OPEN-SOURCE SCRIPT

Telah dikemas kini Index Reversal Range with Volatility Index or VIX

What is the Indicator?

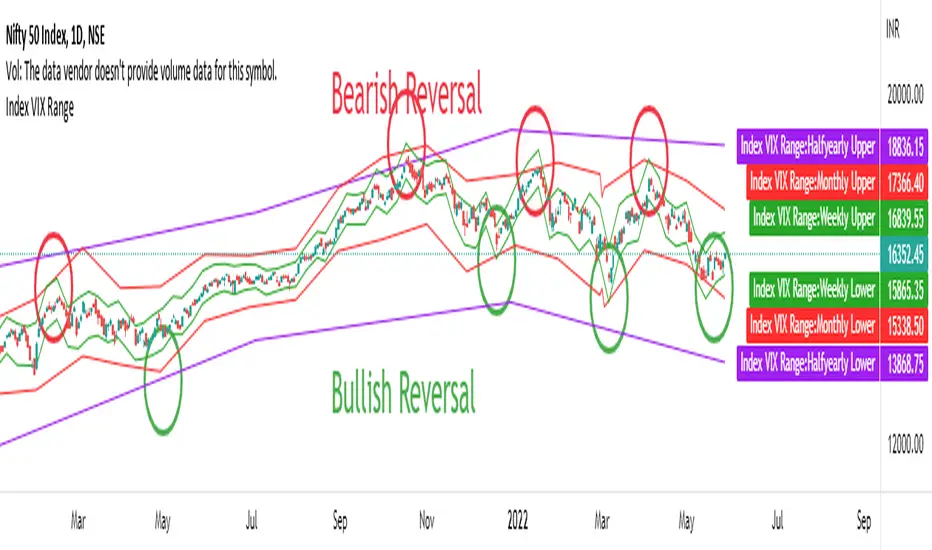

• The indicator is a visualization of maximum price in which the respective index can go up to in comparison with it's Volatility Index or VIX.

Who to use?

• Intraday

• Swing

• Position

• Long term Investors

• Futures

• Options

• Portfolio Managers

• Mutual Fund Managers

• Index Traders

• Volatility based Traders

• Long term Investors and Options Traders gets the maximum benefit

What timeframe to use?

• 1 Year: Position & Investors

• 6 Months: Position & Investors

• 3 Months: Swing & Position

• 1 Month: Swing & Position

• 1 Week: Swing

• 1 Day: Swing

• 1 Hour: Intraday & Swing

What are Upper and Lower lines?

• Upper Line: If the index price reach closer to the Upper line there is a high chance of reversal to Bearish trend.

• Lower Line: If the index price reach closer to the Lower line there is a high chance of reversal to Bullish trend.

• This need to be confirmed with multiple levels like Daily, Weekly, Monthly etc.

How to use?

• If the price reach closer to that level there is a high chance of reversal from the current trend.

• To identify the reversal zone of the index.

• To identify the trend.

• Option Traders can Sell a Call or Put Option from that level.

• Long term Investors, Position or Swing traders can plan for a Long entry.

• Intraday traders can use lower timeframes to do the same.

Indicator Menu

• Input VIX: Identify the VIX Symbol of your Index and type it in the box.

• For example for NIFTY Index chart type INDIAVIX in the box.

• Choose multiple timeframes according to your convenience.

How to turn on indicator Name and Value labels?

• Right side of the screen >

• Right click on the Price scale >

• Labels > Indicators and financial name labels, Indicators and financial value labels

Further Reading:

• Various videos and reading materials are available about this method.

• The indicator is a visualization of maximum price in which the respective index can go up to in comparison with it's Volatility Index or VIX.

Who to use?

• Intraday

• Swing

• Position

• Long term Investors

• Futures

• Options

• Portfolio Managers

• Mutual Fund Managers

• Index Traders

• Volatility based Traders

• Long term Investors and Options Traders gets the maximum benefit

What timeframe to use?

• 1 Year: Position & Investors

• 6 Months: Position & Investors

• 3 Months: Swing & Position

• 1 Month: Swing & Position

• 1 Week: Swing

• 1 Day: Swing

• 1 Hour: Intraday & Swing

What are Upper and Lower lines?

• Upper Line: If the index price reach closer to the Upper line there is a high chance of reversal to Bearish trend.

• Lower Line: If the index price reach closer to the Lower line there is a high chance of reversal to Bullish trend.

• This need to be confirmed with multiple levels like Daily, Weekly, Monthly etc.

How to use?

• If the price reach closer to that level there is a high chance of reversal from the current trend.

• To identify the reversal zone of the index.

• To identify the trend.

• Option Traders can Sell a Call or Put Option from that level.

• Long term Investors, Position or Swing traders can plan for a Long entry.

• Intraday traders can use lower timeframes to do the same.

Indicator Menu

• Input VIX: Identify the VIX Symbol of your Index and type it in the box.

• For example for NIFTY Index chart type INDIAVIX in the box.

• Choose multiple timeframes according to your convenience.

How to turn on indicator Name and Value labels?

• Right side of the screen >

• Right click on the Price scale >

• Labels > Indicators and financial name labels, Indicators and financial value labels

Further Reading:

• Various videos and reading materials are available about this method.

Nota Keluaran

Updated on 29 May 2022- Added dots between lines.

Nota Keluaran

Updated on 31 May 2022- Updated with current Volatility levels as Lines and Labels.

- The number in % is the Volatility Percentage which appear at the end of each label.

- Removed the dots on lines as it looks clustered.

Nota Keluaran

Updated on 10 June 2022- Added timeframes 30, 5 and 1 minutes.

Note: The gap between lines is the limitation of script. Draw a line manually to fill that for now.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.