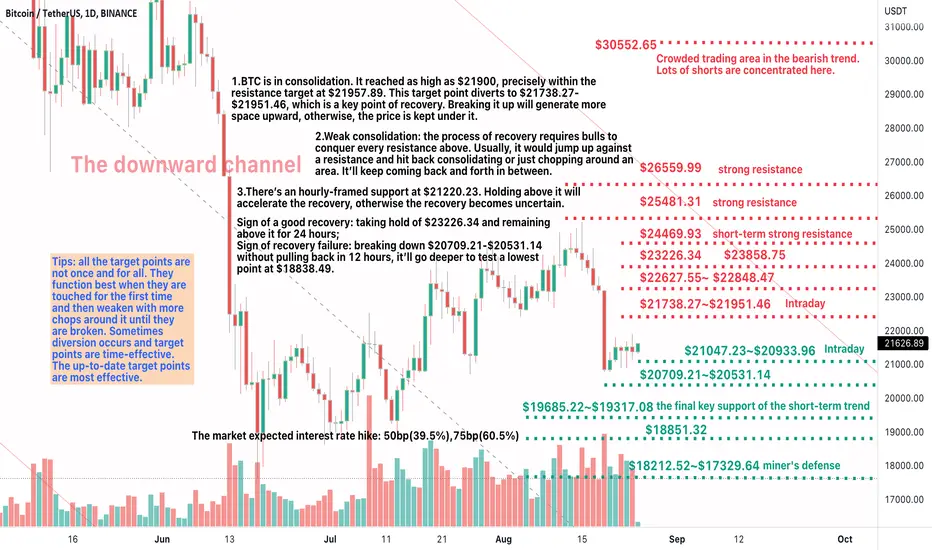

BTC is in consolidation. It reached as high as $21900, precisely within the resistance target at $21957.89. This target point diverts to $21738.27-$21951.46, which is a key point of recovery. Breaking it up will generate more space upward, otherwise, the price is kept under it.

Weak consolidation: the process of recovery requires bulls to conquer every resistance above. Usually, it would jump up against a resistance and hit back consolidating or just chopping around an area. It’ll keep coming back and forth in between.

There’s an hourly-based support at $21220.23. Holding above it will accelerate the recovery, otherwise recovery is quite uncertain.

Sign of a good recovery: taking hold of $23226.34 and remaining above it for 24 hours;

Sign of recovery failure: breaking down $20709.21-$20531.14 without pulling back in 12 hours, it’ll go deeper to test a lowest point at $18838.49.

The market expected interest rate hike: 50bp(39.5%),75bp(60.5%)

Weak consolidation: the process of recovery requires bulls to conquer every resistance above. Usually, it would jump up against a resistance and hit back consolidating or just chopping around an area. It’ll keep coming back and forth in between.

There’s an hourly-based support at $21220.23. Holding above it will accelerate the recovery, otherwise recovery is quite uncertain.

Sign of a good recovery: taking hold of $23226.34 and remaining above it for 24 hours;

Sign of recovery failure: breaking down $20709.21-$20531.14 without pulling back in 12 hours, it’ll go deeper to test a lowest point at $18838.49.

The market expected interest rate hike: 50bp(39.5%),75bp(60.5%)

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.