PROTECTED SOURCE SCRIPT

ICT Venom Model - Milana Trades

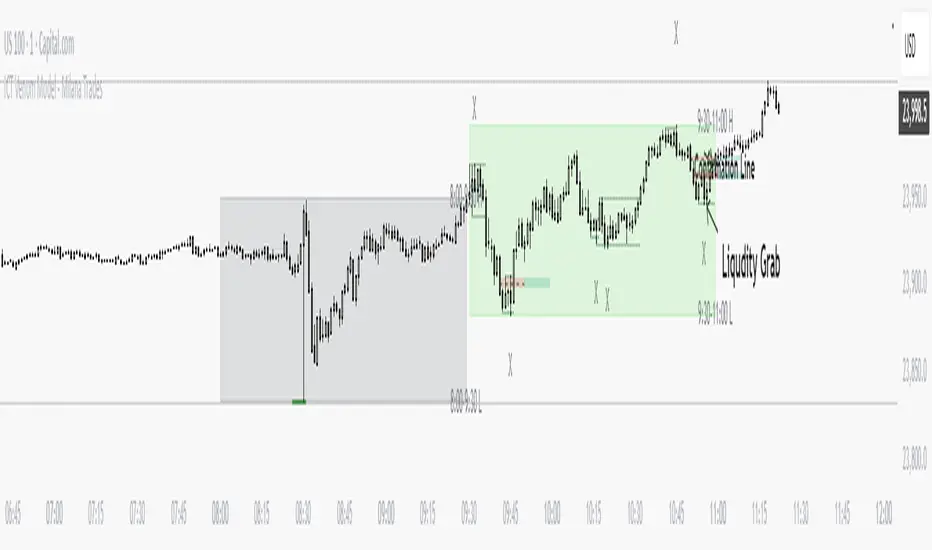

The ICT Venom Model is a high-precision technical analysis toolkit based on ICT (Inner Circle Trader) principles, optimized for traders focusing on New York trading hours. It combines Liquidity detection, volume validation, market structure logic, and BPR or iFVG analysis in a unified script.

Key Components

1. Killzones Visualization

1)Highlights Premarket (08:00–09:30) and Initial NY Session (09:30–11:00) based on New York Time.

2)During Premarket, the indicator identifies swing highs and lows as potential liquidity levels.

snapshot

3)Session highs and lows are dynamically tracked and optionally labeled on the chart.

3) Liuidity Detection Duaaring tradesession(X)

Detects bullish and bearish Manipulatuin using wick logic and real-time structure conditions.

Includes optional volume validation using lower timeframe data.

Market Structure Shifts (MSS) & Break of Structure (BOS)

snapshot

Tracks confirmed swing highs and lows using user-defined pivot strength.

Displays MSS or BOS labels and lines based on price violations.

Option to limit detection only to NY trading hours.

Balance Price Range (BPR) Zones AND iFVG

Identifies overlapping fair value gaps to create BPRs and iFVG (You can choose what more comfortable to use, automaticly turn on iFVG , but you can change on BPR )

Draws zones between opposing imbalances and monitors for price interaction.

Customization

1)Adjustable swing length, volume threshold, and validation mode.

2)Session visibility, label toggles, color customization.

3)Market structure detection strength and display options.

4)BPR visualization settings with maximum visible zones control.

🎯 How to use ICT Venom Model

The model relies on three foundational pillars:

1)Liquidity (wrong-way liquidity sweeps)

2)Time (New York session early window from 08:00–09:30 AM )

3)Price (market structure, fair value gaps and BPR, and order blocks)

🕒 Market Timing

Define the Init high and low between 08:00 and 09:30 AM NY time.

After the official open at 09:30, price often executes a liquidity sweep, which triggers the Venom behavior

🔍 Bullish and Bearish Setup

Bullish Venom

Price falsely breaks below the low of the range → liquidity grab of sell-side retail stops.

Followed by Market Structure Shift (MSS) or CISD, and then price returns into BPR or OB

Entry long when price touches iFVG/OB; stop-loss below false low; target at open range high or daily high.

Bearish Venom

Price breaks above the range high → buy-side liquidity grab.

MSS/CISD confirms reversal, then price retests into BPR zone or bearish order block.

Enter short in iFVG/ob; stop-loss above false high; target range low or support below.

innercircletrader.net

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya dengan percuma dan tanpa had – ketahui lebih lanjut di sini.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya dengan percuma dan tanpa had – ketahui lebih lanjut di sini.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.