OPEN-SOURCE SCRIPT

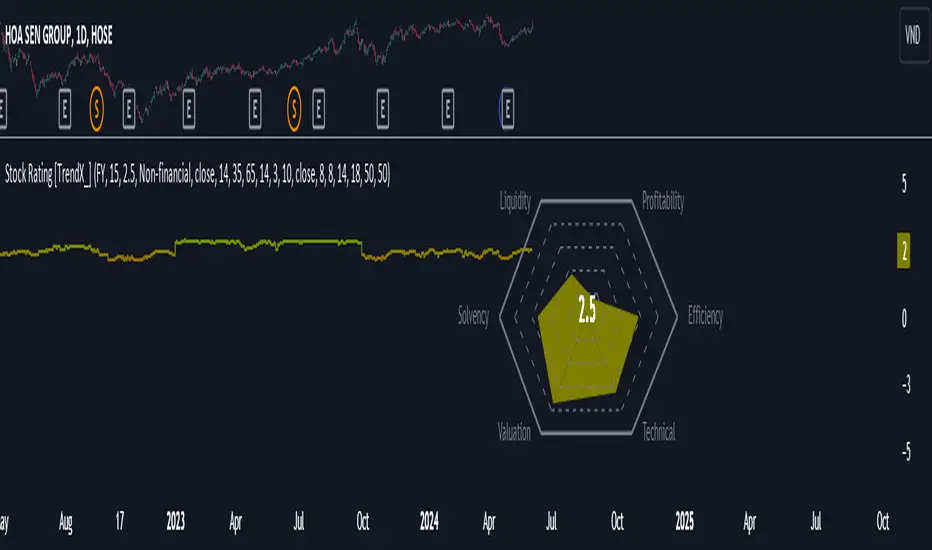

Stock Rating [TrendX_]

# OVERVIEW

This Stock Rating [TrendX_] indicator provides a thorough evaluation of a company (NON-FINANCIAL ONLY) ranging from 0 to 5. The rating is the average of six core financial metrics: efficiency, profitability, liquidity, solvency, valuation, and technical ratings. Each metric encompasses several financial measurements to ensure a robust and holistic evaluation of the stock.

## EFFICIENCY METRICS

1. Asset-to-Liability Ratio : Measures a company's ability to cover its liabilities with its assets.

2. Equity-to-Liability Ratio : Indicates the proportion of equity used to finance the company relative to liabilities.

3. Net Margin : Shows the percentage of revenue that translates into profit.

4. Operating Expense : Reflects the costs required for normal business operations.

5. Operating Expense Ratio : Compares operating expenses to total revenue.

6. Operating Profit Ratio : Measures operating profit as a percentage of revenue.

7. PE to Industry Relative PE/PB : Compares the company's PE ratio to the industry average.

## PROFITABILITY METRICS

1. ROA : Indicates how efficiently a company uses its assets to generate profit.

2. ROE : Measures profitability relative to shareholders' equity.

3. EBITDA : Reflects a company's operational profitability.

4. Free Cash Flow Margin : Shows the percentage of revenue that remains as free cash flow.

5. Revenue Growth : Measures the percentage increase in revenue over a period.

6. Gross Margin : Reflects the percentage of revenue exceeding the cost of goods sold.

7. Net Margin : Percentage of revenue that is net profit.

8. Operating Margin : Measures the percentage of revenue that is operating profit.

## LIQUIDITY METRICS

1. Current Ratio : Indicates the ability to cover short-term obligations with short-term assets.

2. Interest Coverage Ratio : Measures the ability to pay interest on outstanding debt.

3. Debt-to-EBITDA : Compares total debt to EBITDA.

4. Debt-to-Equity Ratio : Indicates the relative proportion of debt and equity financing.

## SOLVENCY METRICS

1. Altman Z-score : Predicts bankruptcy risk

2. Beneish M-score : Detects earnings manipulation.

3. Fulmer H-factor : Predicts business failure risk.

## VALUATION METRICS

1. Industry Relative PE/PB Comparison : Compares the company's PE and PB ratios to industry averages.

2. Momentum of PE, PB, and EV/EBITDA Multiples : Tracks the trends of PE, PB, and EV/EBITDA ratios over time.

## TECHNICAL METRICS

1. Relative Strength Index (RSI) : Measures the speed and change of price movements.

2. Supertrend : Trend-following indicator that identifies market trends.

3. Moving Average Golden-Cross : Occurs when a short-term MA crosses above mid-term and long-term MA which are determined by half-PI increment in smoothing period.

4. On-Balance Volume Golden-Cross : Measures cumulative buying and selling pressure.

This Stock Rating [TrendX_] indicator provides a thorough evaluation of a company (NON-FINANCIAL ONLY) ranging from 0 to 5. The rating is the average of six core financial metrics: efficiency, profitability, liquidity, solvency, valuation, and technical ratings. Each metric encompasses several financial measurements to ensure a robust and holistic evaluation of the stock.

## EFFICIENCY METRICS

1. Asset-to-Liability Ratio : Measures a company's ability to cover its liabilities with its assets.

2. Equity-to-Liability Ratio : Indicates the proportion of equity used to finance the company relative to liabilities.

3. Net Margin : Shows the percentage of revenue that translates into profit.

4. Operating Expense : Reflects the costs required for normal business operations.

5. Operating Expense Ratio : Compares operating expenses to total revenue.

6. Operating Profit Ratio : Measures operating profit as a percentage of revenue.

7. PE to Industry Relative PE/PB : Compares the company's PE ratio to the industry average.

## PROFITABILITY METRICS

1. ROA : Indicates how efficiently a company uses its assets to generate profit.

2. ROE : Measures profitability relative to shareholders' equity.

3. EBITDA : Reflects a company's operational profitability.

4. Free Cash Flow Margin : Shows the percentage of revenue that remains as free cash flow.

5. Revenue Growth : Measures the percentage increase in revenue over a period.

6. Gross Margin : Reflects the percentage of revenue exceeding the cost of goods sold.

7. Net Margin : Percentage of revenue that is net profit.

8. Operating Margin : Measures the percentage of revenue that is operating profit.

## LIQUIDITY METRICS

1. Current Ratio : Indicates the ability to cover short-term obligations with short-term assets.

2. Interest Coverage Ratio : Measures the ability to pay interest on outstanding debt.

3. Debt-to-EBITDA : Compares total debt to EBITDA.

4. Debt-to-Equity Ratio : Indicates the relative proportion of debt and equity financing.

## SOLVENCY METRICS

1. Altman Z-score : Predicts bankruptcy risk

2. Beneish M-score : Detects earnings manipulation.

3. Fulmer H-factor : Predicts business failure risk.

## VALUATION METRICS

1. Industry Relative PE/PB Comparison : Compares the company's PE and PB ratios to industry averages.

2. Momentum of PE, PB, and EV/EBITDA Multiples : Tracks the trends of PE, PB, and EV/EBITDA ratios over time.

## TECHNICAL METRICS

1. Relative Strength Index (RSI) : Measures the speed and change of price movements.

2. Supertrend : Trend-following indicator that identifies market trends.

3. Moving Average Golden-Cross : Occurs when a short-term MA crosses above mid-term and long-term MA which are determined by half-PI increment in smoothing period.

4. On-Balance Volume Golden-Cross : Measures cumulative buying and selling pressure.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.