OPEN-SOURCE SCRIPT

Previous Daily High/Low

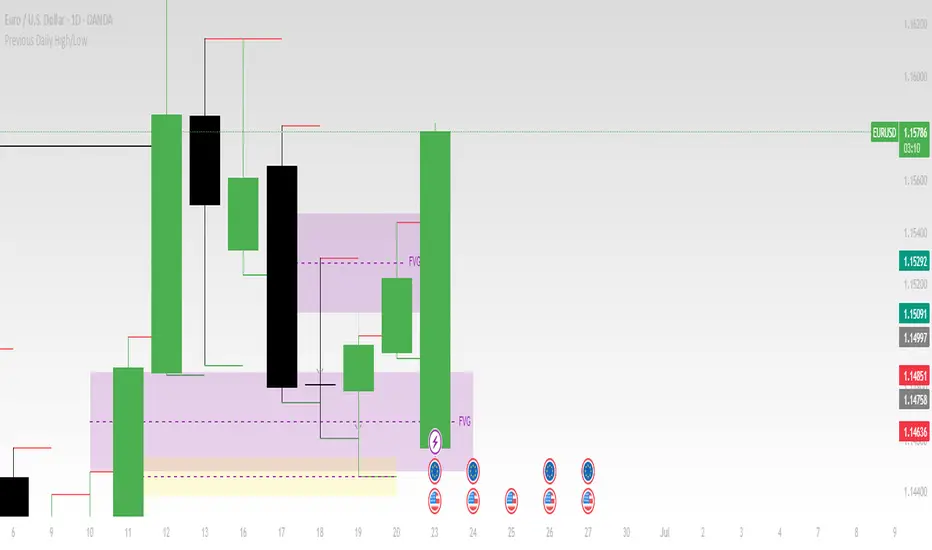

The previous day’s high and low are critical price levels that traders use to identify potential support, resistance, and intraday trading opportunities. These levels represent the highest and lowest prices reached during the prior trading session and often act as reference points for future price action.

Why Are Previous Daily High/Low Important?

Support & Resistance Zones

The previous day’s low often acts as support (buyers defend this level).

The previous day’s high often acts as resistance (sellers defend this level).

Breakout Trading

A move above the previous high suggests bullish momentum.

A move below the previous low suggests bearish momentum.

Mean Reversion Trading

Traders fade moves toward these levels, expecting reversals.

Example: Buying near the previous low in an uptrend.

Institutional Order Flow

Market makers and algos often reference these levels for liquidity.

How to Use Previous Daily High/Low in Trading

1. Breakout Strategy

Long Entry: Price breaks & closes above previous high → bullish continuation.

Short Entry: Price breaks & closes below previous low → bearish continuation.

2. Reversal Strategy

Long at Previous Low: If price pulls back to the prior day’s low in an uptrend.

Short at Previous High: If price rallies to the prior day’s high in a downtrend.

3. Range-Bound Markets

Buy near previous low, sell near previous high if price oscillates between them.

Example Trade Setup

Scenario: Price opens near the previous day’s high.

Bullish Case: A breakout above it targets next resistance.

Bearish Case: Rejection at the high signals a pullback.

Why Are Previous Daily High/Low Important?

Support & Resistance Zones

The previous day’s low often acts as support (buyers defend this level).

The previous day’s high often acts as resistance (sellers defend this level).

Breakout Trading

A move above the previous high suggests bullish momentum.

A move below the previous low suggests bearish momentum.

Mean Reversion Trading

Traders fade moves toward these levels, expecting reversals.

Example: Buying near the previous low in an uptrend.

Institutional Order Flow

Market makers and algos often reference these levels for liquidity.

How to Use Previous Daily High/Low in Trading

1. Breakout Strategy

Long Entry: Price breaks & closes above previous high → bullish continuation.

Short Entry: Price breaks & closes below previous low → bearish continuation.

2. Reversal Strategy

Long at Previous Low: If price pulls back to the prior day’s low in an uptrend.

Short at Previous High: If price rallies to the prior day’s high in a downtrend.

3. Range-Bound Markets

Buy near previous low, sell near previous high if price oscillates between them.

Example Trade Setup

Scenario: Price opens near the previous day’s high.

Bullish Case: A breakout above it targets next resistance.

Bearish Case: Rejection at the high signals a pullback.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.