OPEN-SOURCE SCRIPT

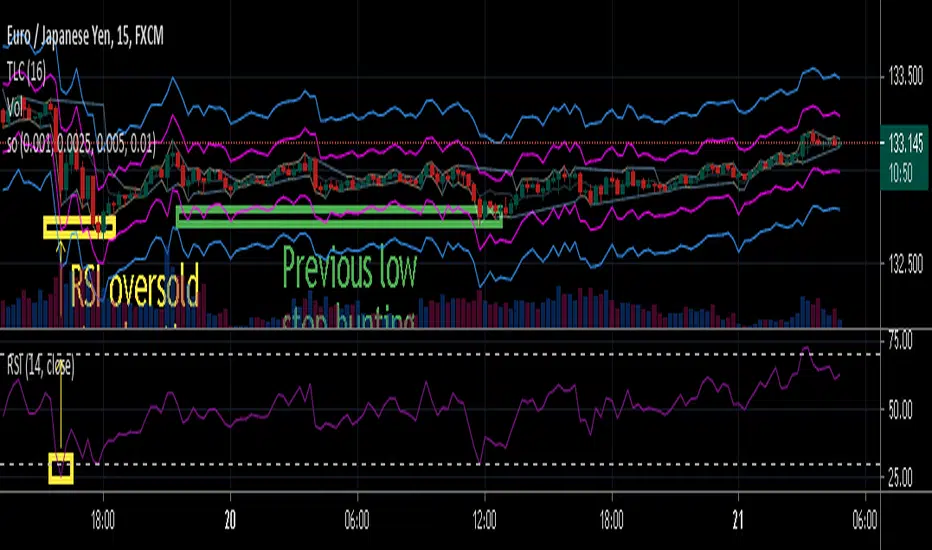

stop out or margin call price levels

Abstract

This script finds the potential stop out or margin call price levels without considering timeframe.

This script computes stop out or margin call price levels that over leveraged positions buy cheap enough.

You can use this indicator to follow stop hunters.

Introduction

Stop hunting exists because of benefit conflict.

When most of retails traders are in the correct direction, big banks do not want to buy more expensive then retail traders.

Therefore, Big banks create sell pressure to make retail traders misunderstand their trade decisions are wrong.

When retail traders decide to cut loss, it is time big banks buy cheaper.

Many courses recommend average true range as a stop loss reference.

However, in different timeframe, average true ranges are different.

Therefore, we need to have a method to measure potential stop hunting levels which is not relative to timeframe.

There is a method because there are observable levels where over leveraged positions must cut loss.

For example, for a 100 leverage position, its margin call level is 0.005, so 0.005 drawdown is a potential stop hunting level.

Computing

For buy

potential stop out or margin call price level = low * ( 1 - ratio )

For sell

potential stop out or margin call price level = high * ( 1 + ratio )

Parameters

There are 4 levels available for adjusting.

The default values are :

(1) 0.001 : 500 leverage , 50% margin call

(2) 0.0025 : 200 leverage , 50% margin call

(3) 0.005 : 100 leverage , 50% margin call

(4) 0.010 : 50 leverage , 50% margin call

Usage

(1) Find an oversold price level. If you don't want to use an another indicator, you can use previous low.

(2) Memorize their stop out or margin call price levels of that level.

(2) Consider buy near those levels.

(3) If there are quick price rejection near those levels, better entry opportunities.

(4) Take profit and stop loss : you decide.

Conclusion

This script can find potential stop out or margin call price levels that over leveraged positions buy cheap enough.

If you are bored, you can consider find 100 signals you are interested in and share your observation.

Reference

Brokers, leverage and margin call threshold

This script finds the potential stop out or margin call price levels without considering timeframe.

This script computes stop out or margin call price levels that over leveraged positions buy cheap enough.

You can use this indicator to follow stop hunters.

Introduction

Stop hunting exists because of benefit conflict.

When most of retails traders are in the correct direction, big banks do not want to buy more expensive then retail traders.

Therefore, Big banks create sell pressure to make retail traders misunderstand their trade decisions are wrong.

When retail traders decide to cut loss, it is time big banks buy cheaper.

Many courses recommend average true range as a stop loss reference.

However, in different timeframe, average true ranges are different.

Therefore, we need to have a method to measure potential stop hunting levels which is not relative to timeframe.

There is a method because there are observable levels where over leveraged positions must cut loss.

For example, for a 100 leverage position, its margin call level is 0.005, so 0.005 drawdown is a potential stop hunting level.

Computing

For buy

potential stop out or margin call price level = low * ( 1 - ratio )

For sell

potential stop out or margin call price level = high * ( 1 + ratio )

Parameters

There are 4 levels available for adjusting.

The default values are :

(1) 0.001 : 500 leverage , 50% margin call

(2) 0.0025 : 200 leverage , 50% margin call

(3) 0.005 : 100 leverage , 50% margin call

(4) 0.010 : 50 leverage , 50% margin call

Usage

(1) Find an oversold price level. If you don't want to use an another indicator, you can use previous low.

(2) Memorize their stop out or margin call price levels of that level.

(2) Consider buy near those levels.

(3) If there are quick price rejection near those levels, better entry opportunities.

(4) Take profit and stop loss : you decide.

Conclusion

This script can find potential stop out or margin call price levels that over leveraged positions buy cheap enough.

If you are bored, you can consider find 100 signals you are interested in and share your observation.

Reference

Brokers, leverage and margin call threshold

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.