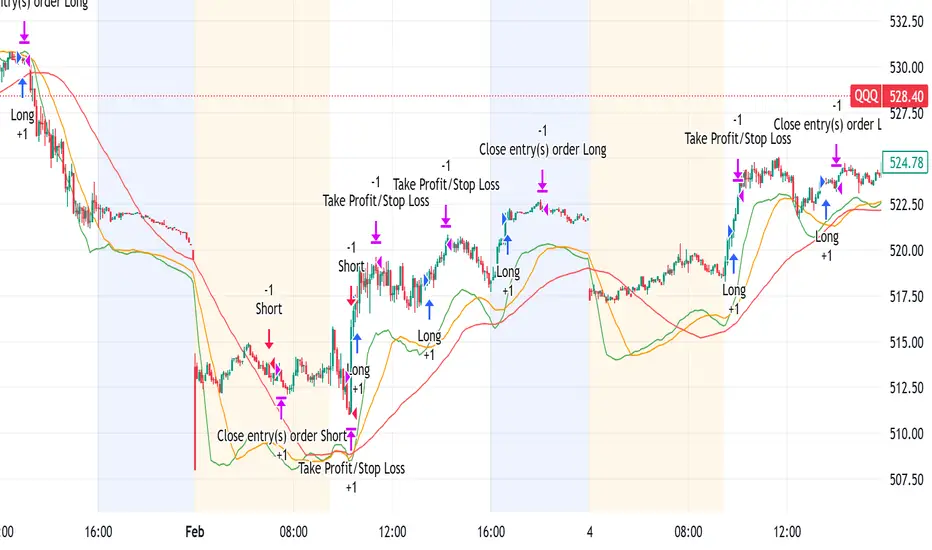

The Triple EMA Crossover Strategy is a trend-following trading system that utilizes three Exponential Moving Averages (EMAs) to identify potential entry and exit points in the market. This strategy is based on the principle that when shorter-term prices cross above longer-term prices, it can indicate a bullish trend, and conversely when they cross below, it can signal a bearish trend.

Components

Exponential Moving Averages (EMAs):

Short EMA: A fast-moving average that reacts quickly to price changes (commonly set to 9 periods).

Medium EMA: A medium-term average that smooths out price data and helps confirm trends (commonly set to 21 periods).

Long EMA: A slow-moving average that helps identify the overall trend direction (commonly set to 55 periods).

Trading Signals:

Buy Signal: A long entry is triggered when:

The Short EMA (9) crosses above the Medium EMA (21).

The Medium EMA (21) is above the Long EMA (55).

Sell Signal: A short entry is signaled when:

The Short EMA (9) crosses below the Medium EMA (21).

The Medium EMA (21) is below the Long EMA (55).

Stop Loss and Take Profit:

Stop Loss: Implement a predefined percentage or ATR-based stop loss to limit potential losses.

Take Profit: Set a target based on a risk-to-reward ratio that reflects your trading strategy's goals.

Advantages

Trend Identification: The EMA crossover system allows traders to identify the current trend dynamically, focusing on upward or downward price movements.

Simplicity: The strategy is straightforward, making it accessible for both new and experienced traders.

Flexibility: This method can be applied across multiple timeframes and asset classes, making it versatile for various trading styles.

Disadvantages

Lagging Indicator: Moving averages are lagging indicators, meaning signals may come later than the actual price movement, which can lead to missed opportunities.

Whipsaw Effect: In ranging markets, the strategy may produce false signals leading to potential losses.

Overview

The Triple EMA Crossover Strategy is a trend-following trading system that utilizes three Exponential Moving Averages (EMAs) to identify potential entry and exit points in the market. This strategy is based on the principle that when shorter-term prices cross above longer-term prices, it can indicate a bullish trend, and conversely when they cross below, it can signal a bearish trend.

Components

Exponential Moving Averages (EMAs):

Short EMA: A fast-moving average that reacts quickly to price changes (commonly set to 9 periods).

Medium EMA: A medium-term average that smooths out price data and helps confirm trends (commonly set to 21 periods).

Long EMA: A slow-moving average that helps identify the overall trend direction (commonly set to 55 periods).

Trading Signals:

Buy Signal: A long entry is triggered when:

The Short EMA (9) crosses above the Medium EMA (21).

The Medium EMA (21) is above the Long EMA (55).

Sell Signal: A short entry is signaled when:

The Short EMA (9) crosses below the Medium EMA (21).

The Medium EMA (21) is below the Long EMA (55).

Stop Loss and Take Profit:

Stop Loss: Implement a predefined percentage or ATR-based stop loss to limit potential losses.

Take Profit: Set a target based on a risk-to-reward ratio that reflects your trading strategy's goals.

Advantages

Trend Identification: The EMA crossover system allows traders to identify the current trend dynamically, focusing on upward or downward price movements.

Simplicity: The strategy is straightforward, making it accessible for both new and experienced traders.

Flexibility: This method can be applied across multiple timeframes and asset classes, making it versatile for various trading styles.

Disadvantages

Lagging Indicator: Moving averages are lagging indicators, meaning signals may come later than the actual price movement, which can lead to missed opportunities.

Whipsaw Effect: In ranging markets, the strategy may produce false signals leading to potential losses.

Nota Keluaran

The Triple EMA Crossover Strategy is a trend-following indicator designed to identify high-probability trade opportunities by leveraging three Exponential Moving Averages (EMAs) of different periods. This strategy aims to capture momentum in trending markets while filtering out false signals in choppy conditions.Key Features:

✅ Three EMAs for Trend Confirmation – Uses short-, medium-, and long-term EMAs to identify strong uptrends and downtrends.

✅ ADX Filter for Trend Strength – Avoids trades in weak or ranging markets by ensuring trend strength meets a predefined threshold.

✅ Automatic Trade Execution – Includes built-in long and short entries with stop-loss and take-profit levels.

✅ Visual Aids – Plots EMAs, ADX, and trend-based bar coloring to make trend recognition intuitive.

How It Works:

A bullish signal occurs when the shortest EMA crosses above the medium EMA while both remain above the longest EMA, with ADX confirming a strong trend.

A bearish signal occurs when the shortest EMA crosses below the medium EMA while both remain below the longest EMA, with ADX confirming downward momentum.

The strategy implements a dynamic stop-loss and take-profit system based on tick values to manage risk effectively.

This indicator is ideal for traders looking to capitalize on strong trends while minimizing exposure to weak, sideways markets. Perfect for swing traders and intraday traders alike! 🚀

Let me know if you’d like any modifications! 📈

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.