__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

__________________________________________________________________________________

Macro and Fundamental Analysis

__________________________________________________________________________________

__________________________________________________________________________________

Strategic synthesis & R/R guidance

__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

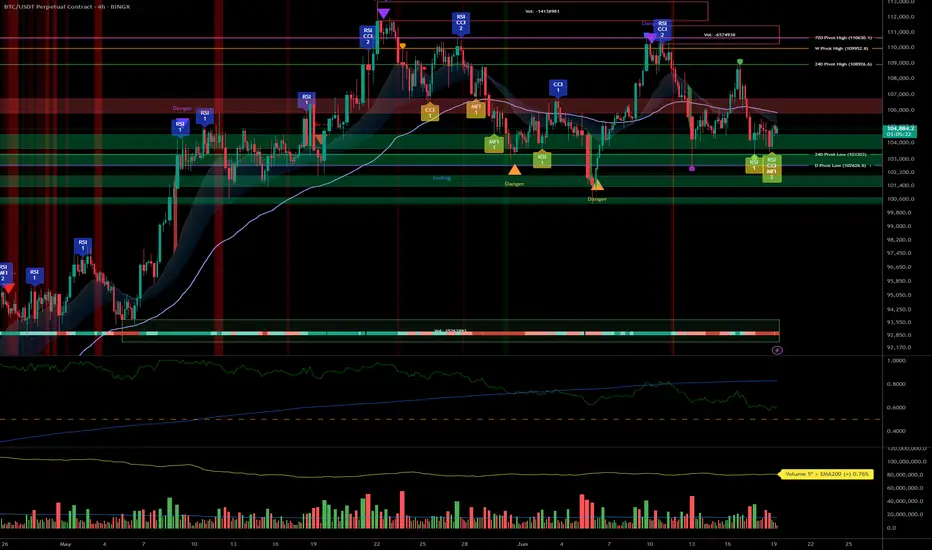

- Momentum: Dominant on all major timeframes (1D, 12H, 6H, 4H). Risk On / Risk Off Indicator signals STRONG BUY except on 15min (neutral).

- Support/Resistance: Structurally key pivot zone 102k–106k; major supports 102k/103k. Potential breakout above 106k (swing target 109k).

- Volumes: Normal across all timeframes. No excess signals, no accumulation/capitulation peaks.

- Multi-TF Behaviors: Horizontal consolidation with bullish dominance. Short-term bearish divergence on 2H–15min, micro-TF in correction only, no panic.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

- Global Bias: Solid bullish structure as long as 102k/103k hold. “Risk On” maintained by sector outperformance.

- Opportunities: Entries on pullback/main base 103k–104k; breakouts to watch above 106k.

- Risk Zones: Clear invalidation <102k, potential rapid flush to 97k–88k; keep strict stop-loss below 102.5k.

- Macro Catalysts: FOMC, Fed projections, Middle East geopolitics keep volatility high, but no shock. Price action leads near-term strategy.

- Action Plan: Swing buy on confirmed support, dynamic hedge post-news, monitor volumes/closures on key pivots.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

- 1D: Bullish momentum, major supports intact (102k/105k). Risk On / Risk Off Indicator = STRONG BUY, stable volume, no excess. Healthy structure for long swings.

- 12H: Positive bias, range 102.6k–106k. Risk On / Risk Off Indicator = STRONG BUY.

- 6H: Presumed accumulation 103k–106k, momentum still strong. No volume weakness.

- 4H: Range oscillation, structural support test at 103k. Sector outperformance, neutral volume.

- 2H: First sign of short-term weakness. Divergent with higher TFs but no panic.

- 1H: Technical rebound towards 104.8k possible as long as 103k support holds.

- 30min: Short-term trend remains bearish (trend 30min = down). Correction/purge ongoing.

- 15min: Neutral momentum, supports being tested. No panic or melt-down observed.

- Summary: Strong bullish confluence on higher TFs, temporary divergence on micro-TFs. “Range with bullish bias” scenario as long as 102k/103k holds the structure.

__________________________________________________________________________________

Macro and Fundamental Analysis

__________________________________________________________________________________

- FED/FOMC (June 18): Rates unchanged, “data dependent” guidance. Raised volatility but no risk-off shift.

- Market Sentiment: BTC technical structure holds, moderate post-FOMC volatility.

- S&P500: Above all key moving averages. Sector momentum (software, uranium, semis) remains dominant.

- Energy Level: Weak oil = little macro pressure against BTC.

- Geopolitics: Israel–Iran escalation / US posture reinforced. High FX/oil volatility but BTC resilient (>102k), no panic on record.

- Economic Calendar: Closely watching BoE & SNB, but low BTC impact odds.

- Implications: Post-news phase = ideal for range trading, no rupture event expected within 48h.

__________________________________________________________________________________

Strategic synthesis & R/R guidance

__________________________________________________________________________________

- Long on pullback 103–104k, swing targets 106/109k. Optimal R/R (>2.5) if stop 102.5k (D Pivot Low).

- Invalidation area: Clean close <102k or heavy downside volume (capitulation via ISPD/volumes).

- Risk Management: Dynamic stops, partial hedge post-FOMC during macro volatility.

- Conclusion: Bullish structure preserved. Range trading scenario dominant, no extreme signals or panic. Actions: support watch, technical buy on confirmed pullback.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.