Altcoin Breadth | QuantumResearch

Purpose:

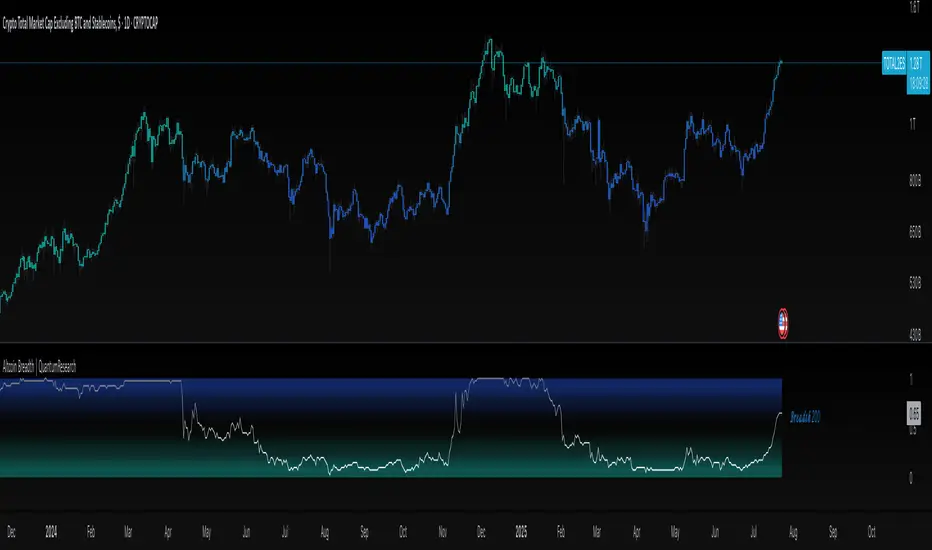

Altcoin Breadth measures the strength of the altcoin market by tracking how many assets trade above key moving averages (50-day and 200-day). It offers a normalized view of trend participation across 40 major crypto assets.

How It Works:

For each of the 40 altcoins:

The script checks whether the asset's current price is above its 50-day and/or 200-day simple moving average.

Each condition counts as a binary "1" (trend up) or "0" (trend down).

The total values are averaged, yielding two normalized values between 0 and 1:

Breadth 50: % of assets above their 50 SMA

Breadth 200: % of assets above their 200 SMA

Visual Display:

Plots Breadth 50 and Breadth 200 separately as two gradient-colored lines.

Dynamic labels at the latest bar indicate current breadth values.

Optional bar coloring to reflect underlying breadth momentum.

Key Features:

Evaluates short-term and long-term trend strength across the altcoin sector.

Dynamic visualization of market participation breadth.

Clear trend shifts and sector-wide bullish/bearish transitions.

Separate toggles to show either Breadth 50, Breadth 200, or both.

Trading Application:

Identify broad altcoin uptrends or breakdowns.

Use Breadth 200 for macro confirmation; Breadth 50 for tactical shifts.

Align altcoin exposure with healthy trend participation levels.

⚠️ Breadth tools offer market-wide context, not individual entry signals. Use in combination with trend or momentum indicators.

Disclaimer: Past performance does not guarantee future results. This tool is intended for informational and educational use only. Cryptocurrency markets are volatile and involve high risk.

Skrip jemputan sahaja

Hanya pengguna disahkan oleh penulis boleh mengakses skrip ini. Anda perlu memohon dan mendapatkan kebenaran untuk menggunakannya. Keizinan selalunya diberikan selepas pembayaran. Untuk lebih butiran, ikuti arahan penulis di bawah atau hubungi QuantumResearch secara terus.

TradingView TIDAK menyarankan pembayaran atau penggunaan skrip kecuali anda mempercayai sepenuhnya penulis dan memahami bagaimana ia berfungsi. Anda juga boleh menjumpai alternatif sumber terbuka dan percuma yang lain di dalam skrip komuniti kami.

Arahan penulis

whop.com/quantum-whop/

⚒️ Get access to our toolbox here for free:

quantumresearchportfolio.carrd.co

All tools and content provided are for informational and educational purposes only.

Penafian

Skrip jemputan sahaja

Hanya pengguna disahkan oleh penulis boleh mengakses skrip ini. Anda perlu memohon dan mendapatkan kebenaran untuk menggunakannya. Keizinan selalunya diberikan selepas pembayaran. Untuk lebih butiran, ikuti arahan penulis di bawah atau hubungi QuantumResearch secara terus.

TradingView TIDAK menyarankan pembayaran atau penggunaan skrip kecuali anda mempercayai sepenuhnya penulis dan memahami bagaimana ia berfungsi. Anda juga boleh menjumpai alternatif sumber terbuka dan percuma yang lain di dalam skrip komuniti kami.

Arahan penulis

whop.com/quantum-whop/

⚒️ Get access to our toolbox here for free:

quantumresearchportfolio.carrd.co

All tools and content provided are for informational and educational purposes only.