Flow State Model [TakingProphets]

The "Flow State Model" by Taking Prophets is a precision-built trading framework based on the Inner Circle Trader (ICT) methodology. This script implements and automates the Flow State Model, a highly effective multi-timeframe trading system created and popularized by ITS Johnny.

It is designed to help traders systematically align higher timeframe liquidity draws with lower timeframe confirmation patterns, offering a clear roadmap for catching institutional moves with high confidence.

🌟 What Makes This Indicator Unique:

This is not a simple liquidity indicator or a basic FVG plotter. The Flow State Model executes a full multi-step process:

Higher Timeframe PD Array Detection: Automatically identifies and displays Fair Value Gaps (FVGs) from Daily, Weekly, and Monthly timeframes.

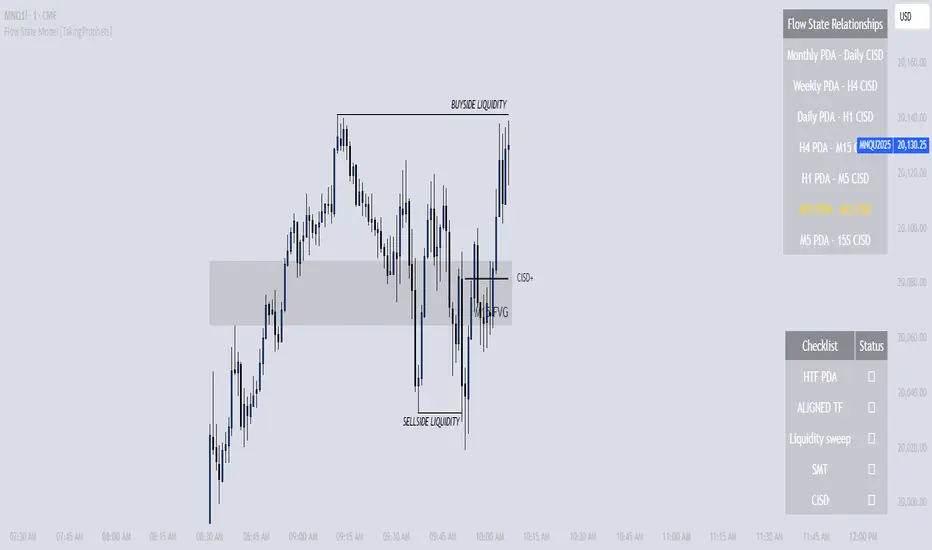

Liquidity Sweep Monitoring: Tracks swing highs and lows to detect Buyside or Sellside Liquidity sweeps into the HTF PD Arrays.

CISD Detection: Waits for a Change in State of Delivery (CISD) by monitoring bullish or bearish displacement after a sweep.

Full Trade Checklist: Visual checklist ensures all critical conditions are met before signaling a completed Flow State setup.

Sensitivity Control: Adapt detection strictness (High, Medium, Low) based on market volatility.

⚙️ How the Indicator Works (Detailed):

Fair Value Gap Mapping:

The indicator constantly scans higher timeframes (4H, Daily, Weekly) for valid bullish or bearish Fair Value Gaps that are large enough (based on ATR multiples) and not weekend gaps.

These FVGs are displayed on the current timeframe with full extension logic and mitigation handling (clearing when invalidated).

Liquidity Sweep Detection:

Swing highs and lows are identified using pivot logic (3-bar pivots). When price sweeps beyond a recent liquidity point into an active FVG, it flags the potential for a Flow State setup.

Change in State of Delivery (CISD) Confirmation:

After a sweep, the script monitors price action for a sequence of bullish or bearish candles followed by displacement (break in delivery).

Only after displacement closes beyond the initiating sequence does a CISD level plot, confirming the market's new delivery state.

Execution Checklist:

An optional table tracks whether critical components are present:

Higher Timeframe PD Array.

Aligned Timeframe Bias.

Liquidity Sweep into FVG.

SMT Divergence (optional manual confirmation).

CISD Confirmation.

Dynamic Management:

Active gaps are extended automatically.

Cleared gaps and mitigated CISDs are deleted to keep charts clean.

Distance-to-FVG prioritization keeps only the nearest active setups visible.

🎯 How to Use It:

Step 1: Identify the bias by locating active higher timeframe FVGs.

Step 2: Wait for a Liquidity Sweep into a PD Array (active FVG).

Step 3: Watch for a CISD event (the Flow State confirmation).

Step 4: Once all conditions are checked off, execute trades based on retracements to CISD levels or continuation after displacement.

Best Timing:

During ICT Killzones: London Open, New York AM.

After daily or weekly liquidity events.

🔎 Underlying Concepts:

Liquidity Theory: Markets seek to engineer liquidity for real institutional entries.

Fair Value Gaps: Imbalances where price is expected to react or rebalance.

Change in State of Delivery (CISD): Confirmation that the market's delivery mechanism has shifted, validating bias continuation.

Flow State Principle: Seamlessly aligning higher timeframe liquidity draws with lower timeframe confirmation to maximize trade probability.

🎨 Customization Options:

Adjust sensitivity (High / Medium / Low) for volatile or calm conditions.

Customize FVG visibility, CISD display, labels, line colors, and sizing.

Set checklist visibility and manual tracking of SMT or aligned bias.

✅ Recommended for:

Traders studying Inner Circle Trader (ICT) models.

Intraday scalpers and swing traders seeking confluence-driven setups.

Traders looking for a structured, checklist-based execution process.

Skrip jemputan sahaja

Hanya pengguna disahkan oleh penulis boleh mengakses skrip ini. Anda perlu memohon dan mendapatkan kebenaran untuk menggunakannya. Keizinan selalunya diberikan selepas pembayaran. Untuk lebih butiran, ikuti arahan penulis di bawah atau hubungi TakingProphets secara terus.

TradingView TIDAK menyarankan pembayaran atau penggunaan skrip kecuali anda mempercayai sepenuhnya penulis dan memahami bagaimana ia berfungsi. Anda juga boleh menjumpai alternatif sumber terbuka dan percuma yang lain di dalam skrip komuniti kami.

Arahan penulis

Penafian

Skrip jemputan sahaja

Hanya pengguna disahkan oleh penulis boleh mengakses skrip ini. Anda perlu memohon dan mendapatkan kebenaran untuk menggunakannya. Keizinan selalunya diberikan selepas pembayaran. Untuk lebih butiran, ikuti arahan penulis di bawah atau hubungi TakingProphets secara terus.

TradingView TIDAK menyarankan pembayaran atau penggunaan skrip kecuali anda mempercayai sepenuhnya penulis dan memahami bagaimana ia berfungsi. Anda juga boleh menjumpai alternatif sumber terbuka dan percuma yang lain di dalam skrip komuniti kami.