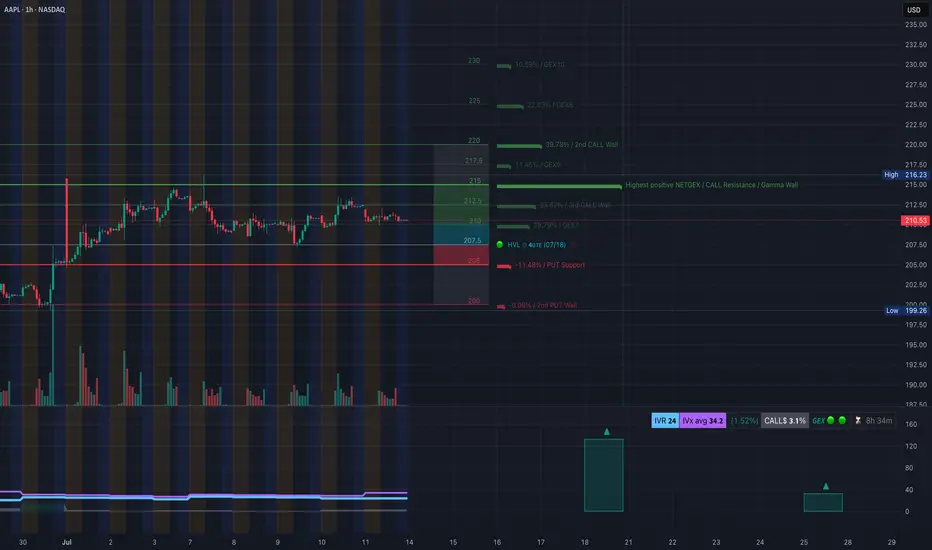

AAPL at a Pivotal Zone! GEX & Price Action Align for Major Move 📉📈

🧠 GEX Sentiment (Options-Based Insight)

* Current Price: $210.53

* GEX Zone Traps:

* Below Price:

* 🟥 Put Support at $205 (-11.48%)

* 🔻 PUT Wall at $200 (-9.06%) — strong floor

* Above Price:

* 🟩 CALL Walls at:

* $212.5 → 29.79% GEX7

* $215 → 38.62% GEX6 (3rd largest resistance)

* $217.5 → 11.45% GEX9

* $220 → 39.78% GEX2 (heavy resistance zone)

* 🟩 Max GEX Cluster: $215–$220

* 🔺GEX10 spike at $230 → unlikely unless squeeze

* IVR/IVX:

* IVR: 24 (low volatility environment)

* IVX: 34.2 → Soft volatility bounce

* Call/Put Flow:

* Calls: 3.1% favored

* GEX trend: 🌕🌕🌕 (Neutral-to-Bullish if over $212.5)

📦 Interpretation: Gamma compression is strong near $212.5–$215. If AAPL stays above $210.5 and reclaims $212.5, options market opens up space toward $217.5–$220. Below $207.5 = risk of drop toward $205 then $200 PUT wall.

🕹️ Option Trade Ideas Based on GEX

Bullish Strategy (IF Breaks $212.5):

* Trade: Buy AAPL 215c or 217.5c (Jul 19 or 26 expiry)

* Trigger: Hold above $212.5

* Target: $217.5–$220

* Stop: Break below $209.8

Bearish Strategy (IF Breaks $207.5):

* Trade: Buy AAPL 205p or 200p (Jul 19 or 26 expiry)

* Trigger: Loss of $207.5 with momentum

* Target: $205 → $200

* Stop: Reclaim of $210.5

🔍 1-Hour Chart Analysis (Price Action)

* Structure: Sideways consolidation between $207.5–$213.5

* Key Levels:

* Demand: $205–$207.5 (Buyers defended)

* CHoCH (Change of Character) confirmed near $209.8

* Resistance: $213.48 (rejected multiple times)

* Trendline: Rising wedge forming under liquidity sweep zone

* Liquidity Pools: Resting above $215 and below $205

* FVG/OB Zones: Thin FVG at $209.8–210.5 and mid OB around $207

📈 Scenario 1 (Bullish):

* If price bounces off $210 again and breaks $212.5 with volume, watch for sweep of $215–$217.5

* Watch for re-entry above CHoCH/BOS confluence near $211.5

📉 Scenario 2 (Bearish):

* If we break $207.5 and fail to reclaim $210.5 → liquidity vacuum opens toward $205 and $200

✅ My Thoughts & Suggestions

* Direction Bias: Neutral > Bullish if $212.5 is claimed, otherwise range-bound.

* Best Risk/Reward: Wait for $212.5 breakout confirmation OR $207.5 breakdown.

* Scalpers: Use $210.5–212.5 as chop zone — fade edges.

* Swing Traders: Only enter on clear breakouts with stop discipline.

🔒 Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk before trading.

🧠 GEX Sentiment (Options-Based Insight)

* Current Price: $210.53

* GEX Zone Traps:

* Below Price:

* 🟥 Put Support at $205 (-11.48%)

* 🔻 PUT Wall at $200 (-9.06%) — strong floor

* Above Price:

* 🟩 CALL Walls at:

* $212.5 → 29.79% GEX7

* $215 → 38.62% GEX6 (3rd largest resistance)

* $217.5 → 11.45% GEX9

* $220 → 39.78% GEX2 (heavy resistance zone)

* 🟩 Max GEX Cluster: $215–$220

* 🔺GEX10 spike at $230 → unlikely unless squeeze

* IVR/IVX:

* IVR: 24 (low volatility environment)

* IVX: 34.2 → Soft volatility bounce

* Call/Put Flow:

* Calls: 3.1% favored

* GEX trend: 🌕🌕🌕 (Neutral-to-Bullish if over $212.5)

📦 Interpretation: Gamma compression is strong near $212.5–$215. If AAPL stays above $210.5 and reclaims $212.5, options market opens up space toward $217.5–$220. Below $207.5 = risk of drop toward $205 then $200 PUT wall.

🕹️ Option Trade Ideas Based on GEX

Bullish Strategy (IF Breaks $212.5):

* Trade: Buy AAPL 215c or 217.5c (Jul 19 or 26 expiry)

* Trigger: Hold above $212.5

* Target: $217.5–$220

* Stop: Break below $209.8

Bearish Strategy (IF Breaks $207.5):

* Trade: Buy AAPL 205p or 200p (Jul 19 or 26 expiry)

* Trigger: Loss of $207.5 with momentum

* Target: $205 → $200

* Stop: Reclaim of $210.5

🔍 1-Hour Chart Analysis (Price Action)

* Structure: Sideways consolidation between $207.5–$213.5

* Key Levels:

* Demand: $205–$207.5 (Buyers defended)

* CHoCH (Change of Character) confirmed near $209.8

* Resistance: $213.48 (rejected multiple times)

* Trendline: Rising wedge forming under liquidity sweep zone

* Liquidity Pools: Resting above $215 and below $205

* FVG/OB Zones: Thin FVG at $209.8–210.5 and mid OB around $207

📈 Scenario 1 (Bullish):

* If price bounces off $210 again and breaks $212.5 with volume, watch for sweep of $215–$217.5

* Watch for re-entry above CHoCH/BOS confluence near $211.5

📉 Scenario 2 (Bearish):

* If we break $207.5 and fail to reclaim $210.5 → liquidity vacuum opens toward $205 and $200

✅ My Thoughts & Suggestions

* Direction Bias: Neutral > Bullish if $212.5 is claimed, otherwise range-bound.

* Best Risk/Reward: Wait for $212.5 breakout confirmation OR $207.5 breakdown.

* Scalpers: Use $210.5–212.5 as chop zone — fade edges.

* Swing Traders: Only enter on clear breakouts with stop discipline.

🔒 Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk before trading.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.