OPEN-SOURCE SCRIPT

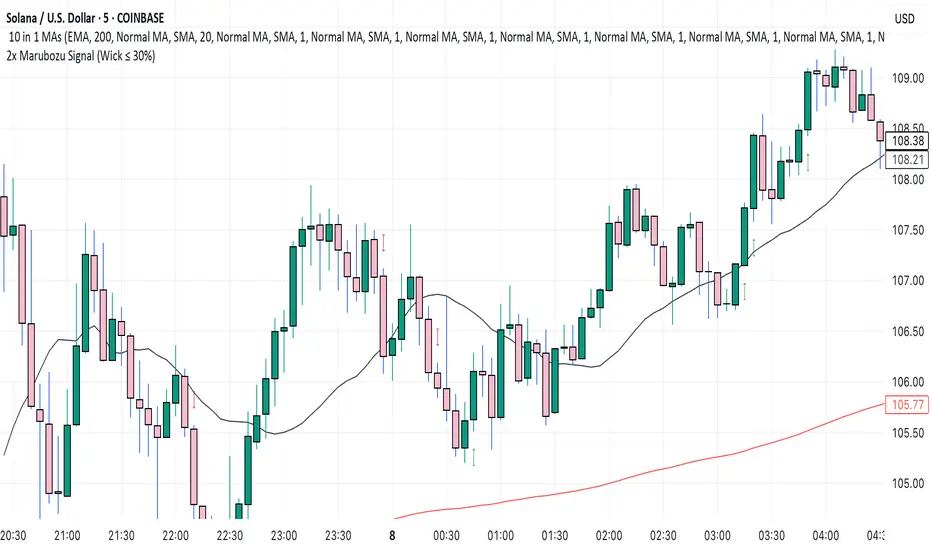

2x Marubozu Signal (Wick ≤ 30%)

The 2x Marubozu Signal (Wick ≤ 30%) is a powerful, momentum-based price action indicator designed to catch strong bullish or bearish trends early. It scans for two consecutive Marubozu-style candles (where wicks are ≤ 30% of the total candle size) to identify moments of solid conviction from buyers or sellers.

This indicator detects:

Bullish Signal: Two green candles in a row, both with tiny wicks (≤ 30% of total candle size), indicating strong buying pressure and momentum.

Bearish Signal: Two red candles in a row, both with tiny wicks (≤ 30%), signaling dominant selling pressure.

The signal appears on the second candle — confirming the continuation move after initial momentum.

Key Features:

🔍 Wick Ratio Filter: Only triggers if both candles have upper and lower wicks less than or equal to 30% of the full candle range (High - Low).

📈 Visual Signal Arrows:

Green Up Arrow on bullish 2x Marubozu

Red Down Arrow on bearish 2x Marubozu

⚙️ Clean and Lightweight: No lag, perfect for intraday, swing, or trend-based strategies.

🎯 Use Case:

Trend Confirmation: Enter after the second strong Marubozu to ride breakout moves.

Momentum Filter: Combine with your existing strategy to filter only high-conviction price action setups.

Reversal Spotting: Catch reversals at key support/resistance when Marubozus form.

🧠 Pro Tips:

Works best on 15m–1D charts, especially after consolidation.

Combine with support/resistance, volume, or EMA/SMA zones for confirmation.

Avoid overtrading in choppy zones—this is a momentum-only tool.

🚀 Who’s It For?

Price Action Traders

Scalpers & Swing Traders

Trend-followers

Crypto, Forex, Stocks

📌 Author Note:

This indicator was crafted for traders who trust pure candle structure over lagging indicators. If you respect momentum, this is your edge.

This indicator detects:

Bullish Signal: Two green candles in a row, both with tiny wicks (≤ 30% of total candle size), indicating strong buying pressure and momentum.

Bearish Signal: Two red candles in a row, both with tiny wicks (≤ 30%), signaling dominant selling pressure.

The signal appears on the second candle — confirming the continuation move after initial momentum.

Key Features:

🔍 Wick Ratio Filter: Only triggers if both candles have upper and lower wicks less than or equal to 30% of the full candle range (High - Low).

📈 Visual Signal Arrows:

Green Up Arrow on bullish 2x Marubozu

Red Down Arrow on bearish 2x Marubozu

⚙️ Clean and Lightweight: No lag, perfect for intraday, swing, or trend-based strategies.

🎯 Use Case:

Trend Confirmation: Enter after the second strong Marubozu to ride breakout moves.

Momentum Filter: Combine with your existing strategy to filter only high-conviction price action setups.

Reversal Spotting: Catch reversals at key support/resistance when Marubozus form.

🧠 Pro Tips:

Works best on 15m–1D charts, especially after consolidation.

Combine with support/resistance, volume, or EMA/SMA zones for confirmation.

Avoid overtrading in choppy zones—this is a momentum-only tool.

🚀 Who’s It For?

Price Action Traders

Scalpers & Swing Traders

Trend-followers

Crypto, Forex, Stocks

📌 Author Note:

This indicator was crafted for traders who trust pure candle structure over lagging indicators. If you respect momentum, this is your edge.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.