Good morning everyone! Let’s jump straight into today’s BTC analysis.

But first… a quick lesson I’ve learned recently:

📌 We don’t predict the market — we prepare for scenarios and react.

Trying to guess the future only puts us behind. Our job isn’t to fight buyers or sellers…

We simply wait for them to finish their battle — then ride with the winner. 🚀⚔️

With that mindset, let’s break down the main possible scenarios:

🟥 Scenario 1: Market Continues Under Sellers’ Control

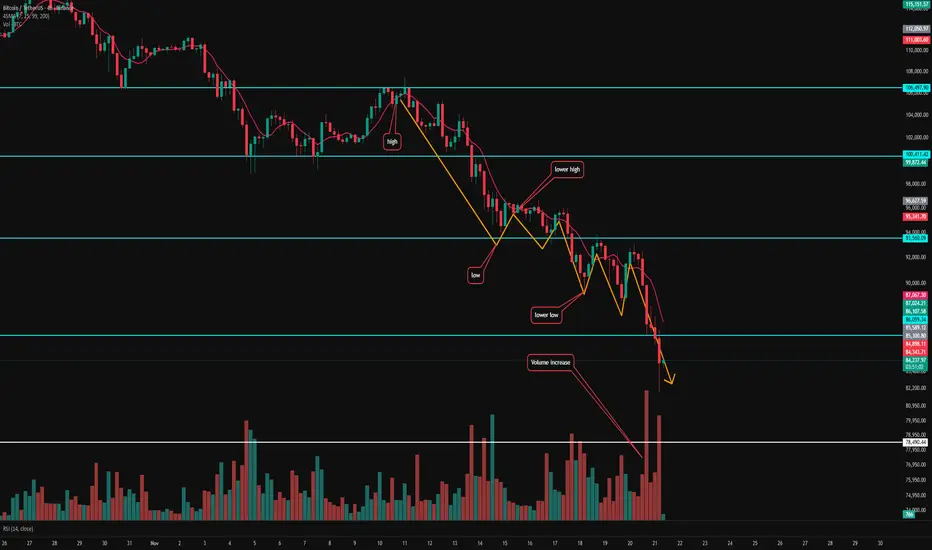

On the daily and 4h timeframe, the trend is clearly bearish:

Lower highs & lower lows

Increasing selling volume

As long as the structure keeps printing lower highs/lows, the logical play is to follow sellers — waiting only for a clean trigger.

We’ve recently tapped into the $85K zone, but my line is outdated (drawn months ago).

I need a fresh reaction from this support area to validate it.

⏳ So I’m not shorting yet.

I’m waiting for a reaction — likely sometime this weekend when global markets are quiet — and then I’ll look for a short trigger.

⚠️ Right now is NOT a short entry for me.

Patience first. Trigger next.

🟩 Scenario 2: What if BTC jumps straight to $93,500?

Nothing changes for me.

As long as sellers dominate, I’m not opening any long on Btc.

Before considering a long position, I need:

At least one equal high + equal low (neutral structure)

And ideally a break into higher highs and higher lows

Until that happens — no longs for me.

🟦 Scenario 3: Range Formation

If the market ranges inside this zone, my short may get stopped out.

But honestly… that’s fine.

A range often builds a strong structural base — and once the direction becomes clear, I’ll simply follow the confirmed trend.

📌 Final Note

Please don’t underestimate risk management and capital preservation.

These scenarios help us stay objective — but discipline is what keeps us alive in the long run.

Thanks for reading my analysis!

Wish you all a great and profitable day. 🚀✨

But first… a quick lesson I’ve learned recently:

📌 We don’t predict the market — we prepare for scenarios and react.

Trying to guess the future only puts us behind. Our job isn’t to fight buyers or sellers…

We simply wait for them to finish their battle — then ride with the winner. 🚀⚔️

With that mindset, let’s break down the main possible scenarios:

🟥 Scenario 1: Market Continues Under Sellers’ Control

On the daily and 4h timeframe, the trend is clearly bearish:

Lower highs & lower lows

Increasing selling volume

As long as the structure keeps printing lower highs/lows, the logical play is to follow sellers — waiting only for a clean trigger.

We’ve recently tapped into the $85K zone, but my line is outdated (drawn months ago).

I need a fresh reaction from this support area to validate it.

⏳ So I’m not shorting yet.

I’m waiting for a reaction — likely sometime this weekend when global markets are quiet — and then I’ll look for a short trigger.

⚠️ Right now is NOT a short entry for me.

Patience first. Trigger next.

🟩 Scenario 2: What if BTC jumps straight to $93,500?

Nothing changes for me.

As long as sellers dominate, I’m not opening any long on Btc.

Before considering a long position, I need:

At least one equal high + equal low (neutral structure)

And ideally a break into higher highs and higher lows

Until that happens — no longs for me.

🟦 Scenario 3: Range Formation

If the market ranges inside this zone, my short may get stopped out.

But honestly… that’s fine.

A range often builds a strong structural base — and once the direction becomes clear, I’ll simply follow the confirmed trend.

📌 Final Note

Please don’t underestimate risk management and capital preservation.

These scenarios help us stay objective — but discipline is what keeps us alive in the long run.

Thanks for reading my analysis!

Wish you all a great and profitable day. 🚀✨

Penafian

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Penafian

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.