PROTECTED SOURCE SCRIPT

Telah dikemas kini Rejection Blocks [Taking Prophets]

🧠 Indicator Purpose:

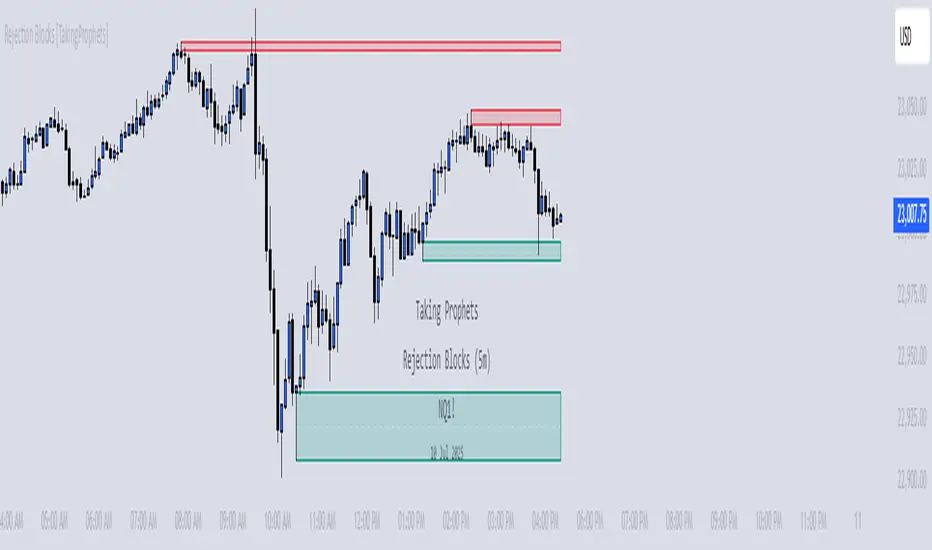

The "Rejection Blocks" indicator is built for traders using Inner Circle Trader (ICT) concepts. It identifies key reversal zones where price action shows strong rejection through wick-dominant behavior around major swing points — often signaling institutional activity. Traders can use these rejection blocks to anticipate future support, resistance, and mitigation zones based on ICT principles.

🌟 What Makes This Indicator Unique:

Unlike standard support/resistance indicators, this script detects true rejection points by filtering only candles where the wick is significantly larger than the body, confirming potential order flow shifts according to ICT methodology.

It not only marks these zones but also:

Dynamically extends the blocks into the future.

Deletes blocks that get invalidated (mitigation logic).

Optionally plots a 50% midline within each block to refine entry or exit precision.

⚙️ How the Indicator Works:

Swing Detection: Identifies significant highs and lows based on pivot structures.

Rejection Filtering: Confirms strong rejections with wick-to-body ratio validation.

Block Creation: Highlights bullish or bearish rejection zones with customizable visuals.

Midline Plotting: (Optional) Marks the 50% midpoint of the block for entry targeting.

Mitigation and Cleanup: Blocks are deleted automatically when their structure is invalidated, maintaining a clean and accurate chart view.

🎯 How to Use It:

Identify Reaction Zones: Use rejection blocks as potential areas for price reversals or consolidations.

Plan Trade Entries: Monitor retests of the block boundaries or 50% lines for precision entries.

Manage Risk: If price closes beyond the block, treat it as a potential invalidation or Change in State of Delivery (CISD) event.

Best Contexts:

Near higher timeframe Points of Interest (POIs) such as Order Blocks or Fair Value Gaps.

During ICT Killzones (London Open, New York AM).

🔎 Underlying Concepts:

Wick Rejections: Indicate strong liquidity rejection, aligning with ICT liquidity sweep theories.

Mitigation Behavior: Blocks often serve as revisit zones where price rebalances after an aggressive move.

Adaptive Market Behavior: Rejection Blocks adjust dynamically based on real-time price action according to ICT market structure logic.

🎨 Customization Options:

Bullish and Bearish block colors with adjustable opacity.

Border visibility, border width, and 50% midline display toggles.

Label size customization for optimal chart clarity.

✅ Recommended for:

Traders following Inner Circle Trader (ICT) concepts.

Scalpers, intraday, and swing traders seeking accurate reversal and mitigation zones.

Traders looking to improve precision around liquidity rejection events.

The "Rejection Blocks" indicator is built for traders using Inner Circle Trader (ICT) concepts. It identifies key reversal zones where price action shows strong rejection through wick-dominant behavior around major swing points — often signaling institutional activity. Traders can use these rejection blocks to anticipate future support, resistance, and mitigation zones based on ICT principles.

🌟 What Makes This Indicator Unique:

Unlike standard support/resistance indicators, this script detects true rejection points by filtering only candles where the wick is significantly larger than the body, confirming potential order flow shifts according to ICT methodology.

It not only marks these zones but also:

Dynamically extends the blocks into the future.

Deletes blocks that get invalidated (mitigation logic).

Optionally plots a 50% midline within each block to refine entry or exit precision.

⚙️ How the Indicator Works:

Swing Detection: Identifies significant highs and lows based on pivot structures.

Rejection Filtering: Confirms strong rejections with wick-to-body ratio validation.

Block Creation: Highlights bullish or bearish rejection zones with customizable visuals.

Midline Plotting: (Optional) Marks the 50% midpoint of the block for entry targeting.

Mitigation and Cleanup: Blocks are deleted automatically when their structure is invalidated, maintaining a clean and accurate chart view.

🎯 How to Use It:

Identify Reaction Zones: Use rejection blocks as potential areas for price reversals or consolidations.

Plan Trade Entries: Monitor retests of the block boundaries or 50% lines for precision entries.

Manage Risk: If price closes beyond the block, treat it as a potential invalidation or Change in State of Delivery (CISD) event.

Best Contexts:

Near higher timeframe Points of Interest (POIs) such as Order Blocks or Fair Value Gaps.

During ICT Killzones (London Open, New York AM).

🔎 Underlying Concepts:

Wick Rejections: Indicate strong liquidity rejection, aligning with ICT liquidity sweep theories.

Mitigation Behavior: Blocks often serve as revisit zones where price rebalances after an aggressive move.

Adaptive Market Behavior: Rejection Blocks adjust dynamically based on real-time price action according to ICT market structure logic.

🎨 Customization Options:

Bullish and Bearish block colors with adjustable opacity.

Border visibility, border width, and 50% midline display toggles.

Label size customization for optimal chart clarity.

✅ Recommended for:

Traders following Inner Circle Trader (ICT) concepts.

Scalpers, intraday, and swing traders seeking accurate reversal and mitigation zones.

Traders looking to improve precision around liquidity rejection events.

Nota Keluaran

-Minor bug fixNota Keluaran

Added info box and option to change the swing strengthNota Keluaran

-Updated detection logic to identify higher probability rejections -Added alert functionality

-Minor aesthetic changes

Nota Keluaran

- Added back swing strength setting :)Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.